Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help urgent Score on last try: 0 of 13 pts. See Details for more. You can retry this question below On January 1, 2021,

Please help urgent

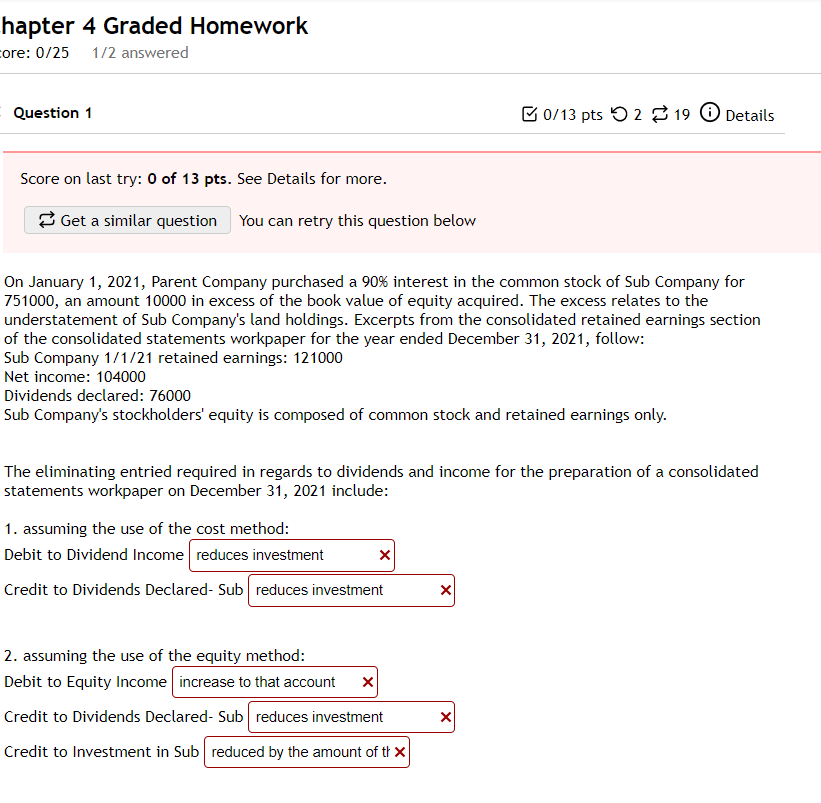

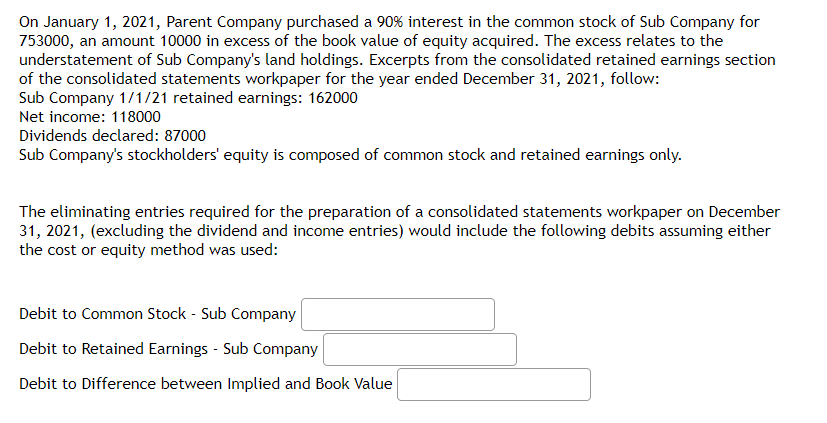

Score on last try: 0 of 13 pts. See Details for more. You can retry this question below On January 1, 2021, Parent Company purchased a 90% interest in the common stock of Sub Company for 751000 , an amount 10000 in excess of the book value of equity acquired. The excess relates to the understatement of Sub Company's land holdings. Excerpts from the consolidated retained earnings section of the consolidated statements workpaper for the year ended December 31, 2021, follow: Sub Company 1/1/21 retained earnings: 121000 Net income: 104000 Dividends declared: 76000 Sub Company's stockholders' equity is composed of common stock and retained earnings only. The eliminating entried required in regards to dividends and income for the preparation of a consolidated statements workpaper on December 31, 2021 include: 1. assuming the use of the cost method: Debit to Dividend Income Credit to Dividends Declared- Sub 2. assuming the use of the equity method: Debit to Equity Income Credit to Dividends Declared- Sub Credit to Investment in Sub On January 1, 2021, Parent Company purchased a 90% interest in the common stock of Sub Company for 753000, an amount 10000 in excess of the book value of equity acquired. The excess relates to the understatement of Sub Company's land holdings. Excerpts from the consolidated retained earnings section of the consolidated statements workpaper for the year ended December 31, 2021, follow: Sub Company 1/1/21 retained earnings: 162000 Net income: 118000 Dividends declared: 87000 Sub Company's stockholders' equity is composed of common stock and retained earnings only. The eliminating entries required for the preparation of a consolidated statements workpaper on December 31, 2021, (excluding the dividend and income entries) would include the following debits assuming either the cost or equity method was used: Debit to Common Stock - Sub Company Debit to Retained Earnings - Sub Company Debit to Difference between Implied and Book ValueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started