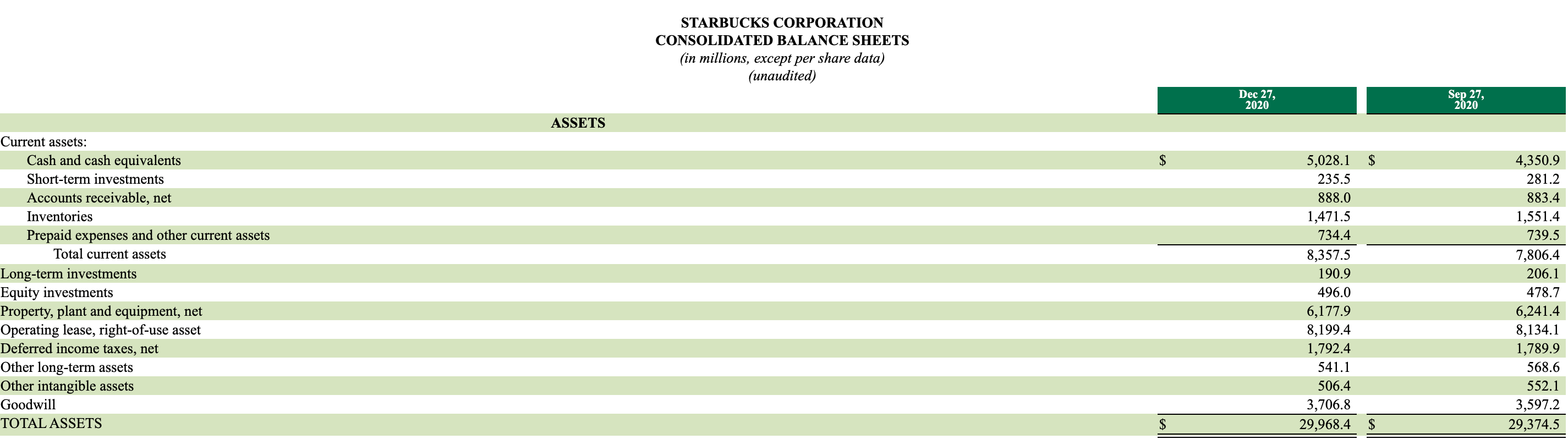

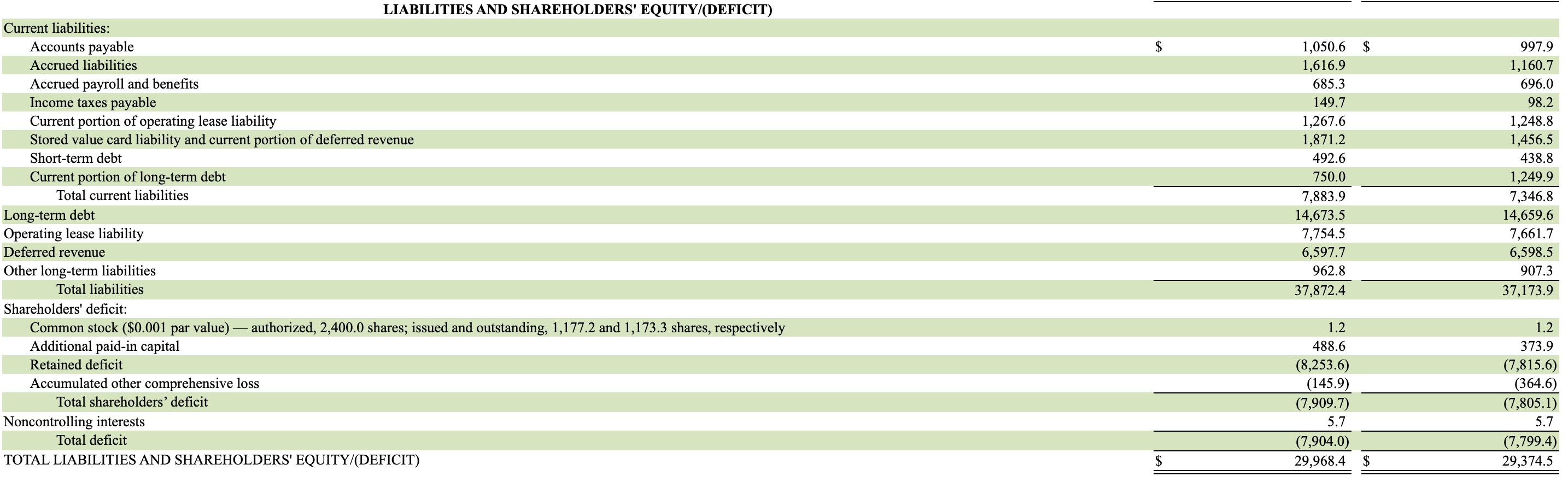

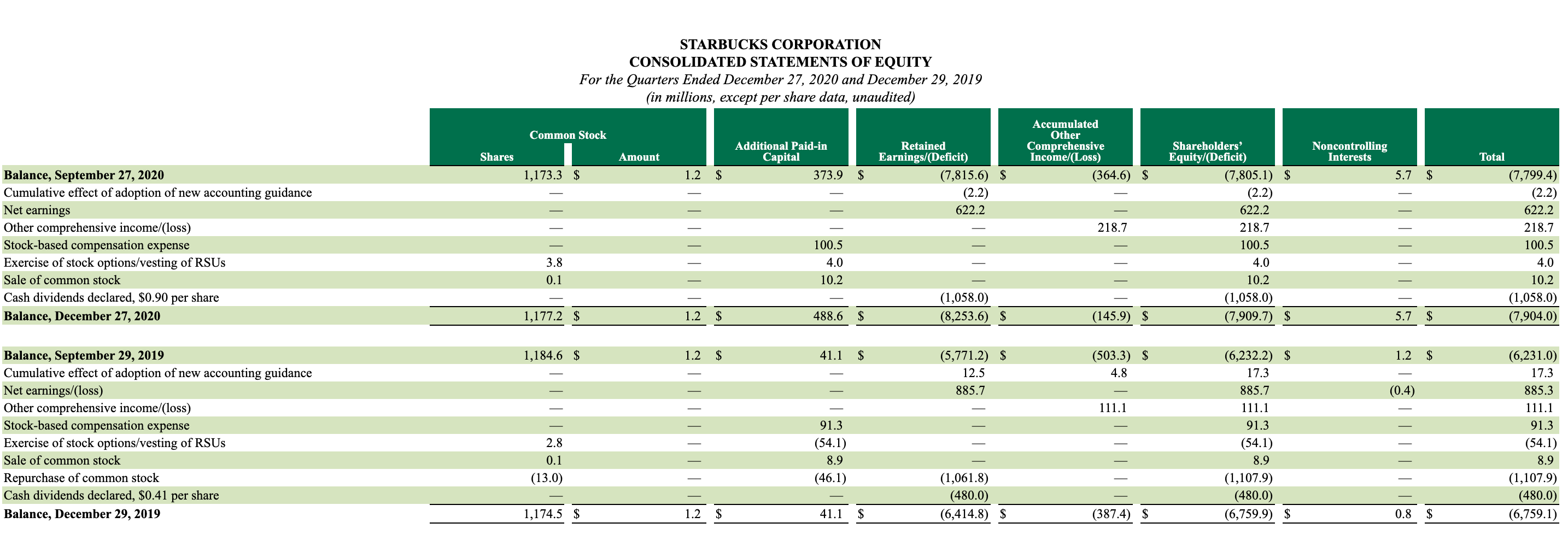

Please help to explain based on the attached pictures. Select two of these line items and explain what their balances might indicate about how the company is utilizing the investment by its stockholders. Address whether you would want to purchase stock in the company based on your analysis.

