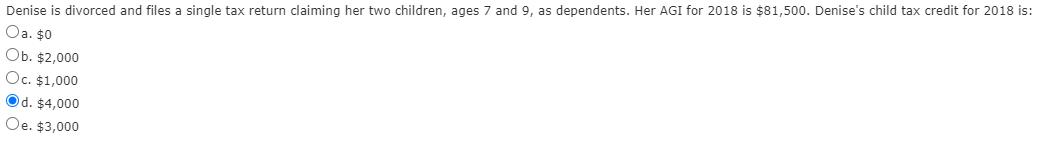

Denise is divorced and files a single tax return claiming her two children, ages 7 and 9, as dependents. Her AGI for 2018 is

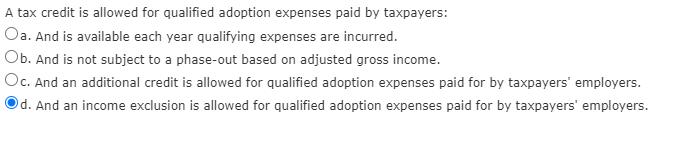

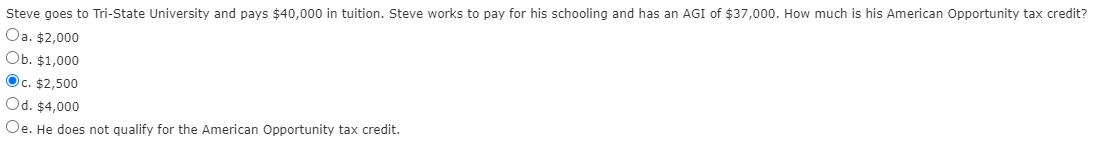

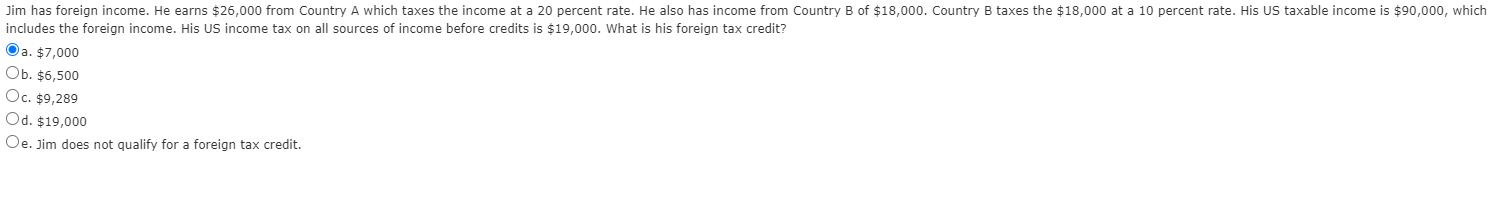

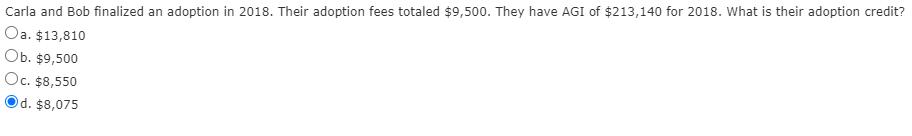

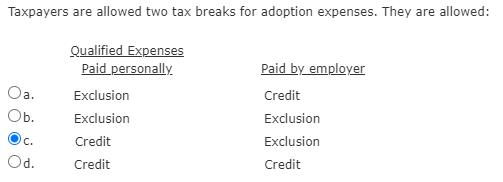

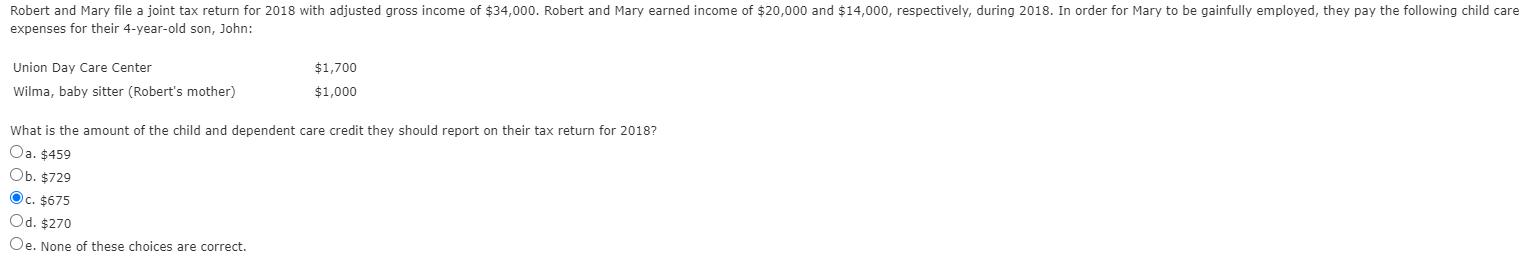

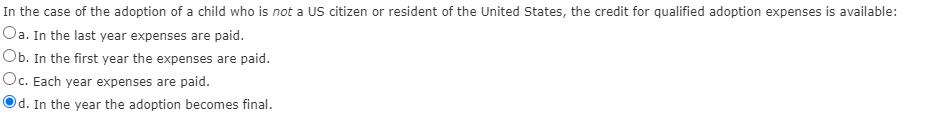

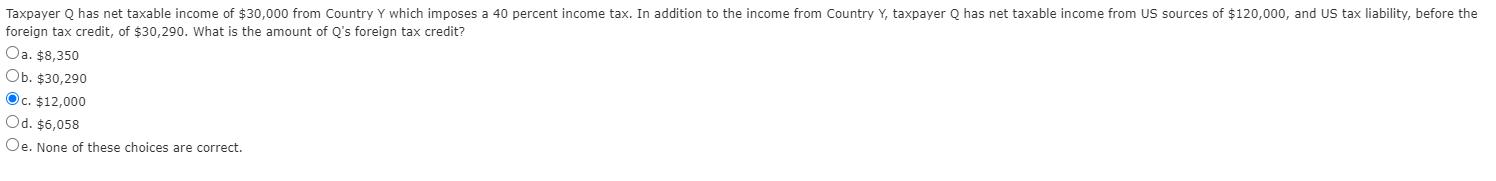

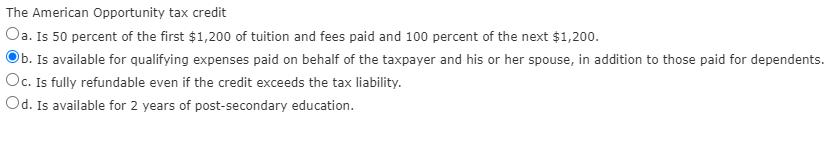

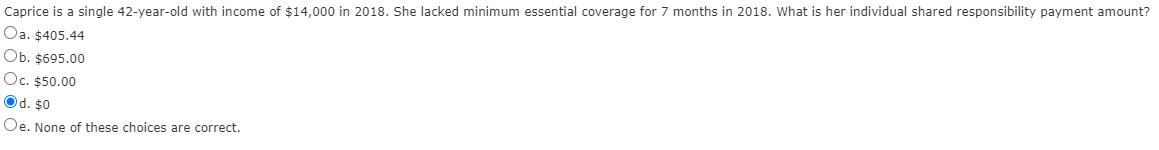

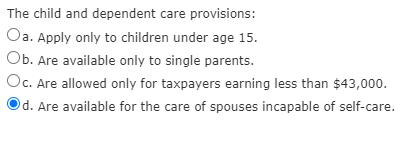

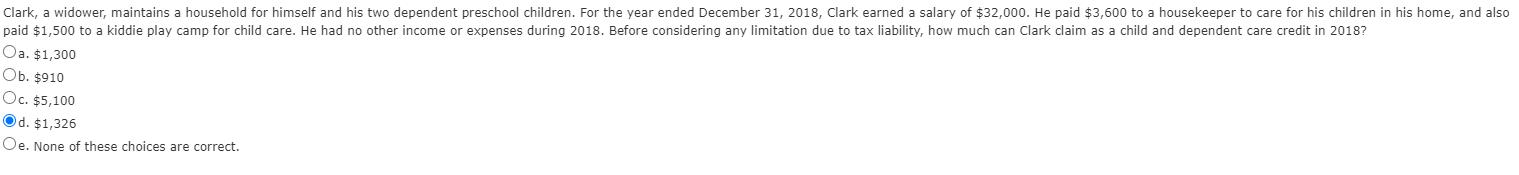

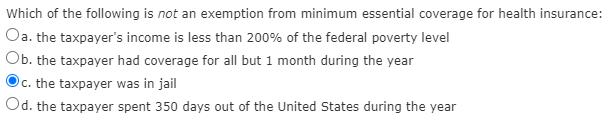

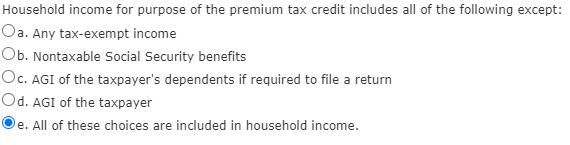

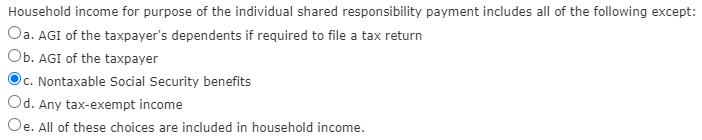

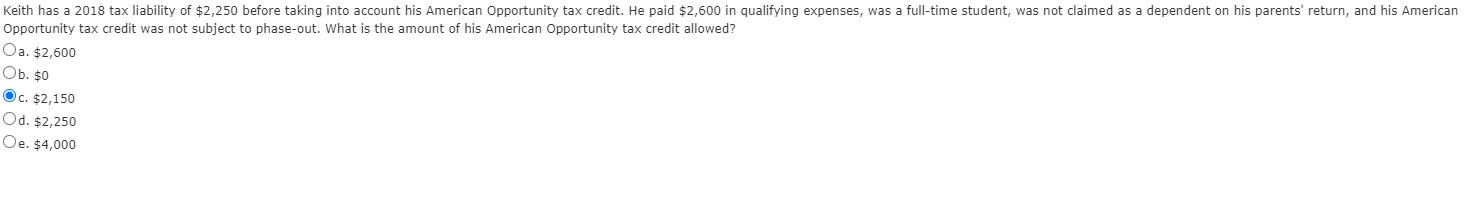

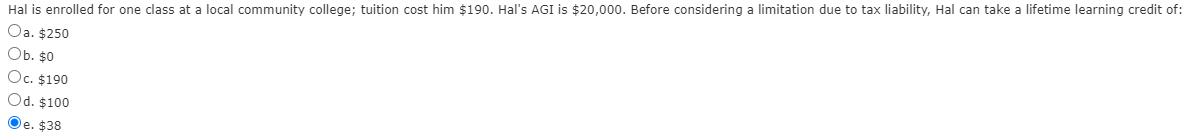

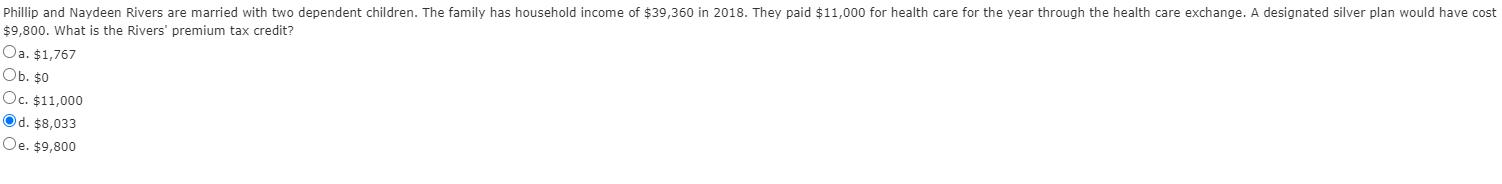

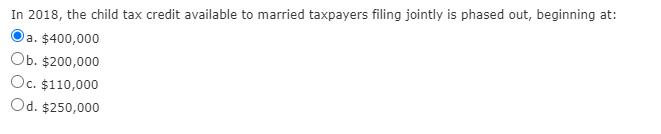

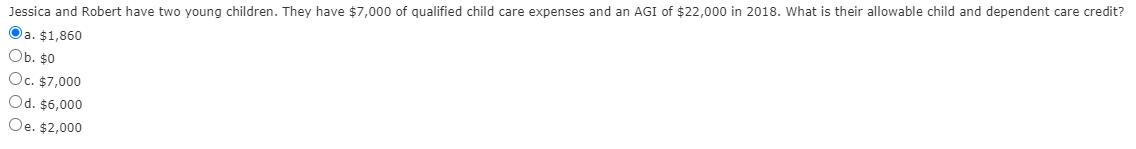

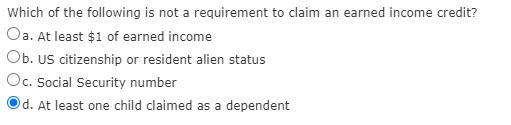

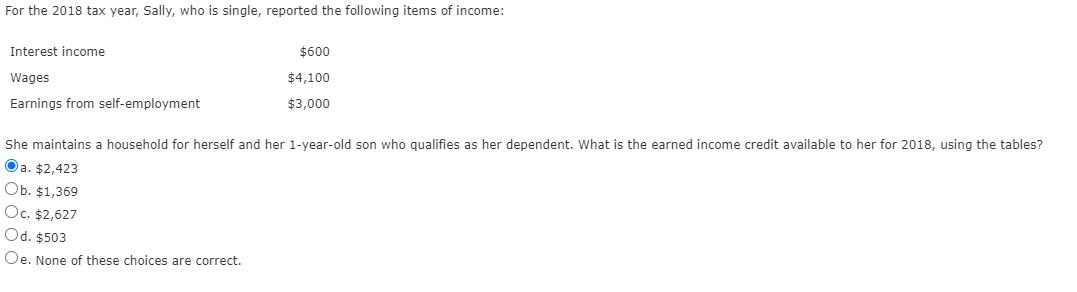

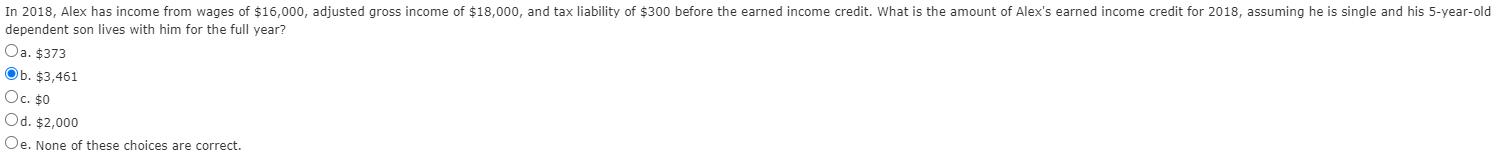

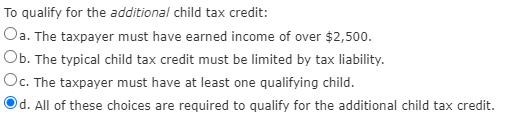

Denise is divorced and files a single tax return claiming her two children, ages 7 and 9, as dependents. Her AGI for 2018 is $81,500. Denise's child tax credit for 2018 is: Oa. $0 Ob. $2,000 Oc. $1,000 Od. $4,000 Oe. $3,000 A tax credit is allowed for qualified adoption expenses paid by taxpayers: Oa. And is available each year qualifying expenses are incurred. Ob. And is not subject to a phase-out based on adjusted gross income. Oc. And an additional credit is allowed for qualified adoption expenses paid for by taxpayers' employers. d. And an income exclusion is allowed for qualified adoption expenses paid for by taxpayers' employers. American Opportunity tax credit? Steve goes to Tri-State University and pays $40,000 in tuition. Steve works to pay for his schooling and has an AGI of $37,000. How much is Oa. $2,000 Ob. $1,000 Oc. $2,500 Od. $4,000 Oe. He does not qualify for the American Opportunity tax credit. Jim has foreign income. He earns $26,000 from Country A which taxes the income at a 20 percent rate. He also has