Please help :)

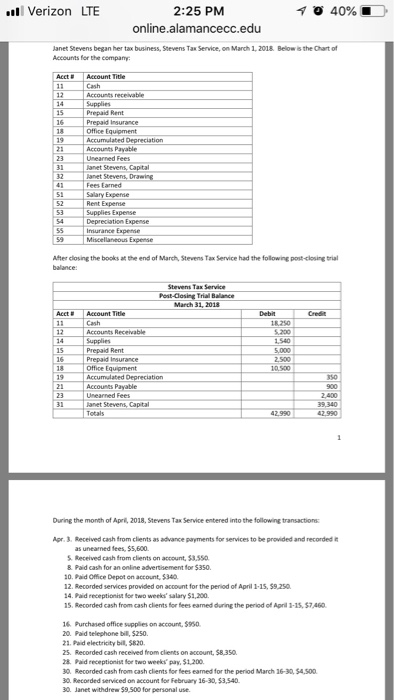

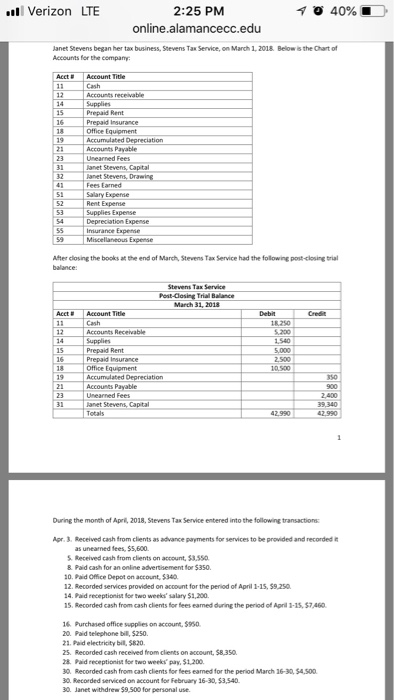

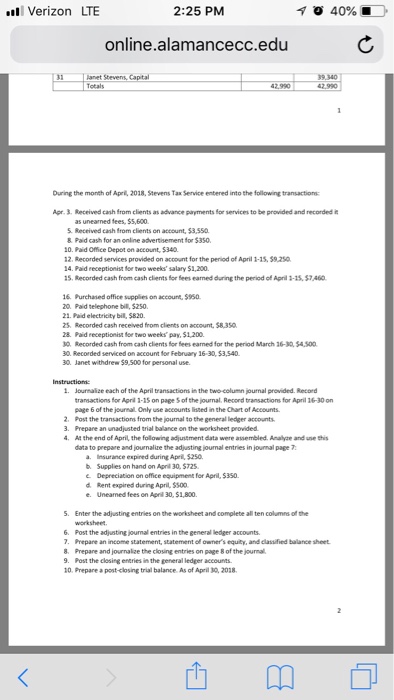

Verizon LTE 40% . 2:25 PM online.alamancecc.edu lanet Stevens began her tax business, Stevens Tax Service, on March 1, 2018 Below is the Chart of Accounts fer the compamy Supplies Prepaid Rent Prepaid Insurance Office Equioment 19 Unearned Fees lanet Stevens, Capital lanet Stevens, D Fees Ear Salary Experse Rent Expense Supplies Expense Depreciation Expense imurance Expense fter closing the books at the end of March, Stevens Tax Service had the following post-closing trial balance Post-Closine Trial Balance March 31, 2018 Account Title Accounts Receivable upplies 18.250 ,200 1,540 Prepaid Insurance Office Equioment 19 350 Accounts Payable During the month of April, 2018, Stevens Tax Service entered into the following transactions er ? Received cash from cients as advance payments for services to be provided and recorded as unearned fees, $5,600 sReceived cash from clients on account, $3550 B. Paid cash for an online advertisement for $350. 20. Paid Office Depot on account, $340 12. Recorded services provided on account for the period of April 1-15, $9,250 4. Paid receptionist for two weeks' salary $1,200. 15. Recorded cash from cash clients for fees eaned during the period of April 2-15,$7/460 16. Purchased office supples on account, $990 20. Paid telephone bill, $250. 23. Paid electricity bil, $820 25. Recorded cash received from clents on account, $8.350 28. Paid receptionist for two weeks' pay, $1,200. 0 Recorded cash from cash clients for fees eaned for the period March 16-30, $4,500 o Recorded serviced on account for February 16-30, $3,540 30. Janet withdrew $9,500 for personal use. Verizon LTE 40% . 2:25 PM online.alamancecc.edu lanet Stevens began her tax business, Stevens Tax Service, on March 1, 2018 Below is the Chart of Accounts fer the compamy Supplies Prepaid Rent Prepaid Insurance Office Equioment 19 Unearned Fees lanet Stevens, Capital lanet Stevens, D Fees Ear Salary Experse Rent Expense Supplies Expense Depreciation Expense imurance Expense fter closing the books at the end of March, Stevens Tax Service had the following post-closing trial balance Post-Closine Trial Balance March 31, 2018 Account Title Accounts Receivable upplies 18.250 ,200 1,540 Prepaid Insurance Office Equioment 19 350 Accounts Payable During the month of April, 2018, Stevens Tax Service entered into the following transactions er ? Received cash from cients as advance payments for services to be provided and recorded as unearned fees, $5,600 sReceived cash from clients on account, $3550 B. Paid cash for an online advertisement for $350. 20. Paid Office Depot on account, $340 12. Recorded services provided on account for the period of April 1-15, $9,250 4. Paid receptionist for two weeks' salary $1,200. 15. Recorded cash from cash clients for fees eaned during the period of April 2-15,$7/460 16. Purchased office supples on account, $990 20. Paid telephone bill, $250. 23. Paid electricity bil, $820 25. Recorded cash received from clents on account, $8.350 28. Paid receptionist for two weeks' pay, $1,200. 0 Recorded cash from cash clients for fees eaned for the period March 16-30, $4,500 o Recorded serviced on account for February 16-30, $3,540 30. Janet withdrew $9,500 for personal use