Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following is not a requirement to claim an earned income credit? Oa. At least $1 of earned income Ob. US citizenship

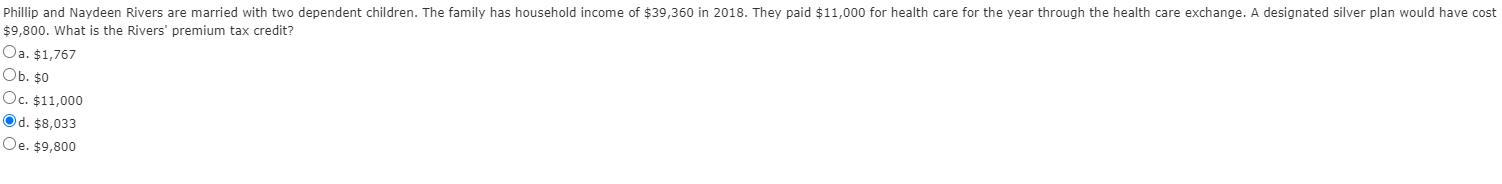

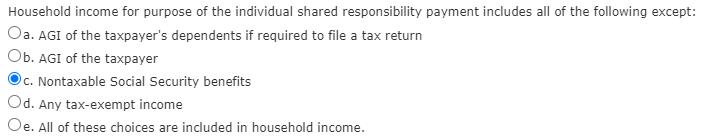

Which of the following is not a requirement to claim an earned income credit? Oa. At least $1 of earned income Ob. US citizenship or resident alien status Oc. Social Security number d. At least one child claimed as a dependent Jessica and Robert have two young children. They have $7,000 of qualified child care expenses and an AGI of $22,000 in 2018. What is their allowable child and dependent care credit? Oa. $1,860 Ob. $0 Oc. $7,000 Od. $6,000 Oe. $2,000 Robert and Mary file a joint tax return for 2018 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2018. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John: Union Day Care Center $1,700 Wilma, baby sitter (Robert's mother) $1,000 What is the amount of the child and dependent care credit they should report on their tax return for 2018? Oa. $459 Ob. $729 Oc. $675 Od. $270 Oe. None of these choices are correct. Phillip and Naydeen Rivers are married with two dependent children. The family has household income of $39,360 in 2018. They paid $11,000 for health care for the year through the health care exchange. A designated silver plan would have cost $9,800. What is the Rivers' premium tax credit? Oa. $1,767 Ob. $0 Oc. $11,000 Od. $8,033 Oe. $9,800 Household income for purpose of the individual shared responsibility payment includes all of the following except: Oa. AGI of the taxpayer's dependents if required to file a tax return Ob. AGI of the taxpayer C. Nontaxable Social Security benefits Od. Any tax-exempt income Oe. All of these choices are included in household income.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1Congress established the Earned Income Tax Credit EITC in 1975 to provide tax credit to certain peo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started