Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help urgently, so far all the question's I have posted similar to these are incorrect and I have to submit them soon Parent Company

Please help urgently, so far all the question's I have posted similar to these are incorrect and I have to submit them soon

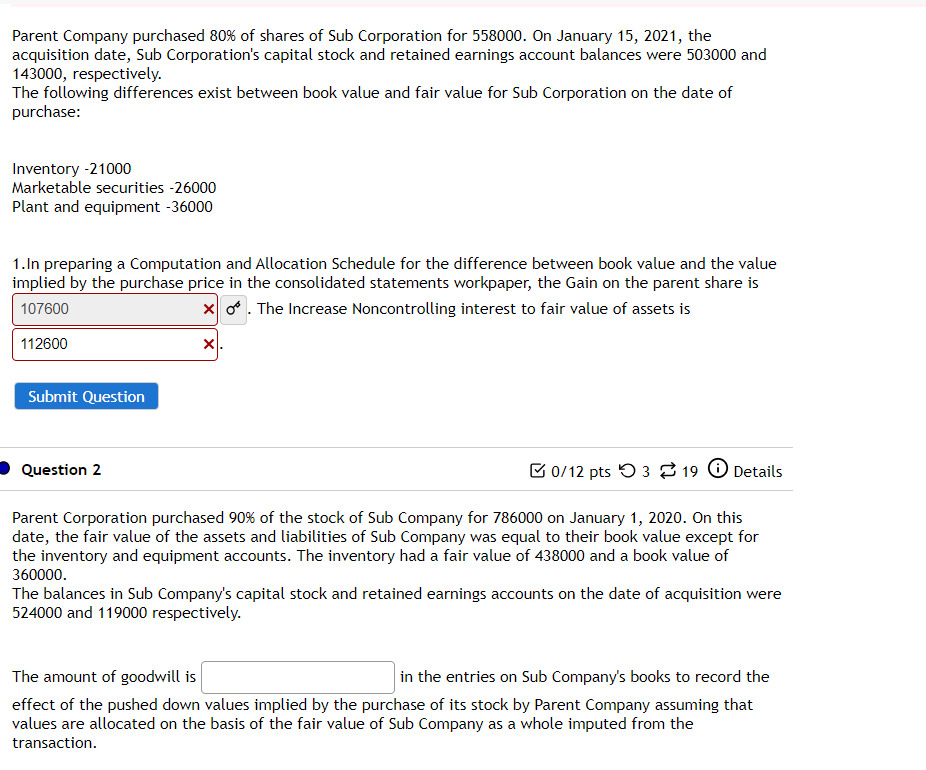

Parent Company purchased 80% of shares of Sub Corporation for 558000 . On January 15,2021 , the acquisition date, Sub Corporation's capital stock and retained earnings account balances were 503000 and 143000 , respectively. The following differences exist between book value and fair value for Sub Corporation on the date of purchase: Inventory -21000 Marketable securities -26000 Plant and equipment -36000 1. In preparing a Computation and Allocation Schedule for the difference between book value and the value implied by the purchase price in the consolidated statements workpaper, the Gain on the parent share is 6. The Increase Noncontrolling interest to fair value of assets is Question 2 0/12 pts 3 19 (i) Details Parent Corporation purchased 90% of the stock of Sub Company for 786000 on January 1, 2020. On this date, the fair value of the assets and liabilities of Sub Company was equal to their book value except for the inventory and equipment accounts. The inventory had a fair value of 438000 and a book value of 360000. The balances in Sub Company's capital stock and retained earnings accounts on the date of acquisition were 524000 and 119000 respectively. The amount of goodwill is in the entries on Sub Company's books to record the effect of the pushed down values implied by the purchase of its stock by Parent Company assuming that values are allocated on the basis of the fair value of Sub Company as a whole imputed from the transactionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started