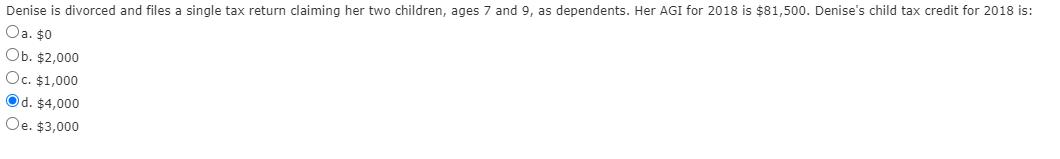

Denise is divorced and files a single tax return claiming her two children, ages 7 and 9, as dependents. Her AGI for 2018 is

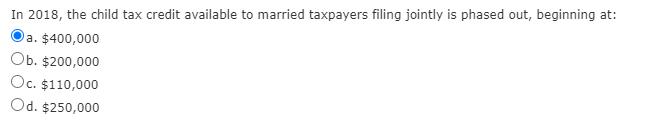

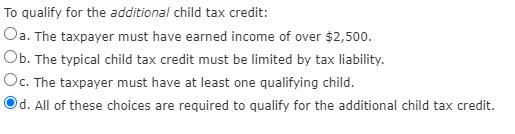

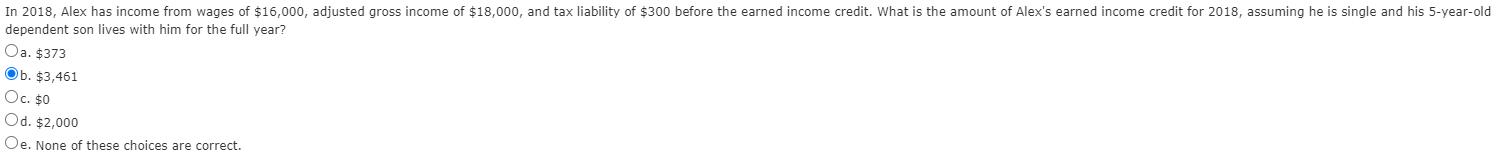

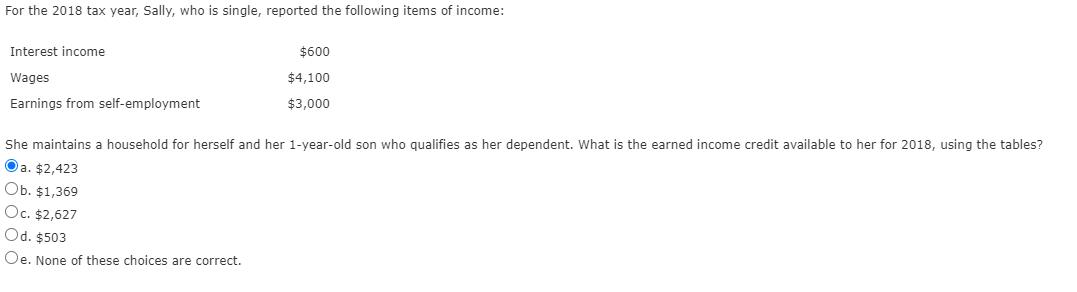

Denise is divorced and files a single tax return claiming her two children, ages 7 and 9, as dependents. Her AGI for 2018 is $81,500. Denise's child tax credit for 2018 is: Oa. $0 Ob. $2,000 Oc. $1,000 Od. $4,000 Oe. $3,000 In 2018, the child tax credit available to married taxpayers filing jointly is phased out, beginning at: a. $400,000 Ob. $200,000 Oc. $110,000 Od. $250,000 To qualify for the additional child tax credit: Oa. The taxpayer must have earned income of over $2,500. Ob. The typical child tax credit must be limited by tax liability. Oc. The taxpayer must have at least one qualifying child. d. All of these choices are required to qualify for the additional child tax credit. In 2018, Alex has income from wages of $16,000, adjusted gross income of $18,000, and tax liability of $300 before the earned income credit. What is the amount of Alex's earned income credit for 2018, assuming he is single and his 5-year-old dependent son lives with him for the full year? Oa. $373 Ob. $3,461 Oc. $0 Od. $2,000 Oe. None of these choices are correct. For the 2018 tax year, Sally, who is single, reported the following items of income: Interest income $600 Wages $4,100 Earnings from self-employment $3,000 She maintains a household for herself and her 1-year-old son who qualifies as her dependent. What is the earned income credit available to her for 2018, using the tables? Oa. $2,423 Ob. $1,369 Oc. $2,627 Od. $503 Oe. None of these choices are correct.

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Denise is divorced and files a single tax return claiming her two children ages 7 9 as dependen...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started