Answered step by step

Verified Expert Solution

Question

1 Approved Answer

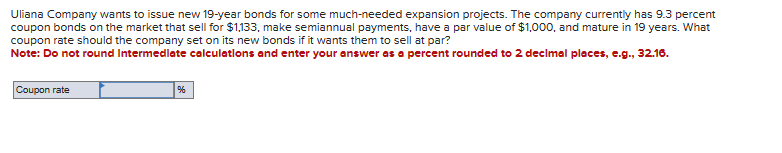

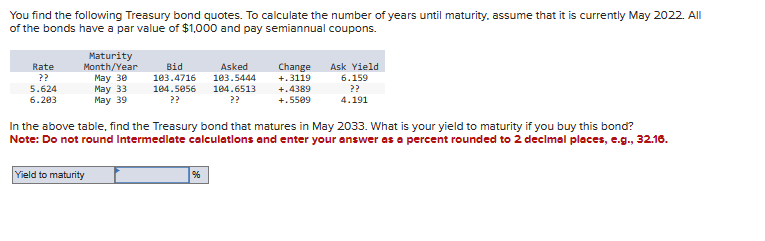

please help Uliana Company wants to issue new 19 -year bonds for some much-needed expansion projects. The company currently has 9.3 percent coupon bonds on

please help

Uliana Company wants to issue new 19 -year bonds for some much-needed expansion projects. The company currently has 9.3 percent coupon bonds on the market that sell for $1,133, make semiannual payments, have a par value of $1,000, and mature in 19 years. What coupon rate should the company set on its new bonds if it wants them to sell at par? Note: Do not round Intermedlate colculatlons and enter your answer as a percent rounded to 2 declmal pleces, e.g., 32.16. You find the following Treasury bond quotes. To calculate the number of years until maturity. assume that it is currently May 2022 . All of the bonds have a par value of $1,000 and pay semiannual coupons. In the above table, find the Treasury bond that matures in May 2033. What is your yield to maturity if you buy this bond? Note: Do not round Intermedlate colculatlons and enter your onswer as a percent rounded to 2 declmal ploces, e.g., 32.16Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started