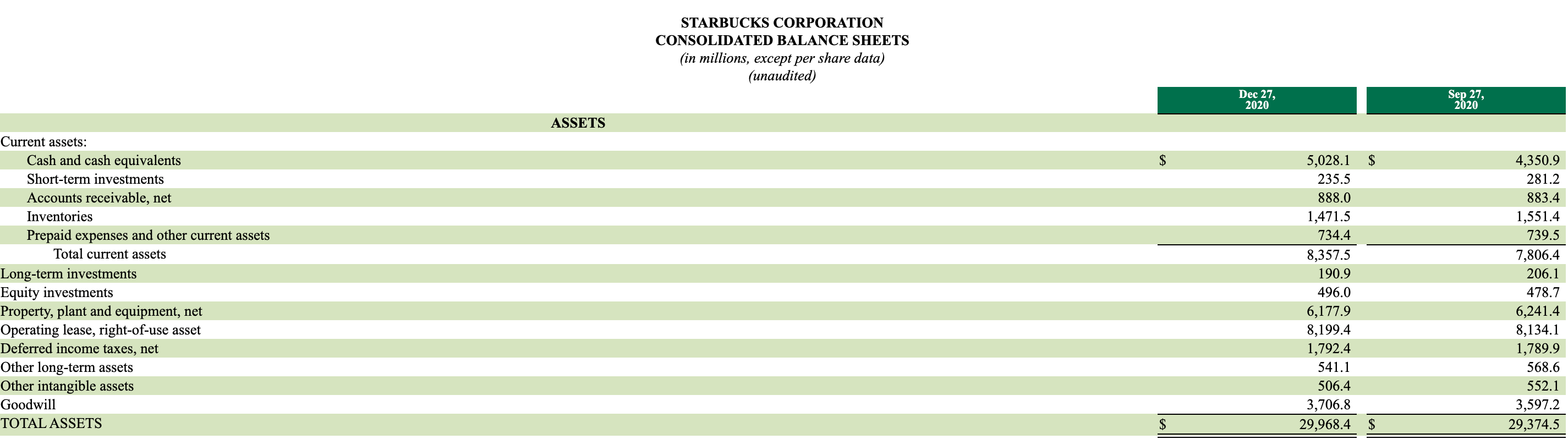

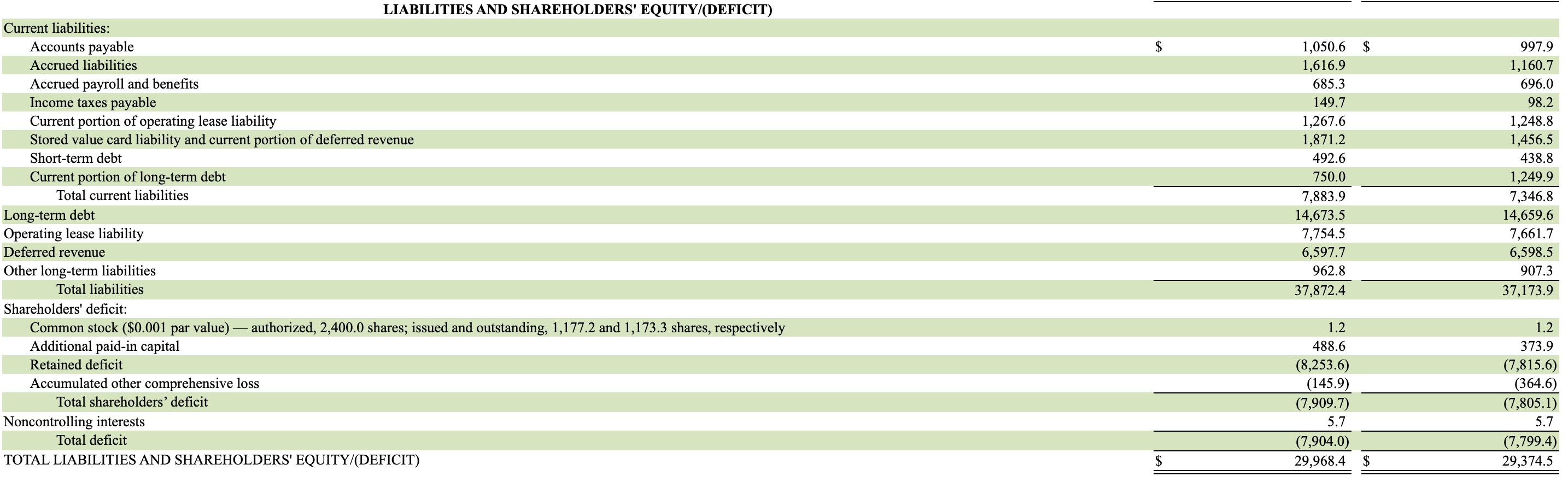

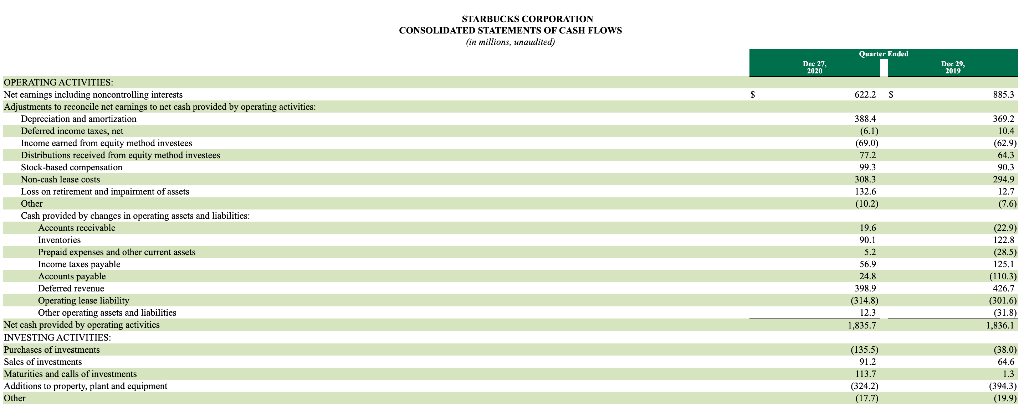

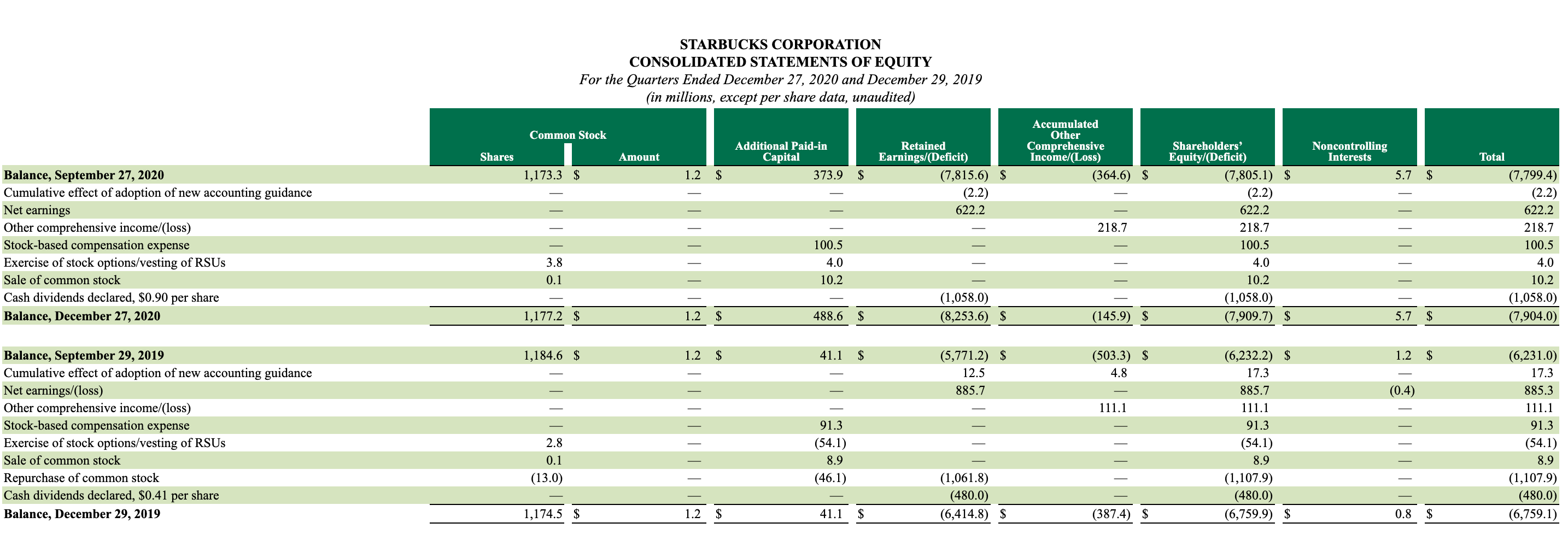

STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) (unaudited) Dec 27, 2020 Sep 27, 2020 ASSETS $ $ Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity investments Property, plant and equipment, net Operating lease, right-of-use asset Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS 5,028.1 235.5 888.0 1,471.5 734.4 8,357.5 190.9 496.0 6,177.9 8,199.4 1,792.4 541.1 506.4 3,706.8 29,968.4 4,350.9 281.2 883.4 1,551.4 739.5 7,806.4 206.1 478.7 6,241.4 8,134.1 1,789.9 568.6 552.1 3,597.2 29,374.5 $ $ $ $ LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) Current liabilities: Accounts payable Accrued liabilities Accrued payroll and benefits Income taxes payable Current portion of operating lease liability Stored value card liability and current portion of deferred revenue Short-term debt Current portion of long-term debt Total current liabilities Long-term debt Operating lease liability Deferred revenue Other long-term liabilities Total liabilities Shareholders' deficit: Common stock ($0.001 par value) authorized, 2,400.0 shares; issued and outstanding, 1,177.2 and 1,173.3 shares, respectively Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total shareholders' deficit Noncontrolling interests Total deficit TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) 1,050.6 1,616.9 685.3 149.7 1,267.6 1,871.2 492.6 750.0 7,883.9 14,673.5 7,754.5 97.7 962.8 37,872.4 997.9 1,160.7 696.0 98.2 1,248.8 1,456.5 438.8 1,249.9 7,346.8 14,659.6 7,661.7 6,598. 907.3 37,173.9 1.2 488.6 (8,253.6) (145.9) (7,909.7) 5.7 (7,904.0) 29,968.4 $ 1.2 373.9 (7,815.6) (364.6) (7,805.1) 5.7 (7,799.4) 29,374.5 $ STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS in millions, unowied) Quarter Endel Dec 27. 