income from Country B of $18,000. Country B taxes the $18,000 at a 10 percent rate. His US taxable income is $90,000, which includes the foreign income. His US income tax on all sources of income before credits is $19,000. What is his foreign tax credit? Oa. $7,000 Ob. $6,500 Oc. $9,289 Od. $19,000 Oe. Jim does not qualify for a foreign tax credit. Carla and Bob finalized an adoption in 2018. Their adoption fees totaled $9,500. They have AGI of $213,140 for 2018. What is their adoption credit? Oa. $13,810 Ob. $9,500 Oc. $8,550 d. $8,075 Taxpayers are allowed two tax breaks for adoption expenses. They are allowed: Qualified Expenses Paid personally Paid by employer Oa. Exclusion Credit b. Exclusion Exclusion . Credit Exclusion Od. Credit Credit Robert and Mary file a joint tax return for 2018 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2018. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John: Union Day Care Center $1,700 Wilma, baby sitter (Robert's mother) $1,000 What is the amount of the child and dependent care credit they should report on their tax return for 2018? Oa. $459 Ob. $729 Oc. $675 Od. $270 Oe. None of these choices are correct. In the case of the adoption of a child who is not a US citizen or resident of the United States, the credit for qualified adoption expenses is available: Oa. In the last year expenses are paid. Ob. In the first year the expenses are paid. Oc. Each year expenses are paid. Od. In the year the adoption becomes final. Taxpayer Q has net taxable income of $30,000 from Country Y which imposes a 40 percent income tax. In addition to the income from Country Y, taxpayer Q has net taxable income from US sources of $120,000, and US tax liability, before the foreign tax credit, of $30,290. What is the amount of Q's foreign tax credit? Oa. $8,350 Ob. $30,290 Oc. $12,000 Od. $6,058 Oe. None of these choices are correct. The American Opportunity tax credit Oa. Is 50 percent of the first $1,200 of tuition and fees paid and 100 percent of the next $1,200. Ob. Is available for qualifying expenses paid on behalf of the taxpayer and his or her spouse, in addition to those paid for dependents. Oc. Is fully refundable even if the credit exceeds