please help urgent!!!

mini case background (question starts from b - g

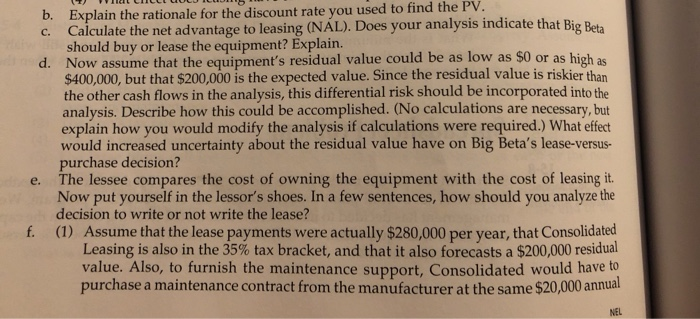

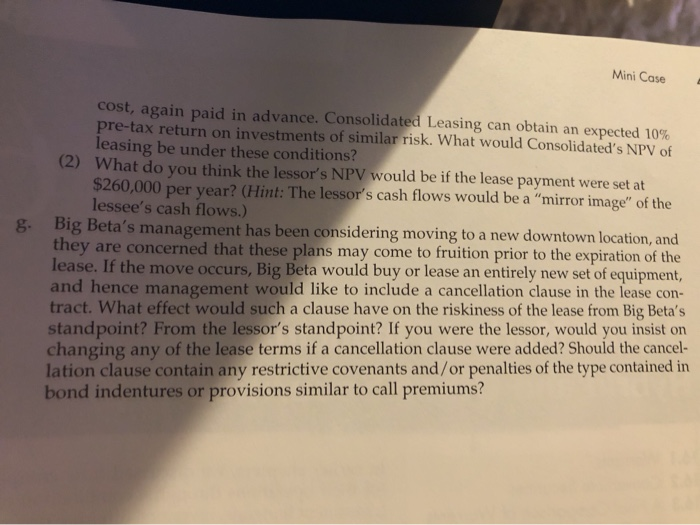

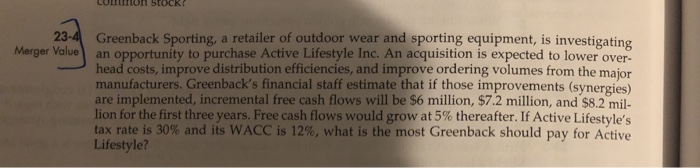

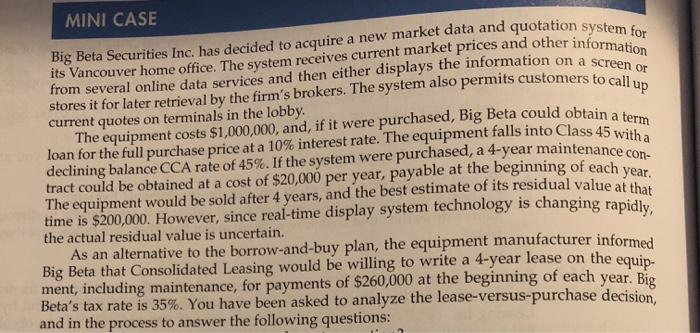

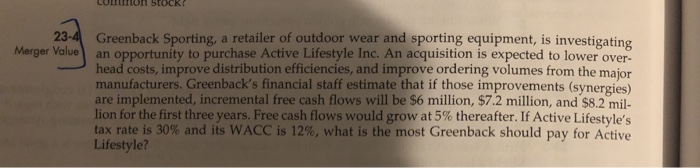

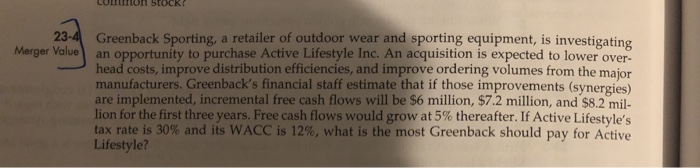

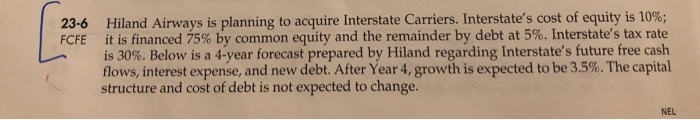

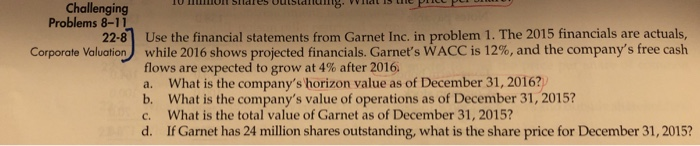

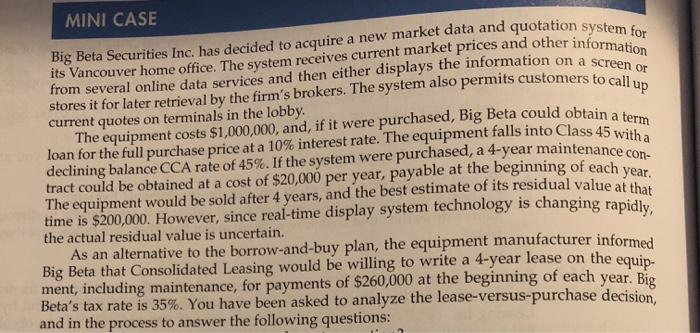

OCK 23-4 Greenback Sporting, a retailer of outdoor wear and sporting equipment, is investigating Merger Value an opportunity to purchase Active Lifestyle Inc. An acquisition is expected to lower over- head costs, improve distribution efficiencies, and improve ordering volumes from the major manufacturers. Greenback's financial staff estimate that if those improvements (synergies) are implemented, incremental free cash flows will be $6 million, $7.2 million, and $8.2 mil- lion for the first three years. Free cash flows would grow at 5% thereafter. If Active Lifestyle's tax rate is 30% and its WACC is 12%, what is the most Greenback should pay for Active Lifestyle? 23-6 FCFE Hiland Airways is planning to acquire Interstate Carriers. Interstate's cost of equity is 10%; it is financed 75% by common equity and the remainder by debt at 5%. Interstate's tax rate is 30%. Below is a 4-year forecast prepared by Hiland regarding Interstate's future free cash flows, interest expense, and new debt. After Year 4, growth is expected to be 3.5%. The capital structure and cost of debt is not expected to change. NEL Challenging Problems 8-11 22-8 Use the financial statements from Garnet Inc. in problem 1. The 2015 financials are actuals, Corporate Valuation while 2016 shows projected financials. Garnet's WACC is 12%, and the company's free cash flows are expected to grow at 4% after 2016, a. What is the company's horizon value as of December 31, 2016? b. What is the company's value of operations as of December 31, 2015? c. What is the total value of Garnet as of December 31, 2015? d. If Garnet has 24 million shares outstanding, what is the share price for December 31, 2015? Big Beta Securities Inc. has decided to acquire a new market data and quotation system for its Vancouver home office. The system receives current market prices and other information MINI CASE from several online data services and then either displays the information on a screen on Stores it for later retrieval by the firm's brokers. The system also permits customers to call up The equipment costs $1,000,000, and, if it were purchased, Big Beta could obtain a term loan for the full purchase price at a 10% interest rate. The equipment falls into Class 45 with a tract could be obtained at a cost of $20,000 per year, payable at the beginning of each year. The equipment would be sold after 4 years, and the best estimate of its residual value at that time is $200,000. However, since real-time display system technology is changing rapidly, the