Answered step by step

Verified Expert Solution

Question

1 Approved Answer

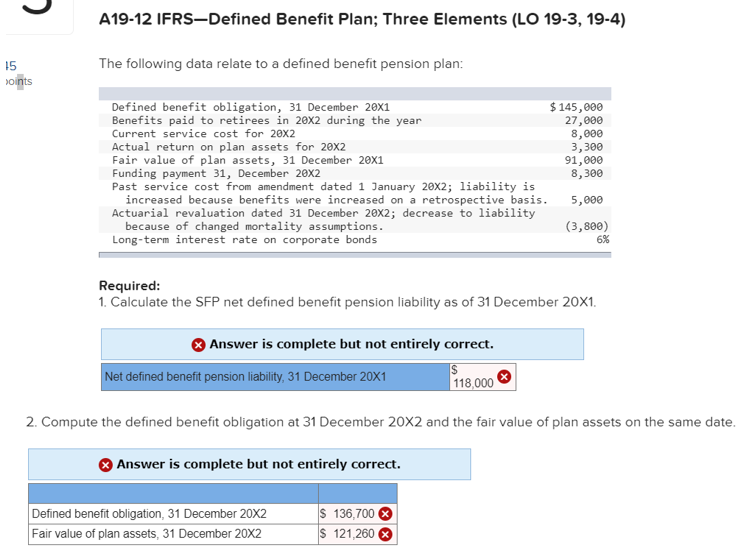

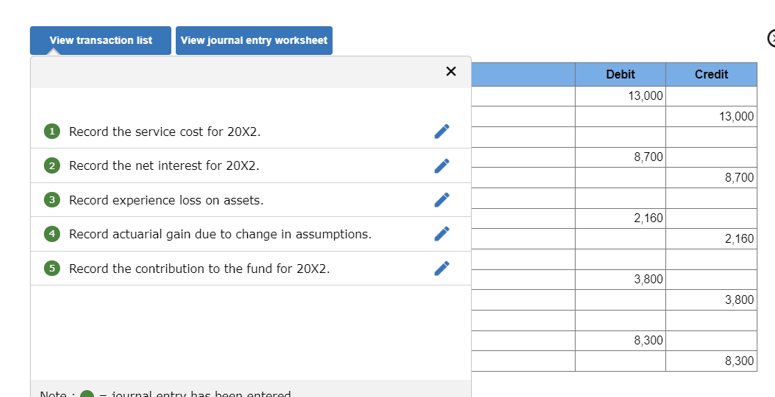

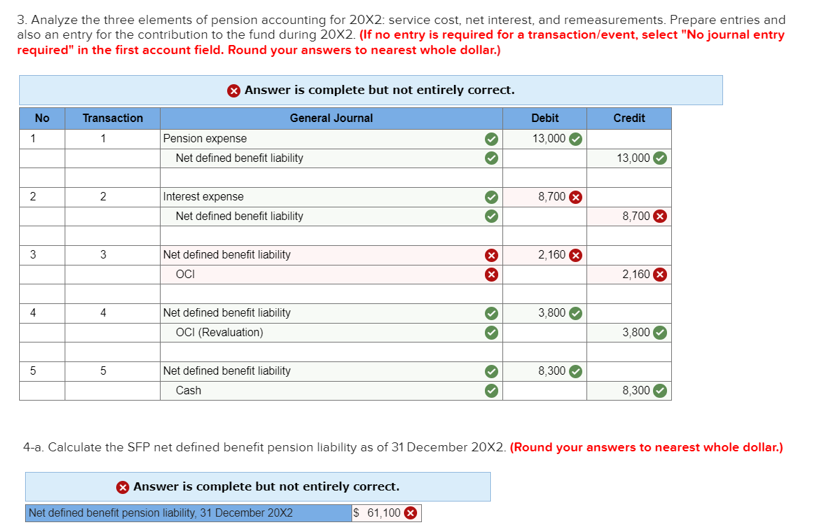

Please help to solve and show your detailed solutions A19-12 IFRS-Defined Benefit Plan; Three Elements (LO 19-3, 19-4) The following data relate to a defined

Please help to solve and show your detailed solutions

A19-12 IFRS-Defined Benefit Plan; Three Elements (LO 19-3, 19-4) The following data relate to a defined benefit pension plan: Required: 1. Calculate the SFP net defined benefit pension liability as of 31 December 201. Answer is complete but not entirely correct. 2. Compute the defined benefit obligation at 31 December 202 and the fair value of plan assets on the same date Answer is complete but not entirely correct. View transaction list View journal entry worksheet (1) Record the service cost for 202. (2) Record the net interest for 202. (3) Record experience loss on assets. (4) Record actuarial gain due to change in assumptions. (5) Record the contribution to the fund for 202. \begin{tabular}{|r|r|r|} \hline & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{c|}{ Credit } \\ \hline & 13,000 & \\ \hline & & 13,000 \\ \hline & & \\ \hline & 8,700 & \\ \hline & & 8,700 \\ \hline & & \\ \hline & & \\ \hline & & 2,160 \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} 3. Analyze the three elements of pension accounting for 202 : service cost, net interest, and remeasurements. Prepare entries and also an entry for the contribution to the fund during 202. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar.) 4-a. Calculate the SFP net defined benefit pension liability as of 31 December 202. (Round your answers to nearest whole dollar.) A19-12 IFRS-Defined Benefit Plan; Three Elements (LO 19-3, 19-4) The following data relate to a defined benefit pension plan: Required: 1. Calculate the SFP net defined benefit pension liability as of 31 December 201. Answer is complete but not entirely correct. 2. Compute the defined benefit obligation at 31 December 202 and the fair value of plan assets on the same date Answer is complete but not entirely correct. View transaction list View journal entry worksheet (1) Record the service cost for 202. (2) Record the net interest for 202. (3) Record experience loss on assets. (4) Record actuarial gain due to change in assumptions. (5) Record the contribution to the fund for 202. \begin{tabular}{|r|r|r|} \hline & \multicolumn{1}{|c|}{ Debit } & \multicolumn{1}{c|}{ Credit } \\ \hline & 13,000 & \\ \hline & & 13,000 \\ \hline & & \\ \hline & 8,700 & \\ \hline & & 8,700 \\ \hline & & \\ \hline & & \\ \hline & & 2,160 \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} 3. Analyze the three elements of pension accounting for 202 : service cost, net interest, and remeasurements. Prepare entries and also an entry for the contribution to the fund during 202. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollar.) 4-a. Calculate the SFP net defined benefit pension liability as of 31 December 202. (Round your answers to nearest whole dollar.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started