Answered step by step

Verified Expert Solution

Question

1 Approved Answer

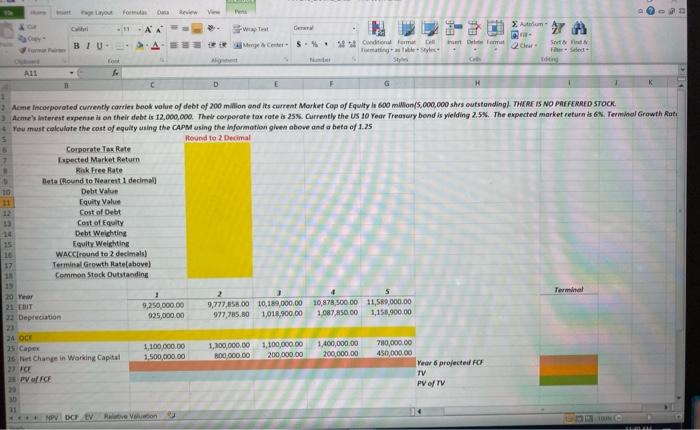

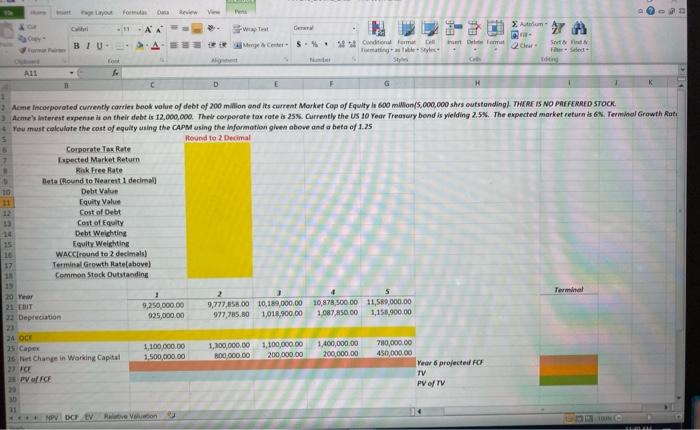

please help V Atrium- Ge Art -11-AA BIUSA D 2 TERMS Condition form The Dee Tags Feed TO om All D G 3 Acne Incorporated

please help

V Atrium- Ge Art -11-AA BIUSA D 2 TERMS Condition form The Dee Tags Feed TO om All D G 3 Acne Incorporated currently carries book value of debt of 200 million and its current Market Cap of Equity le 600 milion/5,000,000 shrs outstanding). THERE IS NO PREFERRED STOCK. Ame's interest expenses on their debt is 12,000,000. The corporate tax rate is 25%. Currently the US 10 Your Treasury bond is yielding 2.5%. The expected market returns 6. Terminal Growth Roti * You must calculate the cost of equity using the CAPM using the information given abover and a bete of 1.25 Round to 2 Decimal 6 Corporate Tax Rate Expected Market Return Risk Free Rate Beta (Round to Nearest 1 decimal 10 Debt Value Equity Value 12 Cost of Debt Cost of Equity Debt Weighting 15 Equity Welchting WACC round to 2 decimals Terminal Growth Rate above) Common Stock Outstaoding Terminal 20 Year 21 COIT 22 Depreciation 9,250,000.00 925,000.00 S 9,777,851.00 10,189,000.00 10,878,500.00 11,589,000.00 977,785.00 1,018,900.00 1,087850.00 1,150,000.00 1,100,000.00 1,500,000.00 1,100,000.00 1,100,000.00 BOO 000.00 200,000.00 1,400,000.00 200,000.00 780,000.00 450,000.00 24 25 Capes 26 et Change in Working Capital 21 FC * poffe 2 Year 6 projected FCF TV PV of TV 31 NPV DC V Atrium- Ge Art -11-AA BIUSA D 2 TERMS Condition form The Dee Tags Feed TO om All D G 3 Acne Incorporated currently carries book value of debt of 200 million and its current Market Cap of Equity le 600 milion/5,000,000 shrs outstanding). THERE IS NO PREFERRED STOCK. Ame's interest expenses on their debt is 12,000,000. The corporate tax rate is 25%. Currently the US 10 Your Treasury bond is yielding 2.5%. The expected market returns 6. Terminal Growth Roti * You must calculate the cost of equity using the CAPM using the information given abover and a bete of 1.25 Round to 2 Decimal 6 Corporate Tax Rate Expected Market Return Risk Free Rate Beta (Round to Nearest 1 decimal 10 Debt Value Equity Value 12 Cost of Debt Cost of Equity Debt Weighting 15 Equity Welchting WACC round to 2 decimals Terminal Growth Rate above) Common Stock Outstaoding Terminal 20 Year 21 COIT 22 Depreciation 9,250,000.00 925,000.00 S 9,777,851.00 10,189,000.00 10,878,500.00 11,589,000.00 977,785.00 1,018,900.00 1,087850.00 1,150,000.00 1,100,000.00 1,500,000.00 1,100,000.00 1,100,000.00 BOO 000.00 200,000.00 1,400,000.00 200,000.00 780,000.00 450,000.00 24 25 Capes 26 et Change in Working Capital 21 FC * poffe 2 Year 6 projected FCF TV PV of TV 31 NPV DC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started