the tax liability. Od. Is available for 2 years of post-secondary education. Caprice is a single 42-year-old with income of $14,000 in 2018. She lacked minimum essential coverage for 7 months in 2018. What is her individual shared responsibility payment amount? Oa. $405.44 Ob. $695.00 Oc. $50.00 Od. $0 Oe. None of these choices are correct. The child and dependent care provisions: Oa. Apply only to children under age 15. Ob. Are available only to single parents. Oc. Are allowed only for taxpayers earning less than $43,000. d. Are available for the care of spouses incapable of self-care. Clark, a widower, maintains a household for himself and his two dependent preschool children. For the year ended December 31, 2018, Clark earned a salary of $32,000. He paid $3,600 to a housekeeper to care for his children in his home, and also paid $1,500 to a kiddie play camp for child care. He had no other income or expenses during 2018. Before considering any limitation due to tax liability, how much can Clark claim as a child and dependent care credit in 2018? Oa. $1,300 Ob. $910 Oc. $5,100 Od. $1,326 Oe. None of these choices are correct. Which of the following is not an exemption from minimum essential coverage for health insurance: Oa. the taxpayer's income is less than 200% of the federal poverty level Ob. the taxpayer had coverage for all but 1 month during the year c. the taxpayer was in jail Od. the taxpayer spent 350 days out of the United States during the year Household income for purpose of the premium tax credit includes all of the following except: Oa. a. Any tax-exempt income Ob. Nontaxable Social Security benefits Oc. AGI of the taxpayer's dependents if required to file a return Od. AGI of the taxpayer Oe. All of these choices are included in household income. Household income for purpose of the individual shared responsibility payment includes all of the following except: Oa. AGI of the taxpayer's dependents if required to file a tax return Ob. AGI of the taxpayer C. Nontaxable Social Security benefits Od. Any tax-exempt income Oe. All of these choices are included in household income. Keith has a 2018 tax liability of $2,250 before taking into account his American Opportunity