2020 Der 29, 1019 S 622.2 S 885.3 388.4 (6.1) (69.08 77.2 99.1 3083 132.6 (10.2) 369.2 10.4 (62.9) 64.3 90.3 294,9 12.7 (7.6) OPERATING ACTIVITIES: Net carnings including noncontrolling interests Adjustments to reconcile net camings to Det cash provided by operating activities: Depreciation and amortization Deferred income taxes, net Income earned from equity method investees Distributions received from equity method investees Slack-based compensation Non-ensh lense costs Loss on retirement and inpoiment of assets Other Cash provided by changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets Incine taxes payahle Accounts payable Deferred revenue Operating lense linbility Other operating assets and liabilities Net cash provided by operating activities INVESTING ACTIVITIES: Purchases of investments Sales of investments Maturities and calls of investments Additions to property, plant and equipment Other 19.6 90.1 5.2 56.9 24.8 3989 (314.8) 12.3 1,835.7 (22.9) 122.8 (28.5) 125,1 (1103) 426,7 (301.6) (31.8) 1,836,1 (135.5) 91.2 113.7 (324.2) ( (17.7) (38.0) 64.6 1.3 (394.3) (19.9) STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EQUITY For the Quarters Ended December 27, 2020 and December 29, 2019 (in millions, except per share data, unaudited) Common Stock Accumulated Other Comprehensive Income/(Loss) (364.6) $ Additional Paid-in Capital 373.9 Noncontrolling Interests Shares Amount 1,173.3 $ 1.2 $ Retained Earnings/(Deficit) (7,815.6) $ (2.2) 622.2 $ 5.7 $ 218.7 Balance, September 27, 2020 Cumulative effect of adoption of new accounting guidance Net earnings Other comprehensive income/(loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Cash