Answered step by step

Verified Expert Solution

Question

1 Approved Answer

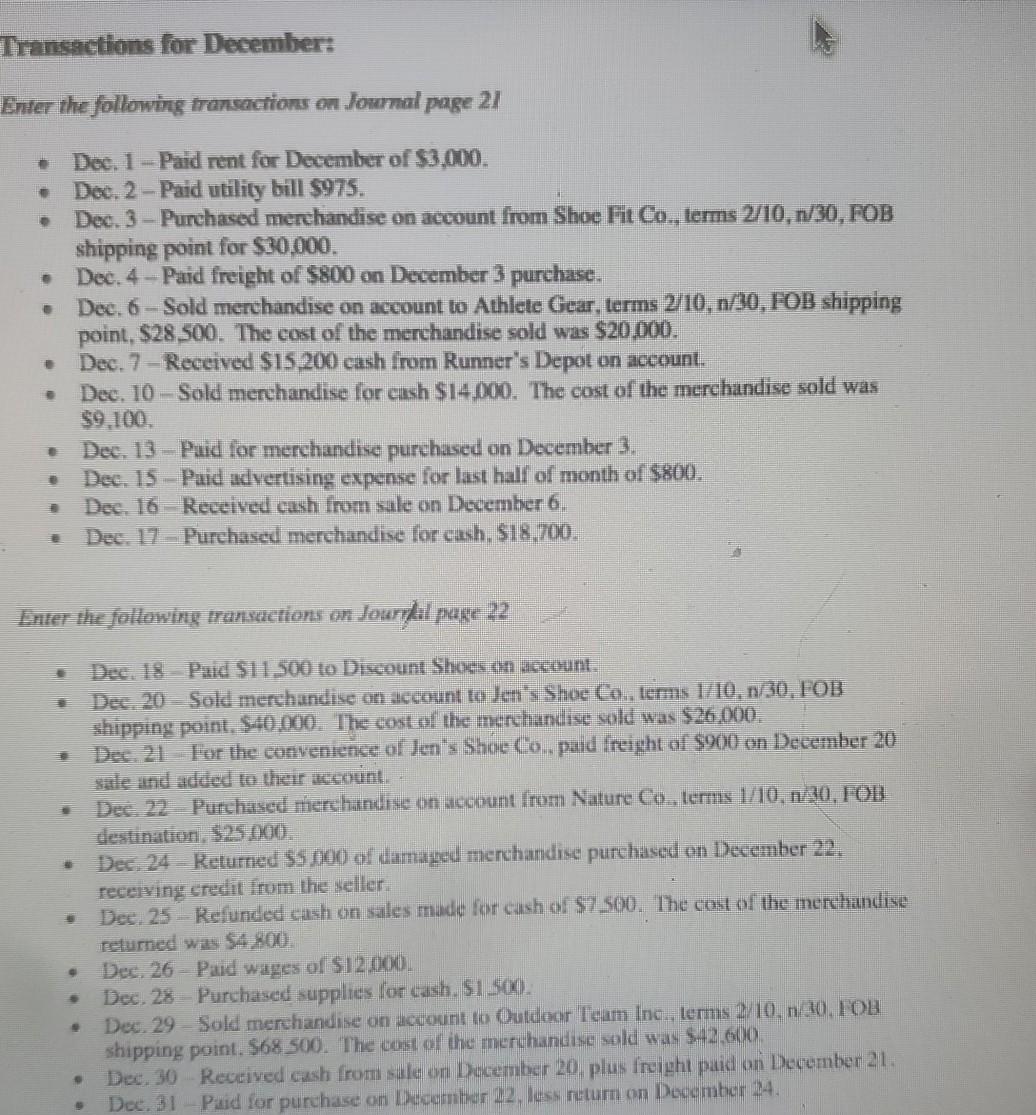

please help!! Transactions for December: Enter the following transactions on Journal page 21 Dec. 1 - Paid rent for December of $3,000. Doc. 2 -

please help!!