tax credit. He paid $2,600 in qualifying expenses, was a full-time student, was not claimed as a dependent on his parents' return, and his American Opportunity tax credit was not subject to phase-out. What is the amount of his American Opportunity tax credit allowed? Oa. $2,600 Ob. $0 Oc. $2,150 Od. $2,250 Oe. $4,000 Hal is enrolled for one class at a local community college; tuition cost him $190. Hal's AGI is $20,000. Before considering a limitation due to tax liability, Hal can take a lifetime learning credit of: Oa. $250 Ob. $0 Oc. $190 Od. $100 Oe. $38 Phillip and Naydeen Rivers are married with two dependent children. The family has household income of $39,360 in 2018. They paid $11,000 for health care for the year through the health care exchange. A designated silver plan would have cost $9,800. What is the Rivers' premium tax credit? Oa. $1,767 Ob. $0 Oc. $11,000 Od. $8,033 Oe. $9,800 In 2018, the child tax credit available to married taxpayers filing jointly is phased out, beginning at: a. $400,000 Ob. $200,000 Oc. $110,000 Od. $250,000 Jessica and Robert have two young children. They have $7,000 of qualified child care expenses and an AGI of $22,000 in 2018. What is their allowable child and dependent care credit? Oa. $1,860 Ob. $0 Oc. $7,000 Od. $6,000 Oe. $2,000 Which of the following is not a requirement to claim an earned income credit? Oa. At least $1 of earned income Ob. US citizenship or resident alien status Oc. Social Security number d. At least one child claimed as a dependent For the 2018 tax year, Sally, who is single, reported the following items of income: Interest income $600 Wages $4,100 Earnings from self-employment $3,000 She maintains a household for herself and her 1-year-old son who qualifies as her dependent. What is the earned income credit available to her for 2018, using the tables? Oa. $2,423 Ob. $1,369 Oc. $2,627 Od. $503 Oe. None of these choices are correct. In 2018, Alex has income from wages of $16,000, adjusted gross income of $18,000, and tax liability of $300 before the earned income credit. What is the amount of Alex's earned income credit for 2018, assuming he is single and his 5-year-old dependent son lives with him for the