dividends declared, $0.90 per share Balance, December 27, 2020 Shareholders Equity/Deficit) (7,805.1) $ (2.2) 622.2 218.7 100.5 4.0 10.2 (1,058.0) (7,909.7) $ Total (7,799.4) (2.2) 622.2 218.7 100.5 4.0 10.2 (1,058.0) (7,904.0) 3.8 0.1 100.5 4.0 10.2 (1,058.0) (8,253.6) $ 1,177.2 $ 1.2 $ 488.6 $ (145.9) $ 5.7 $ 1,184.6 $ 1.2 $ 41.1 $ 1.2 $ (5,771.2) $ 12.5 885.7 (503.3) $ 4.8 (0.4) 111.1 Balance, September 29, 2019 Cumulative effect of adoption of new accounting guidance Net earnings/(loss) Other comprehensive income/(loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $0.41 per share Balance, December 29, 2019 (6,232.2) $ 17.3 885.7 111.1 91.3 (54.1) 8.9 (1,107.9) (480.0) (6,759.9) $ 91.3 (54.1) 8.9 (46.1) (6,231.0) 17.3 885.3 111.1 91.3 (54.1) 8.9 (1,107.9) (480.0) (6,759.1) 2.8 0.1 (13.0) (1,061.8) (480.0) (6,414.8) $ 1,174.5 $ 1.2 $ 41.1 $ (387.4) $ 0.8 $ STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS (in millions, except per share data) (unaudited) Dec 27, 2020 Sep 27, 2020 ASSETS $ $ Current assets: Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Long-term investments Equity investments Property, plant and equipment, net Operating lease, right-of-use asset Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS 5,028.1 235.5 888.0 1,471.5 734.4 8,357.5 190.9 496.0 6,177.9 8,199.4 1,792.4 541.1 506.4 3,706.8 29,968.4 4,350.9 281.2 883.4 1,551.4 739.5 7,806.4 206.1 478.7 6,241.4 8,134.1 1,789.9 568.6 552.1 3,597.2 29,374.5 $ $ $ $ LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) Current liabilities: Accounts payable Accrued liabilities Accrued payroll and benefits Income taxes payable Current portion of operating lease liability Stored value card liability and current portion of deferred revenue Short-term debt Current portion of long-term