Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help urgently. Question 2 (35) - Chapter 5 smaller towns in Mpumalanga. Dresswell (Pty) Ltd is in direct competition with Top Fashion but with

please help urgently.

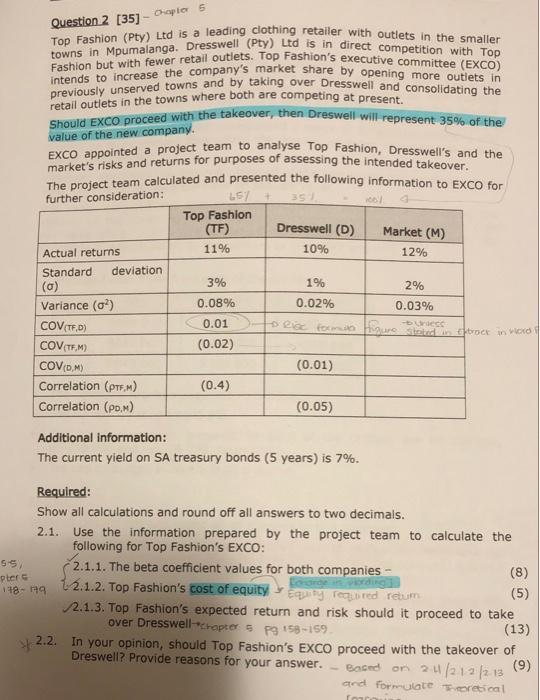

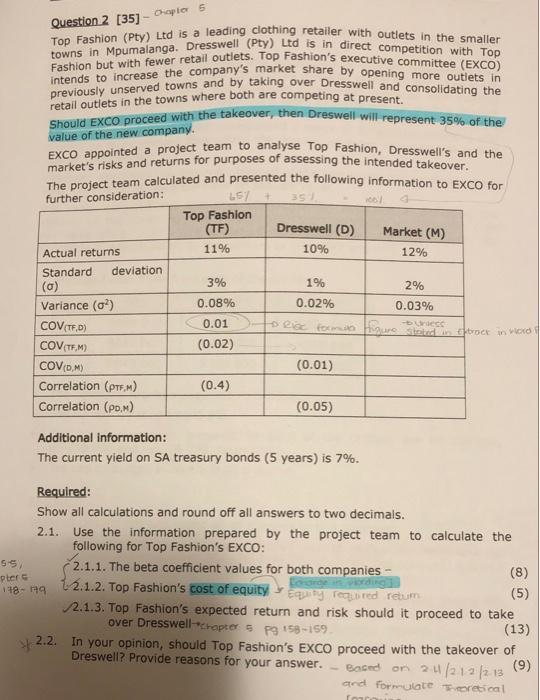

Question 2 (35) - Chapter 5 smaller towns in Mpumalanga. Dresswell (Pty) Ltd is in direct competition with Top Fashion but with fewer retail outlets. Top Fashion's executive committee (EXCO) intends to increase the company's market share by opening more outlets in previously unserved towns and by taking over Dresswell and consolidating the Should EXCO proceed with the takeover, then Dreswell will represent 35% of the value of the new company. retail outlets in the towns where both are competing at present. 35 10% EXCO appointed a project team to analyse Top Fashion, Dresswell's and the market's risks and returns for purposes of assessing the intended takeover. The project team calculated and presented the following information to EXCO for further consideration: LSI Top Fashion (TF) Dresswell (D) Market (M) Actual returns 11% 12% Standard deviation (a) 3% 1% Variance (0) 0.02% 0.03% COV(TF,D) 0.01 to Rice formato figure out in frock in wordt COV (TEM) (0.02) COVOM (0.01) Correlation (PTEM) (0.4) Correlation (PDM) (0.05) 2% 0.08% Additional information: The current yield on SA treasury bonds (5 years) is 7%. 5.5 pler 118-19 Required: Show all calculations and round off all answers to two decimals. 2.1. Use the information prepared by the project team to calculate the following for Top Fashion's EXCO: 2.1.1. The beta coefficient values for both companies - (8) 12.1.2. Top Fashion's cost of equity Equy reared reum re (5) 2.1.3. Top Fashion's expected return and risk should it proceed to take over Dresswell-chapter 5 PS 158-159 (13) 2.2. In your opinion, should Top Fashion's EXCO proceed with the takeover of Dreswell? Provide reasons for your answer. Boced 2.4/212/2.13 and formulate oretical on 2 (9) Question 2 (35) - Chapter 5 smaller towns in Mpumalanga. Dresswell (Pty) Ltd is in direct competition with Top Fashion but with fewer retail outlets. Top Fashion's executive committee (EXCO) intends to increase the company's market share by opening more outlets in previously unserved towns and by taking over Dresswell and consolidating the Should EXCO proceed with the takeover, then Dreswell will represent 35% of the value of the new company. retail outlets in the towns where both are competing at present. 35 10% EXCO appointed a project team to analyse Top Fashion, Dresswell's and the market's risks and returns for purposes of assessing the intended takeover. The project team calculated and presented the following information to EXCO for further consideration: LSI Top Fashion (TF) Dresswell (D) Market (M) Actual returns 11% 12% Standard deviation (a) 3% 1% Variance (0) 0.02% 0.03% COV(TF,D) 0.01 to Rice formato figure out in frock in wordt COV (TEM) (0.02) COVOM (0.01) Correlation (PTEM) (0.4) Correlation (PDM) (0.05) 2% 0.08% Additional information: The current yield on SA treasury bonds (5 years) is 7%. 5.5 pler 118-19 Required: Show all calculations and round off all answers to two decimals. 2.1. Use the information prepared by the project team to calculate the following for Top Fashion's EXCO: 2.1.1. The beta coefficient values for both companies - (8) 12.1.2. Top Fashion's cost of equity Equy reared reum re (5) 2.1.3. Top Fashion's expected return and risk should it proceed to take over Dresswell-chapter 5 PS 158-159 (13) 2.2. In your opinion, should Top Fashion's EXCO proceed with the takeover of Dreswell? Provide reasons for your answer. Boced 2.4/212/2.13 and formulate oretical on 2 (9)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started