full year? Oa. $373 Ob. $3,461 Oc. $0 Od. $2,000 Oe. None of these choices are correct. To qualify for the additional child tax credit: Oa. The taxpayer must have earned income of over $2,500. Ob. The typical child tax credit must be limited by tax liability. Oc. The taxpayer must have at least one qualifying child. d. All of these choices are required to qualify for the additional child tax credit. Denise is divorced and files a single tax return claiming her two children, ages 7 and 9, as dependents. Her AGI for 2018 is $81,500. Denise's child tax credit for 2018 is: Oa. $0 Ob. $2,000 Oc. $1,000 Od. $4,000 Oe. $3,000 A tax credit is allowed for qualified adoption expenses paid by taxpayers: Oa. And is available each year qualifying expenses are incurred. Ob. And is not subject to a phase-out based on adjusted gross income. Oc. And an additional credit is allowed for qualified adoption expenses paid for by taxpayers' employers. d. And an income exclusion is allowed for qualified adoption expenses paid for by taxpayers' employers. American Opportunity tax credit? Steve goes to Tri-State University and pays $40,000 in tuition. Steve works to pay for his schooling and has an AGI of $37,000. How much is Oa. $2,000 Ob. $1,000 Oc. $2,500 Od. $4,000 Oe. He does not qualify for the American Opportunity tax credit. Jim has foreign income. He earns $26,000 from Country A which taxes the income at a 20 percent rate. He also has income from Country B of $18,000. Country B taxes the $18,000 at a 10 percent rate. His US taxable income is $90,000, which includes the foreign income. His US income tax on all sources of income before credits is $19,000. What is his foreign tax credit? Oa. $7,000 Ob. $6,500 Oc. $9,289 Od. $19,000 Oe. Jim does not qualify for a foreign tax credit. Carla and Bob finalized an adoption in 2018. Their adoption fees totaled $9,500. They have AGI of $213,140 for 2018. What is their adoption credit? Oa. $13,810 Ob. $9,500 Oc. $8,550 d. $8,075 Taxpayers are allowed two tax breaks for adoption expenses. They are allowed: Qualified Expenses Paid personally Paid by employer Oa. Exclusion Credit b. Exclusion Exclusion . Credit Exclusion Od. Credit Credit Robert and Mary file