debt Total current liabilities Long-term debt Operating lease liability Deferred revenue Other long-term liabilities Total liabilities Shareholders' deficit: Common stock ($0.001 par value) authorized, 2,400.0 shares; issued and outstanding, 1,177.2 and 1,173.3 shares, respectively Additional paid-in capital Retained deficit Accumulated other comprehensive loss Total shareholders' deficit Noncontrolling interests Total deficit TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY/(DEFICIT) 1,050.6 1,616.9 685.3 149.7 1,267.6 1,871.2 492.6 750.0 7,883.9 14,673.5 7,754.5 97.7 962.8 37,872.4 997.9 1,160.7 696.0 98.2 1,248.8 1,456.5 438.8 1,249.9 7,346.8 14,659.6 7,661.7 6,598. 907.3 37,173.9 1.2 488.6 (8,253.6) (145.9) (7,909.7) 5.7 (7,904.0) 29,968.4 $ 1.2 373.9 (7,815.6) (364.6) (7,805.1) 5.7 (7,799.4) 29,374.5 $ STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS in millions, unowied) Quarter Endel Dec 27. 2020 Der 29, 1019 S 622.2 S 885.3 388.4 (6.1) (69.08 77.2 99.1 3083 132.6 (10.2) 369.2 10.4 (62.9) 64.3 90.3 294,9 12.7 (7.6) OPERATING ACTIVITIES: Net carnings including noncontrolling interests Adjustments to reconcile net camings to Det cash provided by operating activities: Depreciation and amortization Deferred income taxes, net Income earned from equity method investees Distributions received from equity method investees Slack-based compensation Non-ensh lense costs Loss on retirement and inpoiment of assets Other Cash provided by changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets Incine taxes payahle Accounts payable Deferred revenue Operating lense linbility Other operating assets and liabilities Net cash provided by operating activities INVESTING ACTIVITIES: Purchases of investments Sales of investments Maturities and calls of