please help.

view an example on how to answer this question

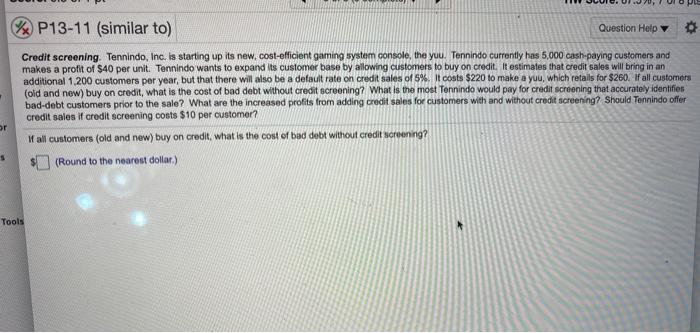

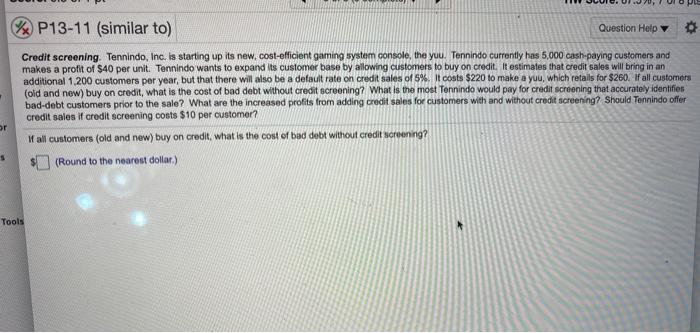

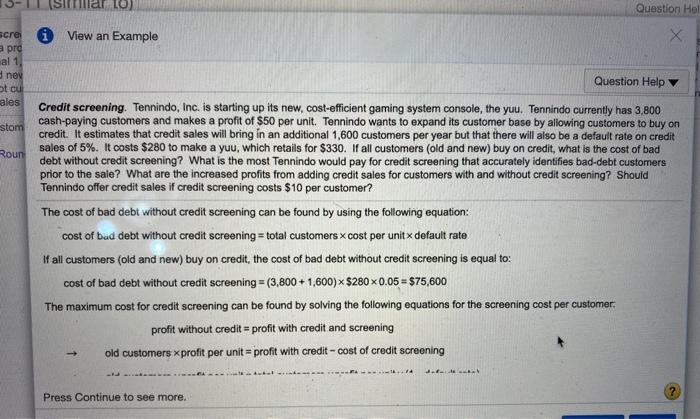

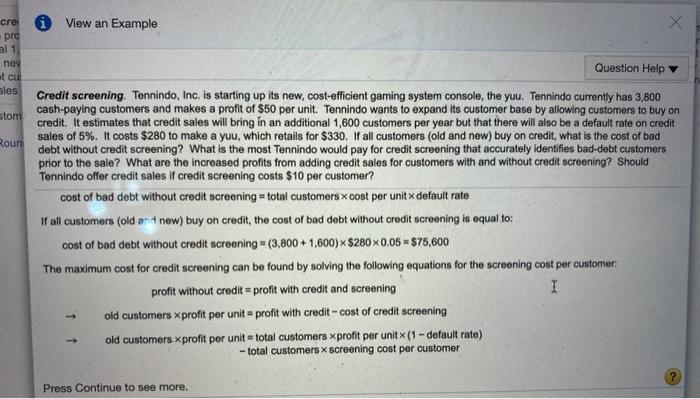

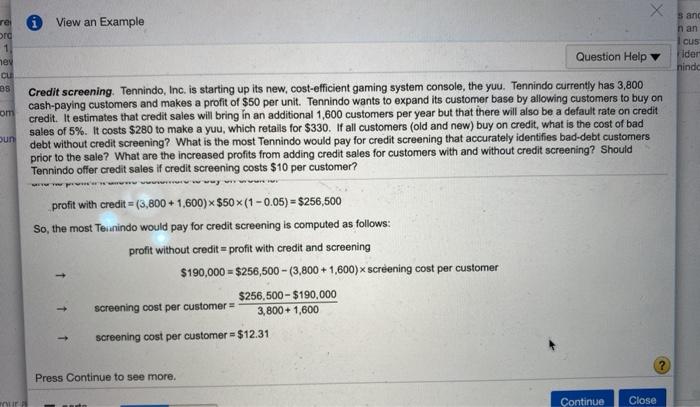

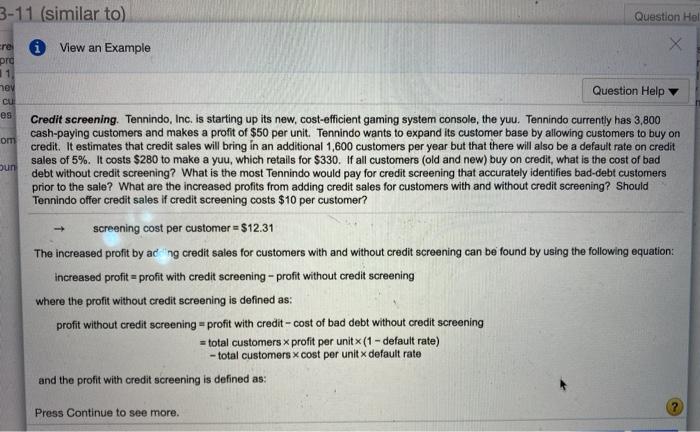

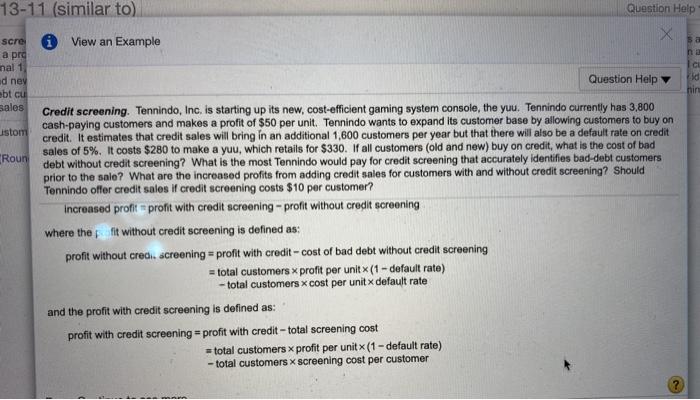

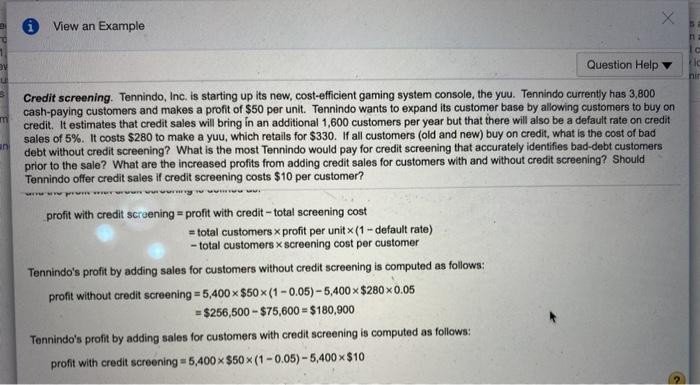

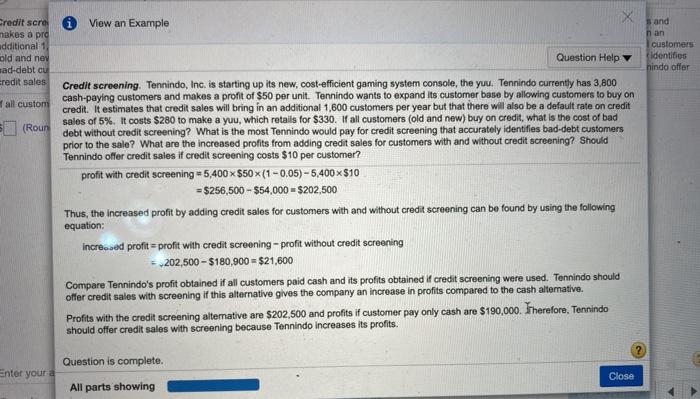

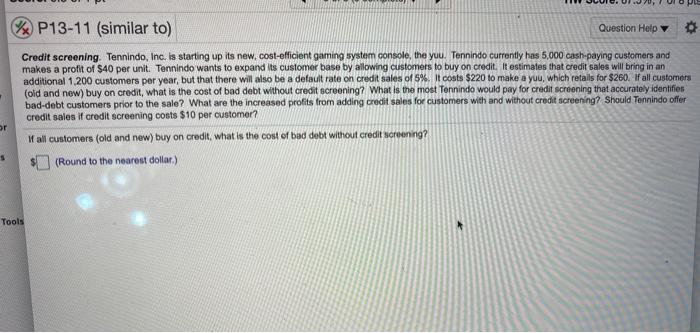

W P13-11 (similar to) Question Help Credit screening. Tennindo, Inc. is starting up its new.cost-efficient gaming system console, the yuu. Tennindo currently has 5,000 cash-paying customers and makes a profit of $40 per unit. Tennindo wants to expand its customer base by allowing customers to buy on credit. It estimates that credit sales will bring in an additional 1.200 customers per year, but that there will also be a default rate on credit sales of 5%. It costs $220 to make a you, which retails for $260. If all customers (old and now) buy on credit, what is the cost of bad debt without credit screening? What is the most Tennindo would pay for credit screening that accurately identifies bad-debt customers prior to the sale? What are the increased profits from adding credit sales for customers with and without credit screening? Should Tennindo offer credit sales if credit screening costs $10 per customer? or If all customers (old and new) buy on credit, what is the cost of bad debt without credit screening? (Round to the nearest dollar) Tools Question Hel i View an Example scre a pro al 1 ney at cu ales Question Help stom Roun Credit screening. Tennindo, Inc. is starting up its new, cost-efficient gaming system console, the yuu. Tennindo currently has 3,800 cash-paying customers and makes a profit of $50 per unit. Tennindo wants to expand its customer base by allowing customers to buy on credit. It estimates that credit sales will bring in an additional 1,600 customers per year but that there will also be a default rate on credit sales of 5%. It costs $280 to make a yuu, which retails for $330. If all customers (old and new) buy on credit, what is the cost of bad debt without credit screening? What is the most Tennindo would pay for credit screening that accurately identifies bad-debt customers prior to the sale? What are the increased profits from adding credit sales for customers with and without credit screening? Should Tennindo offer credit sales if credit screening costs $10 per customer? The cost of bad debt without credit screening can be found by using the following equation: cost of bad debt without credit screening = total customers x cost per unitx default rate Wall customers (old and new) buy on credit, the cost of bad debt without credit screening is equal to: cost of bad debt without credit screening=(3,800 + 1,600)