Answered step by step

Verified Expert Solution

Question

1 Approved Answer

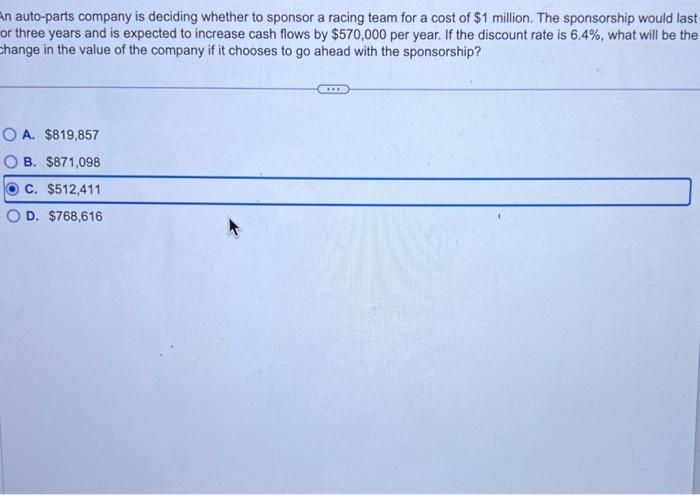

please help very confused! in auto-parts company is deciding whether to sponsor a racing team for a cost of ( $ 1 ) million. The

please help very confused!

