please help

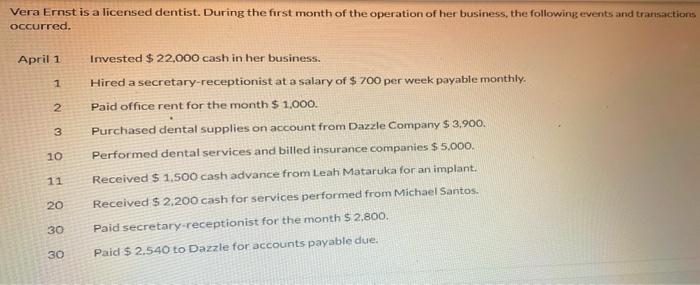

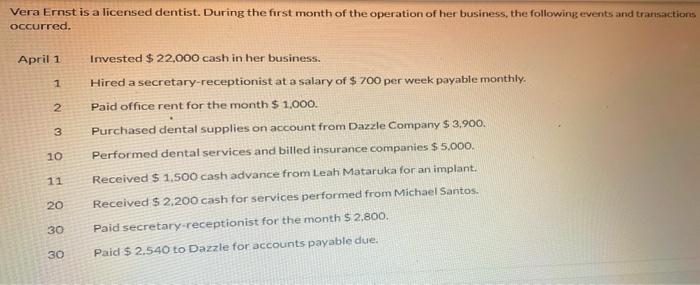

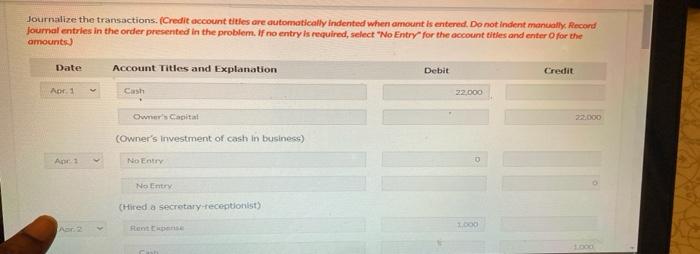

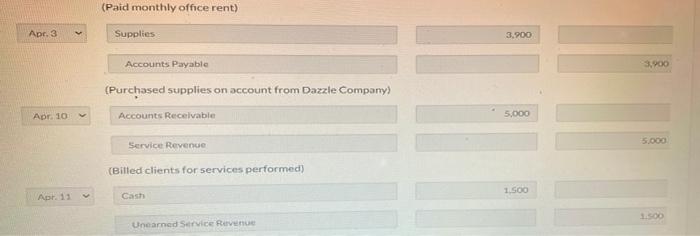

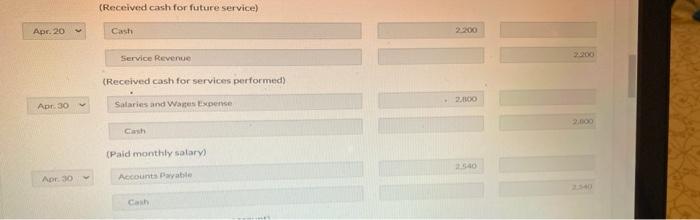

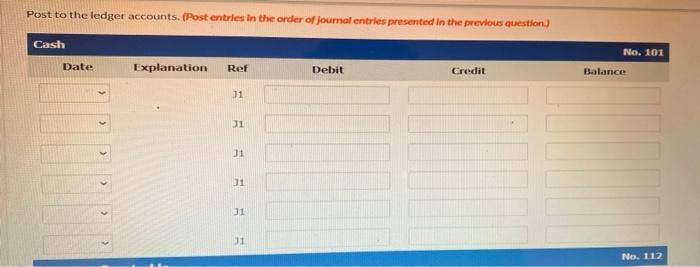

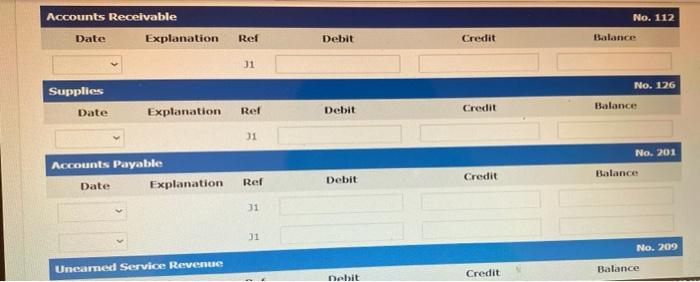

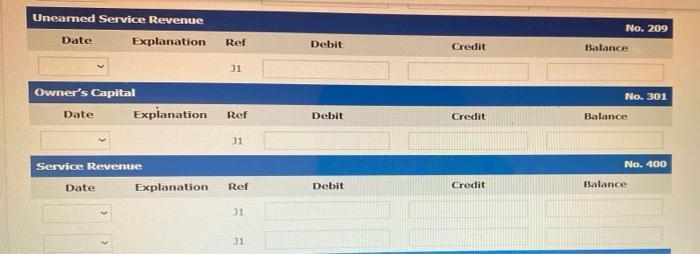

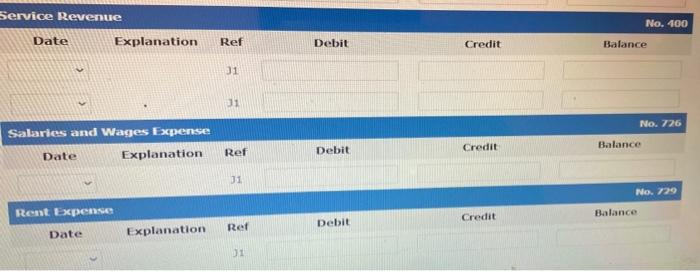

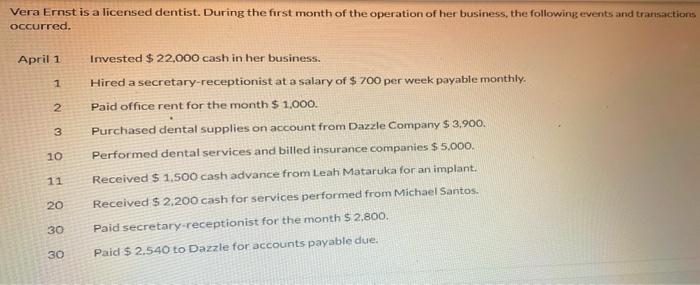

Vera Ernst is a licensed dentist. During the first month of the operation of her business, the following events and transaction occurred. April 1 Invested $ 22,000 cash in her business. Hired a secretary-receptionist at a salary of $ 700 per week payable monthly. 1 2 Paid office rent for the month $ 1.000. 3 10 11 Purchased dental supplies on account from Dazzle Company $ 3.900. Performed dental services and billed insurance companies $ 5.000. Received $ 1.500 cash advance from Leah Mataruka for an implant. Received $ 2.200 cash for services performed from Michael Santos. Paid secretary-receptionist for the month $ 2,800. Paid $ 2.540 to Dazzle for accounts payable due. 20 30 30 Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record Journal entries in the order presented in the problem. If no entry is required, select "No Entry for the account titles and enter for the amounts Date Account Titles and