a joint tax return for 2018 with adjusted gross income of $34,000. Robert and Mary earned income of $20,000 and $14,000, respectively, during 2018. In order for Mary to be gainfully employed, they pay the following child care expenses for their 4-year-old son, John: Union Day Care Center $1,700 Wilma, baby sitter (Robert's mother) $1,000 What is the amount of the child and dependent care credit they should report on their tax return for 2018? Oa. $459 Ob. $729 Oc. $675 Od. $270 Oe. None of these choices are correct. In the case of the adoption of a child who is not a US citizen or resident of the United States, the credit for qualified adoption expenses is available: Oa. In the last year expenses are paid. Ob. In the first year the expenses are paid. Oc. Each year expenses are paid. Od. In the year the adoption becomes final. Taxpayer Q has net taxable income of $30,000 from Country Y which imposes a 40 percent income tax. In addition to the income from Country Y, taxpayer Q has net taxable income from US sources of $120,000, and US tax liability, before the foreign tax credit, of $30,290. What is the amount of Q's foreign tax credit? Oa. $8,350 Ob. $30,290 Oc. $12,000 Od. $6,058 Oe. None of these choices are correct. The American Opportunity tax credit Oa. Is 50 percent of the first $1,200 of tuition and fees paid and 100 percent of the next $1,200. Ob. Is available for qualifying expenses paid on behalf of the taxpayer and his or her spouse, in addition to those paid for dependents. Oc. Is fully refundable even if the credit exceeds the tax liability. Od. Is available for 2 years of post-secondary education. Caprice is a single 42-year-old with income of $14,000 in 2018. She lacked minimum essential coverage for 7 months in 2018. What is her individual shared responsibility payment amount? Oa. $405.44 Ob. $695.00 Oc. $50.00 Od. $0 Oe. None of these choices are correct. The child and dependent care provisions: Oa. Apply only to children under age 15. Ob. Are available only to single parents. Oc. Are allowed only for taxpayers earning less than $43,000. d. Are available for the care of spouses incapable of self-care. Clark, a widower, maintains a household for himself and his