Question

Please help to find these answers. I want you to do calculations please. If you can solve it I would appreciate. otherwise leave to other

Please help to find these answers. I want you to do calculations please.

If you can solve it I would appreciate. otherwise leave to other one to solve it in his way.

| Axel is 30 years old, and has $40,000 accumulated in his RRSP already. Assume he will make an annual real rate of return of 2.8%. How much does Axel need to save each year to reach his retirement goal of having $835,000 at age 65? Input your answer to the nearest dollar (with no minus sign). | |||

| |||

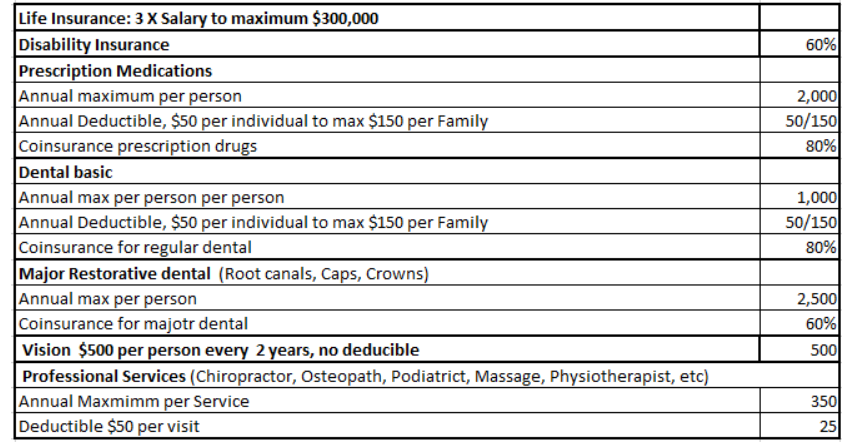

Allen is a single father with two children, Bob and Barb, and has the following coverage in his group benefits plan:

| This year he had the following medical expenses: Prescriptions: Barb: February a prescription for $70 Allen: May a prescription for $134

Dental: Allen: March a cleaning for $161 Allen: April a filling for $216 Bob: April a cleaning for $151 How much of these expenses would he have to cover himself (out of pocket)? Input your answer to the nearest dollar. | |||

| |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started