Answered step by step

Verified Expert Solution

Question

1 Approved Answer

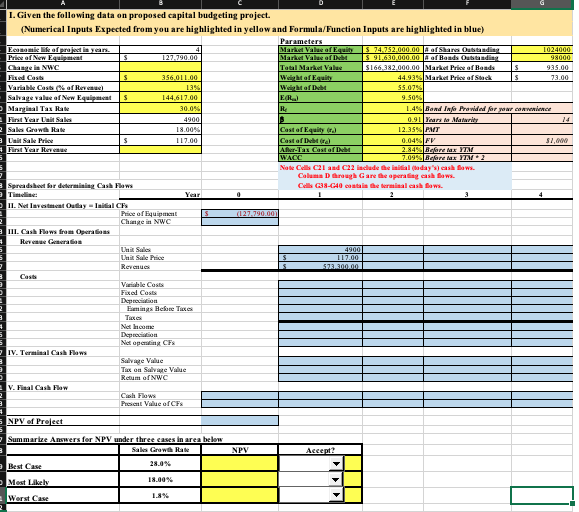

PLEASE HELP!! URGENT!! 1. Given the following data on proposed capital budgeting project. (Numerical Inputs Expected from you are highlighted in yellow and Formula/Function Inputs

PLEASE HELP!! URGENT!!

1. Given the following data on proposed capital budgeting project. (Numerical Inputs Expected from you are highlighted in yellow and Formula/Function Inputs are highlighted in blue) Parameters Economickofprown Market Value of Equity S 74.752.000.00 of Shares Dandia 1024000 Price of New Feet 127.790.00 Marku Vabee of S 91.630,000.00 A of Beads Obitandis 98000 Chanel NWC Total Marku Vaba 5166,382,000.00 Market Price of Bands s 935.00 s 356 01100 We hof Eet 44.93 Market Price of Stack s 73.00 Variable Cast of Rura) 1354 Weight of the S5.079 Salvage value of New Equipment s 144.617.00 ER 9.50% Marginal Tax Rate 30.0% RE 1.4 |Band Ins Pravilai ar ar arrience First Year Lalit Sale 4900 0.91 Years in Mal 14 Sales Corowa Rate 18.00% Cast of Equity or 12.355PMT Walt Sale Price 117.00 Cast of the 0.04%|FV 57,00 First Year He Afer Tax Cost of the 2.84 Bofare tax YTM WACO 7.099 Boare fax YTM ? Note Cells C21 and 22 include the initial (today's) cash flows. Colume through Gare the operating cash Bows Spreadsheet for determining Cash Flows Calls 38-G40 centain the brimal cash flaws. Year 0 3 II. Net lavet Oday Initial CF Price of Equipo S 20.007 Change in NWC M. Cash Flows from Oras Remeration La Salo 4900 Laat Sale Price 117.00 Revenues 573.300.00 Casita Ville Cost Fixed Cost Depecon Fenings Before Taxes To Net home | Deprai | Net IV. Terminal Cash Flow Saare Value Tax on Sulae Value Reum of NWC V. Final Cash Flow Cash Flows Present Value ofCFX NPV Accept? NPV of Project Summarize Answers for NPV under three cases in area below Sal Growth Rae 28.0% Best Case 18.00% Most Likely 1.8% Werst Cove 1. Given the following data on proposed capital budgeting project. (Numerical Inputs Expected from you are highlighted in yellow and Formula/Function Inputs are highlighted in blue) Parameters Economickofprown Market Value of Equity S 74.752.000.00 of Shares Dandia 1024000 Price of New Feet 127.790.00 Marku Vabee of S 91.630,000.00 A of Beads Obitandis 98000 Chanel NWC Total Marku Vaba 5166,382,000.00 Market Price of Bands s 935.00 s 356 01100 We hof Eet 44.93 Market Price of Stack s 73.00 Variable Cast of Rura) 1354 Weight of the S5.079 Salvage value of New Equipment s 144.617.00 ER 9.50% Marginal Tax Rate 30.0% RE 1.4 |Band Ins Pravilai ar ar arrience First Year Lalit Sale 4900 0.91 Years in Mal 14 Sales Corowa Rate 18.00% Cast of Equity or 12.355PMT Walt Sale Price 117.00 Cast of the 0.04%|FV 57,00 First Year He Afer Tax Cost of the 2.84 Bofare tax YTM WACO 7.099 Boare fax YTM ? Note Cells C21 and 22 include the initial (today's) cash flows. Colume through Gare the operating cash Bows Spreadsheet for determining Cash Flows Calls 38-G40 centain the brimal cash flaws. Year 0 3 II. Net lavet Oday Initial CF Price of Equipo S 20.007 Change in NWC M. Cash Flows from Oras Remeration La Salo 4900 Laat Sale Price 117.00 Revenues 573.300.00 Casita Ville Cost Fixed Cost Depecon Fenings Before Taxes To Net home | Deprai | Net IV. Terminal Cash Flow Saare Value Tax on Sulae Value Reum of NWC V. Final Cash Flow Cash Flows Present Value ofCFX NPV Accept? NPV of Project Summarize Answers for NPV under three cases in area below Sal Growth Rae 28.0% Best Case 18.00% Most Likely 1.8% Werst CoveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started