two dependent preschool children. For the year ended December 31, 2018, Clark earned a salary of $32,000. He paid $3,600 to a housekeeper to care for his children in his home, and also paid $1,500 to a kiddie play camp for child care. He had no other income or expenses during 2018. Before considering any limitation due to tax liability, how much can Clark claim as a child and dependent care credit in 2018? Oa. $1,300 Ob. $910 Oc. $5,100 Od. $1,326 Oe. None of these choices are correct. Which of the following is not an exemption from minimum essential coverage for health insurance: Oa. the taxpayer's income is less than 200% of the federal poverty level Ob. the taxpayer had coverage for all but 1 month during the year c. the taxpayer was in jail Od. the taxpayer spent 350 days out of the United States during the year Household income for purpose of the premium tax credit includes all of the following except: Oa. a. Any tax-exempt income Ob. Nontaxable Social Security benefits Oc. AGI of the taxpayer's dependents if required to file a return Od. AGI of the taxpayer Oe. All of these choices are included in household income. Household income for purpose of the individual shared responsibility payment includes all of the following except: Oa. AGI of the taxpayer's dependents if required to file a tax return Ob. AGI of the taxpayer C. Nontaxable Social Security benefits Od. Any tax-exempt income Oe. All of these choices are included in household income. Keith has a 2018 tax liability of $2,250 before taking into account his American Opportunity tax credit. He paid $2,600 in qualifying expenses, was a full-time student, was not claimed as a dependent on his parents' return, and his American Opportunity tax credit was not subject to phase-out. What is the amount of his American Opportunity tax credit allowed? Oa. $2,600 Ob. $0 Oc. $2,150 Od. $2,250 Oe. $4,000 Hal is enrolled for one class at a local community college; tuition cost him $190. Hal's AGI is $20,000. Before considering a limitation due to tax liability, Hal can take a lifetime learning credit of: Oa. $250 Ob. $0 Oc. $190 Od. $100 Oe. $38 Phillip and Naydeen Rivers are married with two dependent children. The family has