Please help to fix my numbers

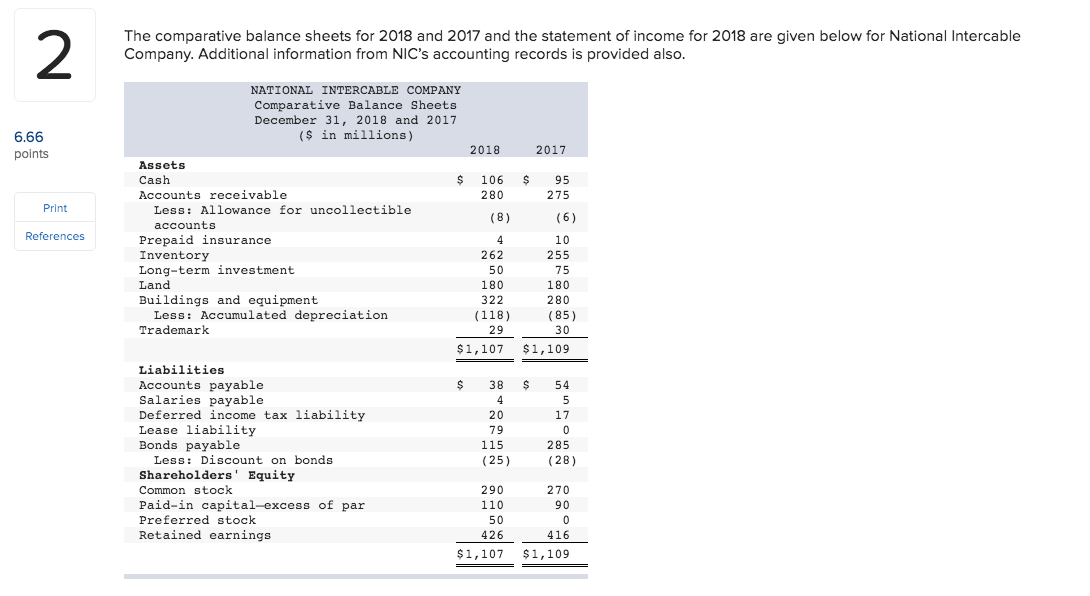

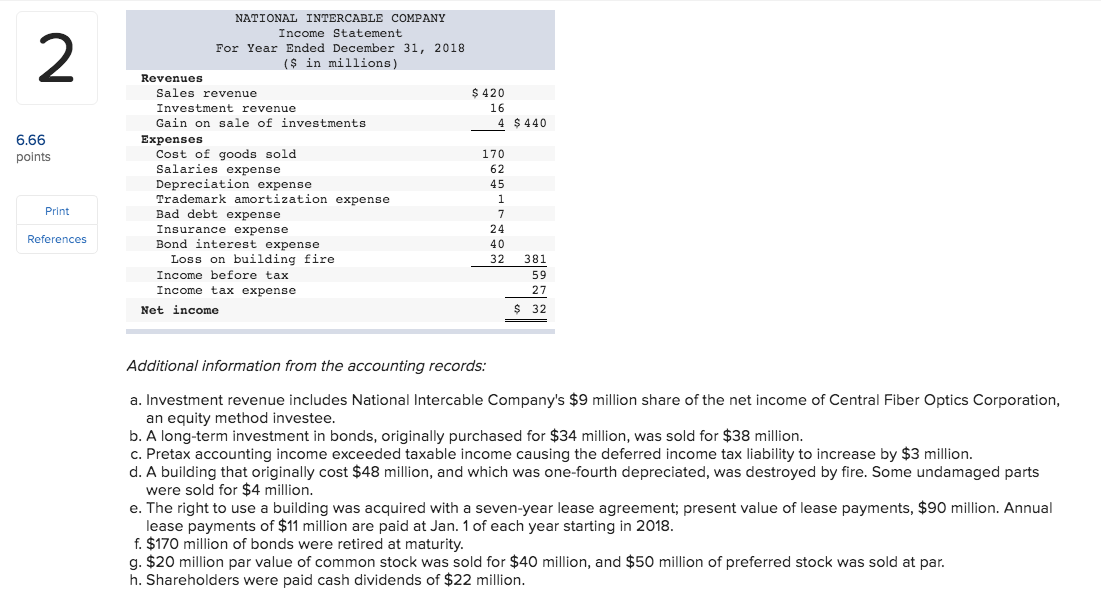

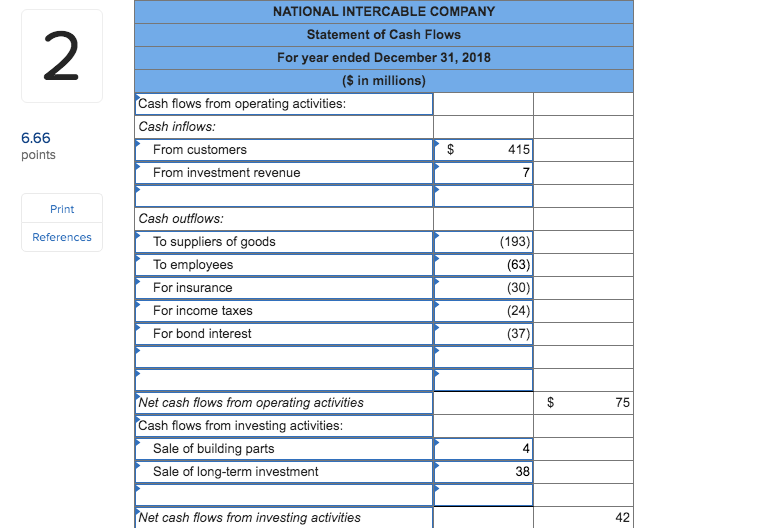

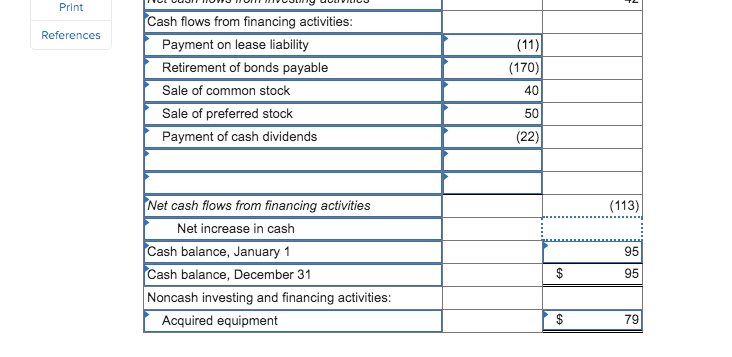

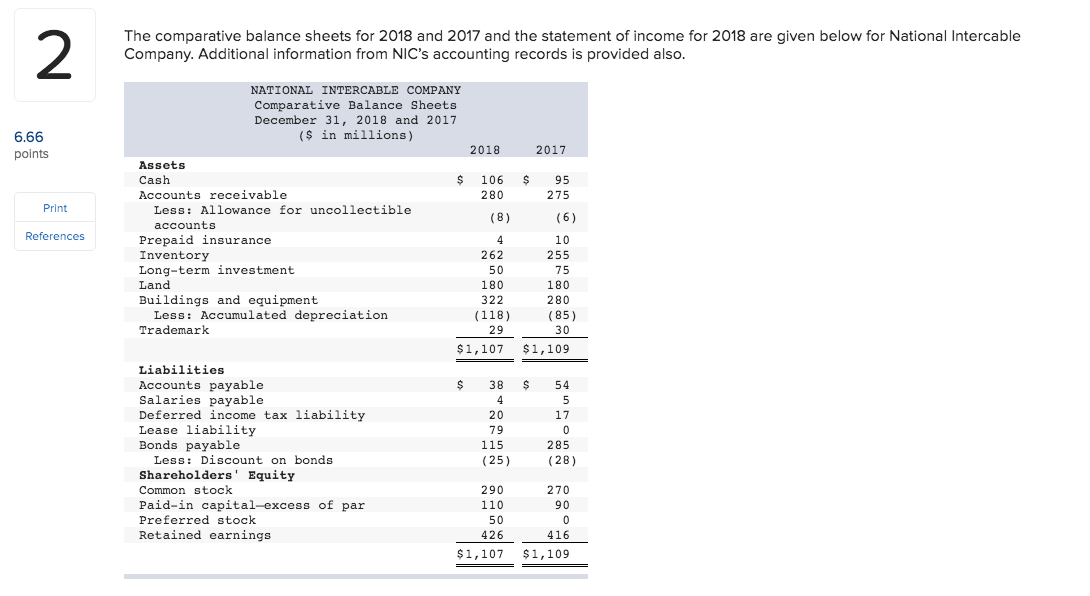

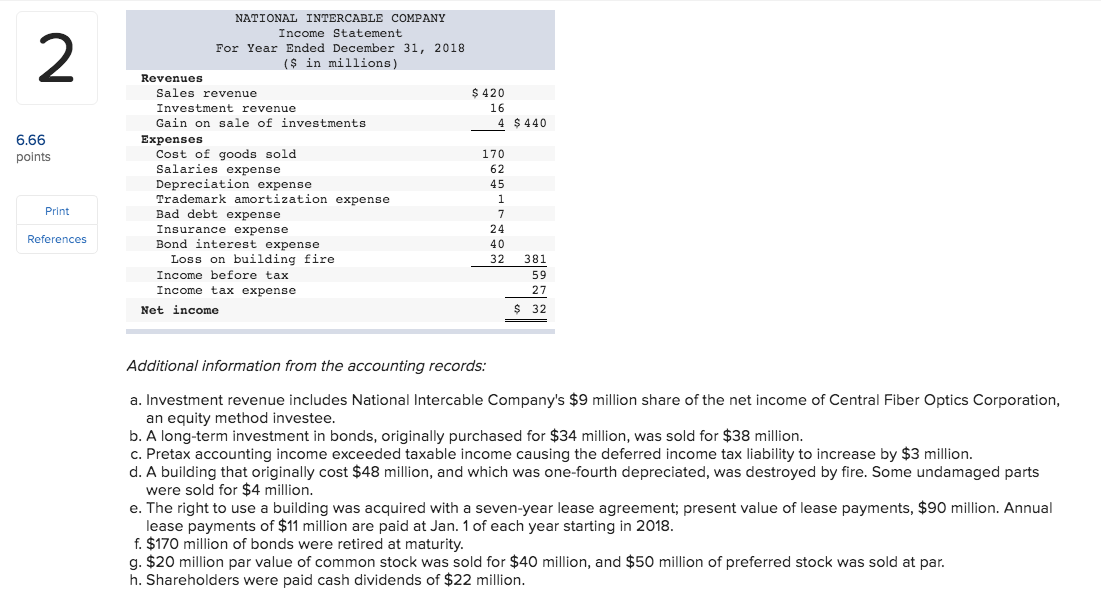

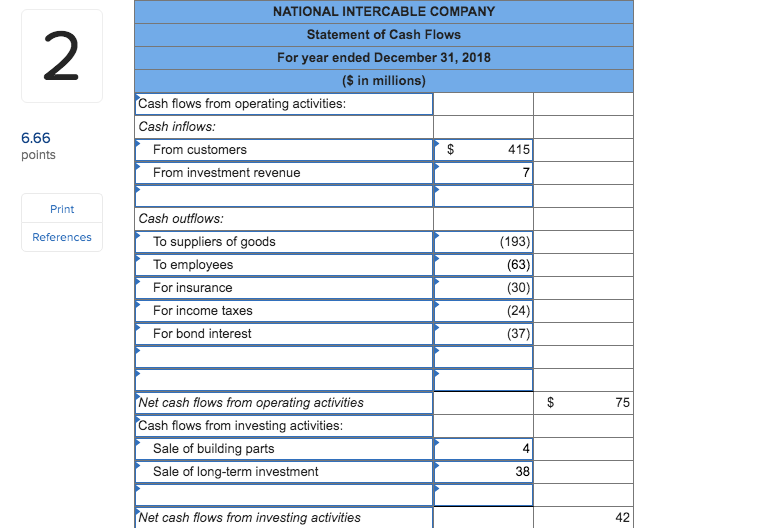

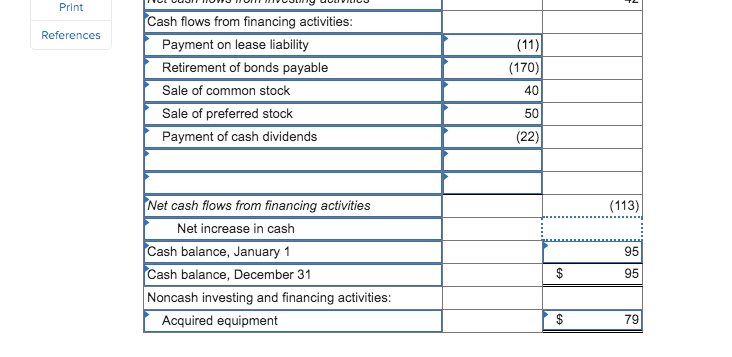

The comparative balance sheets for 2018 and 2017 and the statement of income for 2018 are given below for National Intercable Company. Add itional information from NIC's accounting records is provided also. 2 NATIONAL INTERCABLE COMPANY Comparative Balance Sheets December 31, 2018 and 2017 ($ in millions) 6.66 points 2018 2017 Assets Cash 106 95 Accounts receivable Less: Allowance for uncollectible 280 275 Print (6) (8) accounts References Prepaid insurance Inventory Long-term investment 10 4 255 262 50 75 180 180 Land Buildings and equipment Less: Accumulated