Explanation Debit Credit Aor Cash 22 000 Owner's Capital 222.000 (Owner's Investment of cash in business) Ar No Entry 0 No Entry (Hired a secretary receptionist) Tood Rent (Paid monthly office rent) Apr. 3 Supplies 3.900 Accounts Payable 3.900 (Purchased supplies on account from Dazzle Company) Accounts Receivable Apr. 10 5.000 Service Revenue 5.000 (Billed clients for services performed) ILSOO Apr. 13 Cash 1500 Unearned Service Revenue Post to the ledger accounts. (Post entries in the order of Journal entries presented in the previous question.) Cash No. 101 Date Explanation Ref Debit Credit Balance > J1 01 11 31 31 3 31 > No. 112 Accounts Receivable No. 112 Date Explanation Ref Debit Credit Balance 31 No. 126 Supplies Date Explanation Rer Debit Debit Balance Credit Credit 31 No. 201 Accounts Payable Date Explanation Credit Credit Balance Debit Ref 31 No. 209 Uneared Service Revenue Debit Credit Balance Uneared Service Revenue No. 209 Date Explanation Ref Debit Credit Balance ji Owner's Capital Date Explanation No. 301 Balance Ref Debit Credit 11 Service Revenue No. 400 Date Explanation Ref Debit Credit Balance 31 31 No. 400 Service Revenue Date Explanation Ref Debit Credit Balance 31 31 No. 726 Salaries and Wages Expense Date Explanation Credit Balance credite Ref Debit 31 No. 729 Balance Rent Expense Credit Debit Ref Date Explanation 01