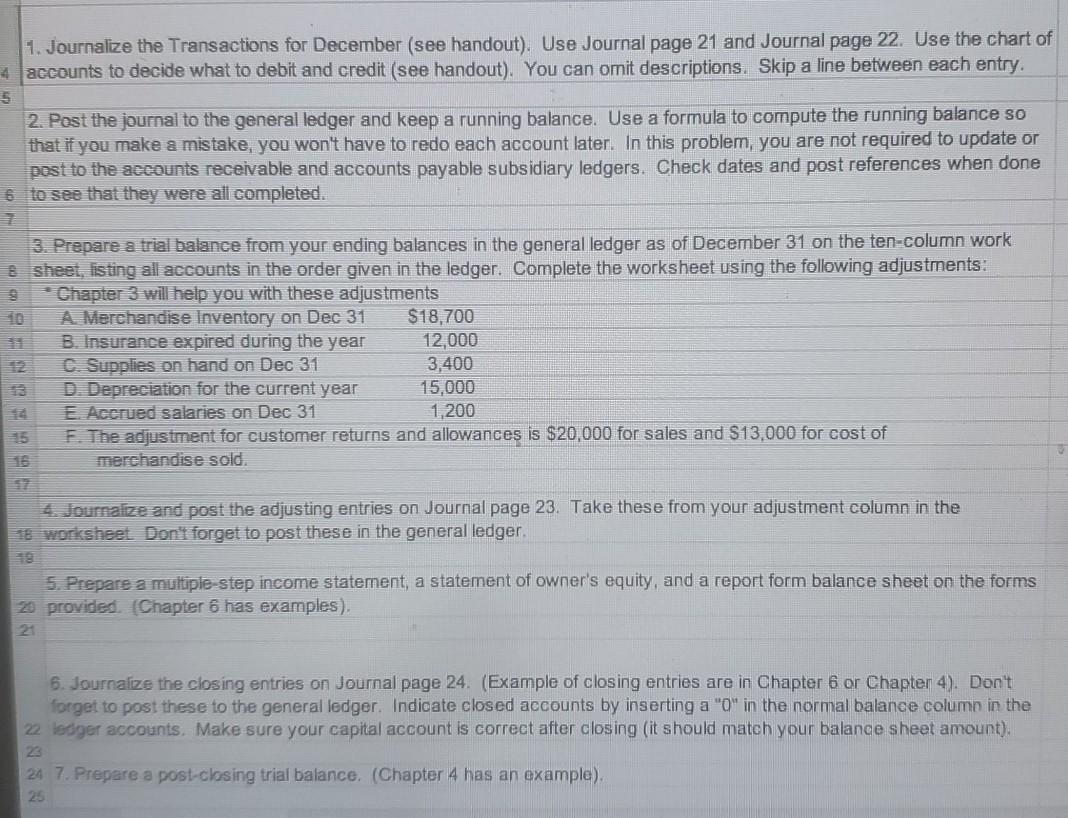

Transactions for December: Enter the following transactions on Journal page 21 Dec. 1 - Paid rent for December of $3,000. Doc. 2 - Paid utility bill $975. Dec. 3 - Purchased merchandise on account from Shoe Fit Co., terms 2/10,n/30, POB shipping point for $30,000. Dec. 4 - Paid freight of $800 on December 3 purchase. Dec. 6 - Sold merchandise on account to Athlete Gear, terms 2/10, n/30, FO3 shipping point, $28 500. The cost of the merchandise sold was $20.000. Dec. 7-Received $15,200 cash from Runner's Depot on account. Dec. 10 - Sold merchandise for cash $14,000. The cost of the merchandise sold was $9,100 Dec, 13 - Paid for merchandise purchased on December 3. Dec. 15 -- Paid advertising expense for last half of month of $800. Dec. 16 Received cash from sale on December 6. Dec. 17 - Purchased merchandise lor cash. $18.700. Enter the following transactions on Jouredil page 22 Dec. 18 Paid $11.500 to Discount Shoes on account. Dec. 20 Sold merchandise an account to Jen's Shoe Co.. terms 1/10, 1/30, FOB shipping point, $40.000. The cost of the merchandise sold was $26.000. Dec. 21 For the convenience of Jen's Shoe Co., paid freight of $900 on December 20 sale and added to their account Dec 22 Purchased merchandise on account from Nature Co. terms 1/10. n 10. FOB destination. $25.000. Dec. 24 Returned $5 000 of damaged merchandise purchased on December 22. receiving credit from the seller. Des. 25 - Refunded cash on sales made for cash or $7.500. The cost of the merchandise returned was $4800, Dec. 26 - Paid wages of $12000 Dec. 28Purchased supplies for cash. $1.500. Dec. 29 - Sold merchandise on account to Outdoor Team Inc., terms 110. n30, TOH shipping point. $68_500. The cost of the merchandise sold was $42.600. Dec. 30 Received cash from sale on December 20, plus freight puid on December 21. Dec.31 - Paid for purchase on December 12, less return on December 14. . . 1. Journalize the Transactions for December (see handout). Use Journal page 21 and Journal page 22. Use the chart of 4 accounts to decide what to debit and credit (see handout). You can omit descriptions. Skip a line between each entry. 2. Post the journal to the general ledger and keep a running balance. Use a formula to compute the running balance so that if you make a mistake, you won't have to redo each account later. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. Check dates and post references when done 6 to see that they were all completed. 3. Prepare a trial balance from your ending balances in the general ledger as of December 31 on the ten-column work 8 sheet, listing all accounts in the order given in the ledger. Complete the worksheet using the following adjustments: Chapter 3 will help you with these adjustments A Merchandise Inventory on Dec 31 $18,700 B. Insurance expired during the year 12,000 C. Supplies on hand on Dec 31 3,400 D. Depreciation for the current year 15,000 E Accrued salaries on Dec 31 1,200 F. The adjustment for customer returns and allowances is $20,000 for sales and $13,000 for cost of merchandise sold. 4. Journaize and post the adjusting entries on Journal page 23. Take these from your adjustment column in the 18 worksheet Don't forget to post these in the general ledger 5. Prepare a multiple-step income statement, a statement of owner's equity, and a report form balance sheet on the forms 20 provided. (Chapter 6 has examples). 6. Journalize the closing entries on Journal page 24. (Example of closing entries are in Chapter 6 or Chapter 4). Don't forget to post these to the general ledger. Indicate closed accounts by inserting a "0" in the normal balance column in the 22 ledger accounts. Make sure your capital account is correct after closing (it should match your balance sheet amount), 24 7. Prepare a post-closing trial balance. (Chapter 4 has an example)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started