depreciation 322 280 (85) (118) 29 Trademark 30 $1,107 $1,109 Liabilities Accounts payable Salaries payable Deferred income tax liability Lease liability Bonds payable 38 54 4 5 20 17 0 79 285 115 Less: Discount on bonds (28) (25 Shareholders' Equity 290 Common stock 270 Paid-in capital-excess of par Preferred stock Retained earnings 110 90 0 50 426 416 $1,109 $1,107 NATIONAL INTERCABLE COMPANY Income Statement 2 For Year Ended December 31, 2018 ($ in millions) Revenues Sales revenue 420 Investment revenue 16 Gain on sale of investments 4 $440 6.66 Expenses Cost of goods sold Salaries expense 170 points 62 Depreciation expense Trademark amortization expense Bad debt expense 45 1 Print 7 24 Insurance expense References Bond interest expense 40 32 Loss on building fire 381 Income before tax 59 Income tax expense 27 s32 Net income Additional information from the accounting records: a. Investment revenue includes National Intercable Company's $9 million share of the net income of Central Fiber Optics Corporation, an equity method investee. b. A long-term investment in bonds, originally purchased for $34 million, was sold for $38 million. c. Pretax accounting income exceeded taxable income causing the deferred income tax liability to increase by $3 million. d. A building that originally cost $48 million, and which was one-fourth depreciated, was destroyed by fire. Some undamaged parts were sold for $4 million e. The right to use a building was acquired with a seven-year lease agreement; present value of lease payments, $90 million. Annual lease payments of $11 million are paid at Jan. 1 of each year starting in 2018. f. $170 million of bonds were retired at maturity. g. $20 million par value of common stock was sold for $40 million, and $50 million of preferred stock was sold at par. h. Shareholders were paid cash dividends of $22 million. NATIONAL INTERCABLE COMPANY Statement of Cash Flows 2 For year ended December 31, 2018 ($ in millions) Cash flows from operating activities: Cash inflows: 6.66 From customers $ 415 points From investment revenue 7 Print Cash outflows: References (193) (63) To suppliers of goods To employees For insurance (30) For income taxes (24) For bond interest (37) Net cash flows from operating activities Cash flows from investing activities: 75 Sale of building parts Sale of long-term investment 38 Net cash flows from investing activities 42 Print Cash flows from financing activities: References Payment on lease liability (11) (170) Retirement of bonds payable Sale of common stock 40 Sale of preferred stock 50 Payment of cash dividends (22) Net cash flows from financing activities (113) Net increase in cash Cash balance, January 1 Cash balance, December 31 Noncash investing and financing activities: 95 95 79 Acquired equipment