Question

Please help to find these answers. I want you to do calculations please. If you can solve it I would appreciate. otherwise leave to other

Please help to find these answers. I want you to do calculations please.

If you can solve it I would appreciate. otherwise leave to other one to solve it in his way.

1. Sasha has annual gross income of $58,000 and works as a lawyer. What is the maximum disability insurance coverage he can get based on the insurance company limit of maximum 90% of after tax income?

Input your answer to the nearest dollar with no $ sign, only the numbers.

Correct Answer: 3,573 1

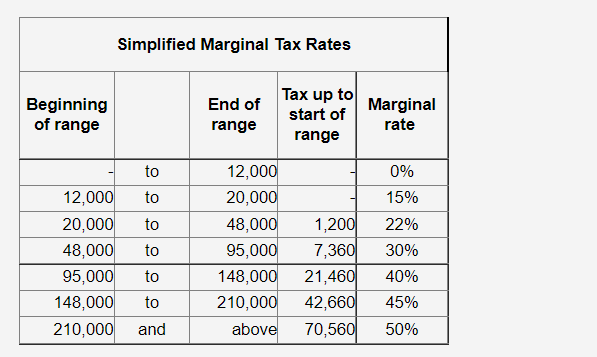

2. Janet makes $82,000 annually. Use the the marginal tax information in the table below to calculate what Janet's after tax monthly income should be.

Input your answer to the nearest dollar, numbers only, no $ sign etc.

Correct Answer: 5,370 1

Simplified Marginal Tax Rates Beginning of range End of range Tax up to start of range Marginal rate to 0% 15% to 12,000 20,000 48,000 95,000 148,000 210,000 to to to to and 12,000 20,000 48,000 95,000 148,000 210,000 above 1,200 7,360 21,460 42,660 70,560 22% 30% 40% 45% 50%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started