investments Additions to property, plant and equipment Other 19.6 90.1 5.2 56.9 24.8 3989 (314.8) 12.3 1,835.7 (22.9) 122.8 (28.5) 125,1 (1103) 426,7 (301.6) (31.8) 1,836,1 (135.5) 91.2 113.7 (324.2) ( (17.7) (38.0) 64.6 1.3 (394.3) (19.9) STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EQUITY For the Quarters Ended December 27, 2020 and December 29, 2019 (in millions, except per share data, unaudited) Common Stock Accumulated Other Comprehensive Income/(Loss) (364.6) $ Additional Paid-in Capital 373.9 Noncontrolling Interests Shares Amount 1,173.3 $ 1.2 $ Retained Earnings/(Deficit) (7,815.6) $ (2.2) 622.2 $ 5.7 $ 218.7 Balance, September 27, 2020 Cumulative effect of adoption of new accounting guidance Net earnings Other comprehensive income/(loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Cash dividends declared, $0.90 per share Balance, December 27, 2020 Shareholders Equity/Deficit) (7,805.1) $ (2.2) 622.2 218.7 100.5 4.0 10.2 (1,058.0) (7,909.7) $ Total (7,799.4) (2.2) 622.2 218.7 100.5 4.0 10.2 (1,058.0) (7,904.0) 3.8 0.1 100.5 4.0 10.2 (1,058.0) (8,253.6) $ 1,177.2 $ 1.2 $ 488.6 $ (145.9) $ 5.7 $ 1,184.6 $ 1.2 $ 41.1 $ 1.2 $ (5,771.2) $ 12.5 885.7 (503.3) $ 4.8 (0.4) 111.1 Balance, September 29, 2019 Cumulative effect of adoption of new accounting guidance Net earnings/(loss) Other comprehensive income/(loss) Stock-based compensation expense Exercise of stock options/vesting of RSUS Sale of common stock Repurchase of common stock Cash dividends declared, $0.41 per share Balance, December 29, 2019 (6,232.2) $ 17.3 885.7 111.1 91.3 (54.1) 8.9 (1,107.9) (480.0) (6,759.9) $ 91.3 (54.1) 8.9 (46.1) (6,231.0) 17.3 885.3 111.1 91.3 (54.1) 8.9 (1,107.9) (480.0) (6,759.1) 2.8 0.1 (13.0) (1,061.8) (480.0) (6,414.8) $ 1,174.5 $ 1.2 $ 41.1 $ (387.4) $ 0.8 $