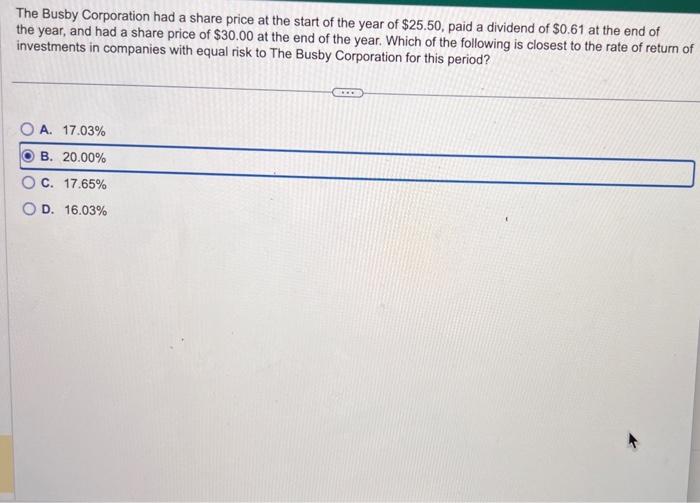

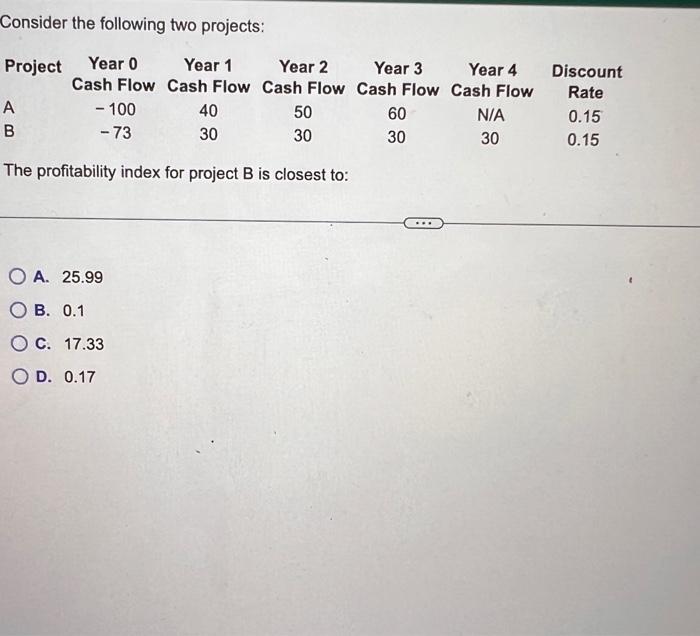

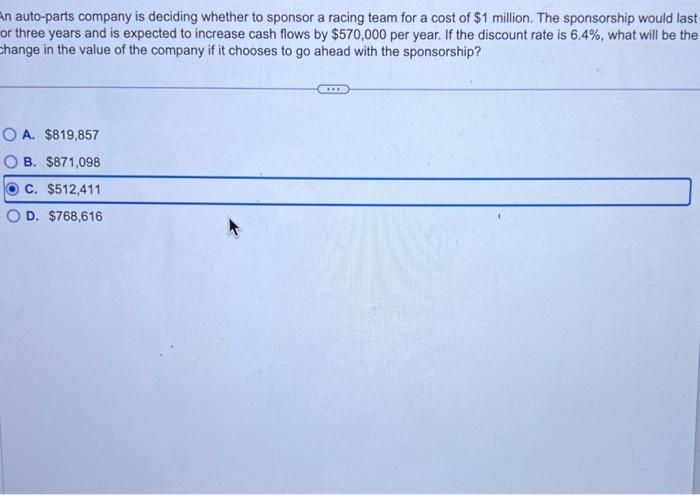

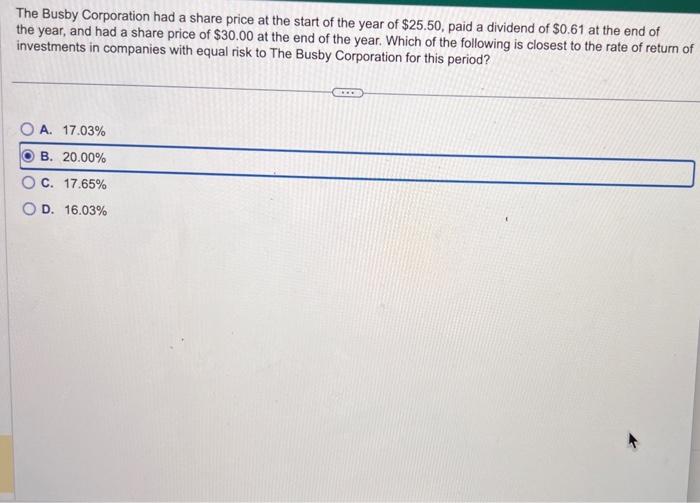

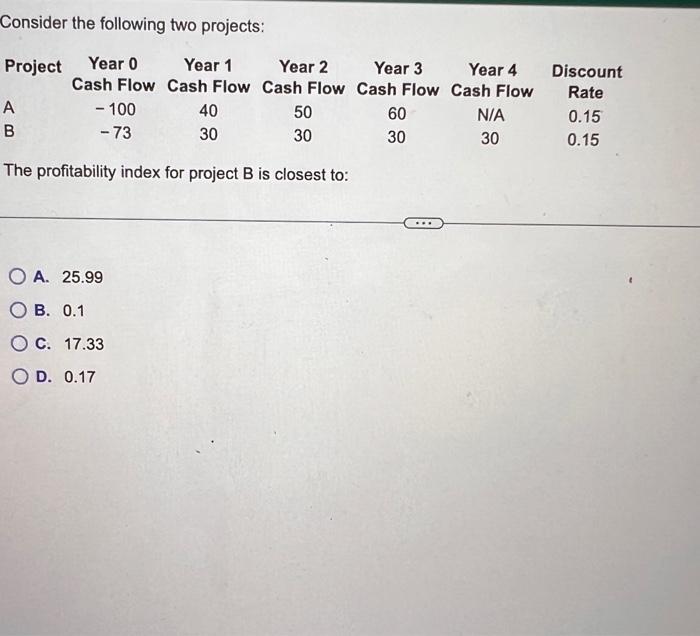

in auto-parts company is deciding whether to sponsor a racing team for a cost of \\( \\$ 1 \\) million. The sponsorship would last or three years and is expected to increase cash flows by \\( \\$ 570,000 \\) per year. If the discount rate is \6.4, what will be the thange in the value of the company if it chooses to go ahead with the sponsorship? A. \\( \\$ 819,857 \\) B. \\( \\$ 871,098 \\) C. \\( \\$ 512,411 \\) D. \\( \\$ 768,616 \\) Consider the following two projects: The profitability index for project \\( B \\) is closest to: A. 25.99 B. 0.1 C. 17.33 D. 0.17 The Busby Corporation had a share price at the start of the year of \\( \\$ 25.50 \\), paid a dividend of \\( \\$ 0.61 \\) at the end of the year, and had a share price of \\( \\$ 30.00 \\) at the end of the year. Which of the following is closest to the rate of return of investments in companies with equal risk to The Busby Corporation for this period? A. \17.03 B. \20.00 C. \17.65 D. \16.03

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started