Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hal is enrolled for one class at a local community college; tuition cost him $190. Hal's AGI is $20,000. Before considering a limitation due

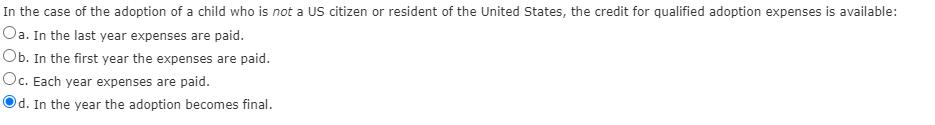

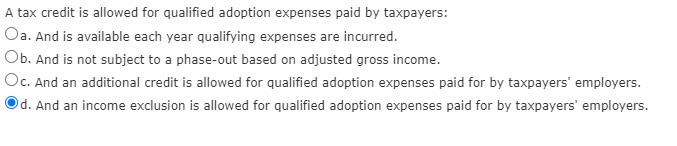

Hal is enrolled for one class at a local community college; tuition cost him $190. Hal's AGI is $20,000. Before considering a limitation due to tax liability, Hal can take a lifetime learning credit of: Oa. $250 Ob. $0 Oc. $190 Od. $100 Oe. $38 The American Opportunity tax credit Oa. Is 50 percent of the first $1,200 of tuition and fees paid and 100 percent of the next $1,200. Ob. Is available for qualifying expenses paid on behalf of the taxpayer and his or her spouse, in addition to those paid for dependents. Oc. Is fully refundable even if the credit exceeds the tax liability. Od. Is available for 2 years of post-secondary education. Taxpayer Q has net taxable income of $30,000 from Country Y which imposes a 40 percent income tax. In addition to the income from Country Y, taxpayer Q has net taxable income from US sources of $120,000, and US tax liability, before the foreign tax credit, of $30,290. What is the amount of Q's foreign tax credit? Oa. $8,350 Ob. $30,290 Oc. $12,000 Od. $6,058 Oe. None of these choices are correct. In the case of the adoption of a child who is not a US citizen or resident of the United States, the credit for qualified adoption expenses is available: Oa. In the last year expenses are paid. Ob. In the first year the expenses are paid. Oc. Each year expenses are paid. Od. In the year the adoption becomes final. A tax credit is allowed for qualified adoption expenses paid by taxpayers: Oa. And is available each year qualifying expenses are incurred. Ob. And is not subject to a phase-out based on adjusted gross income. Oc. And an additional credit is allowed for qualified adoption expenses paid for by taxpayers' employers. d. And an income exclusion is allowed for qualified adoption expenses paid for by taxpayers' employers.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started