actual residual value is uncertain. As an alternative to the borrow-and-buy plan, the equipment manufacturer informed Big Beta that Consolidated Leasing would be willing to write a 4-year lease on the equip- ment, including maintenance, for payments of $260,000 at the beginning of each year. Big Beta's tax rate is 35%. You have been asked to analyze the lease-versus-purchase decision, and in the process to answer the following questions: c. b. Explain the rationale for the discount rate you used to find the PV. Calculate the net advantage to leasing (NAL). Does your analysis indicate that Big Beta should buy or lease the equipment? Explain. d. Now assume that the equipment's residual value could be as low as $0 or as high as $400,000, but that $200,000 is the expected value. Since the residual value is riskier than the other cash flows in the analysis, this differential risk should be incorporated into the analysis. Describe how this could be accomplished. (No calculations are necessary, but explain how you would modify the analysis if calculations were required.) What effect would increased uncertainty about the residual value have on Big Beta's lease-versus- purchase decision? The lessee compares the cost of owning the equipment with the cost of leasing it. Now put yourself in the lessor's shoes. In a few sentences, how should you analyze the decision to write or not write the lease? (1) Assume that the lease payments were actually $280,000 per year, that Consolidated Leasing is also in the 35% tax bracket, and that it also forecasts a $200,000 residual value. Also, to furnish the maintenance support, Consolidated would have to purchase a maintenance contract from the manufacturer at the same $20,000 annual e. NEL Mini Case cost, again paid in advance. Consolidated Leasing can obtain an expected 10% pre-tax return on investments of similar risk. What would Consolidated's NPV of leasing be under these conditions? (2) What do you think the lessor's NPV would be if the lease payment were set at $260,000 per year? (Hint: The lessor's cash flows would be a "mirror image" of the lessee's cash flows.) 8. Big Beta's management has been considering moving to a new downtown location, and they are concerned that these plans may come to fruition prior to the expiration of the lease. If the move occurs, Big Beta would buy or lease an entirely new set of equipment, and hence management would like to include a cancellation clause in the lease con- tract. What effect would such a clause have on the riskiness of the lease from Big Beta's standpoint? From the lessor's standpoint? If you were the lessor, would you insist on changing any of the lease terms if a cancellation clause were added? Should the cancel- lation clause contain any restrictive covenants and/or penalties of the type contained in bond indentures or provisions similar to call premiums

mini case background (question starts from b - g

mini case background (question starts from b - g