Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help to show the workings: On January 1, 2013 UGA Enterprises bought 4,000 shares of Mizzou & Company, representing 40% of Mizzzou & Companys

Please help to show the workings:

On January 1, 2013 UGA Enterprises bought 4,000 shares of Mizzou & Company, representing 40% of Mizzzou & Companys outstanding shares, at a price of $30 per share. UGA Enterprises uses the equity method of accounting for these investments.

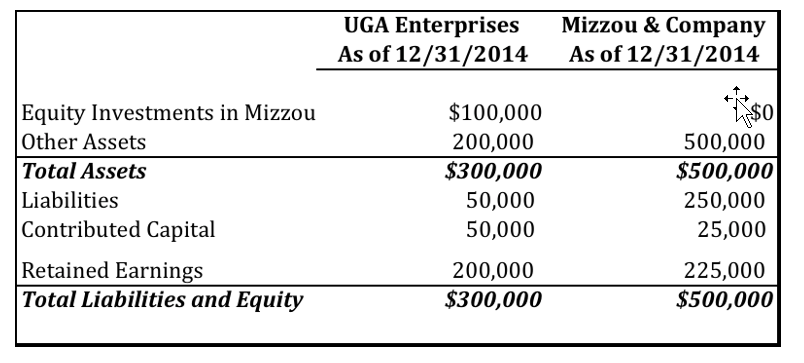

The balance sheets of the two companies at December 31, 2014 are provided below:

- The market price of a share in Mizzou & Company was $25 and $28 on December 31, 2013 and 2014, respectively.

- Mizzou & Company paid dividends totaling $40,000 cash to its shareholders during the year ended December 31, 2013 and December 31, 2014.

- UGA Enterprises reported its Equity Investments in Mizzou & Company at $70,000 on December 31, 2013.

REQUIRED:

- Provide the journal entry to record the receipt of dividends by UGA Enterprises in 2014.

B. Determine the Net Income (Loss) reported by Mizzou & Company during the year ended December 31, 2014.

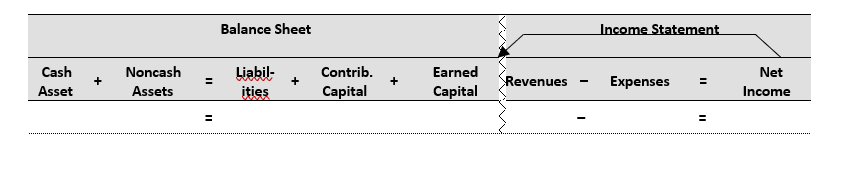

UGA EnterprisesMizzou & Company As of 12/31/2014 As of 12/31/2014 Equity Investments in Mizzou Other Assets Total Assets Liabilities Contributed Capital $100,000 200,000 $300,000 50,000 50,000 200,000 $300,000 $0 500,000 $500,000 250,000 25,000 225,000 $500,000 Retained Earnings Total Liabilities and Equity Balance Sheet Cash Asset Noncash Assets Liabil- + ities Contrib. Capital Earned Revenues Expenses Capital Net Income +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started