household income of $39,360 in 2018. They paid $11,000 for health care for the year through the health care exchange. A designated silver plan would have cost $9,800. What is the Rivers' premium tax credit? Oa. $1,767 Ob. $0 Oc. $11,000 Od. $8,033 Oe. $9,800 In 2018, the child tax credit available to married taxpayers filing jointly is phased out, beginning at: a. $400,000 Ob. $200,000 Oc. $110,000 Od. $250,000 Jessica and Robert have two young children. They have $7,000 of qualified child care expenses and an AGI of $22,000 in 2018. What is their allowable child and dependent care credit? Oa. $1,860 Ob. $0 Oc. $7,000 Od. $6,000 Oe. $2,000 Which of the following is not a requirement to claim an earned income credit? Oa. At least $1 of earned income Ob. US citizenship or resident alien status Oc. Social Security number d. At least one child claimed as a dependent For the 2018 tax year, Sally, who is single, reported the following items of income: Interest income $600 Wages $4,100 Earnings from self-employment $3,000 She maintains a household for herself and her 1-year-old son who qualifies as her dependent. What is the earned income credit available to her for 2018, using the tables? Oa. $2,423 Ob. $1,369 Oc. $2,627 Od. $503 Oe. None of these choices are correct. In 2018, Alex has income from wages of $16,000, adjusted gross income of $18,000, and tax liability of $300 before the earned income credit. What is the amount of Alex's earned income credit for 2018, assuming he is single and his 5-year-old dependent son lives with him for the full year? Oa. $373 Ob. $3,461 Oc. $0 Od. $2,000 Oe. None of these choices are correct. To qualify for the additional child tax credit: Oa. The taxpayer must have earned income of over $2,500. Ob. The typical child tax credit must be limited by tax liability. Oc. The taxpayer must have at least one qualifying child. d. All of these choices are required to qualify for the additional child tax credit.

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The child tax credit allows a 2000 credit per dependantschild In this case Denises Child tax credit for 2018 is 4000 2000 times 2 for the t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started