Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! View transaction list View journal entry worksheet begin{tabular}{l} 10 points hline eBook hline Print hline References hline end{tabular}

please help!

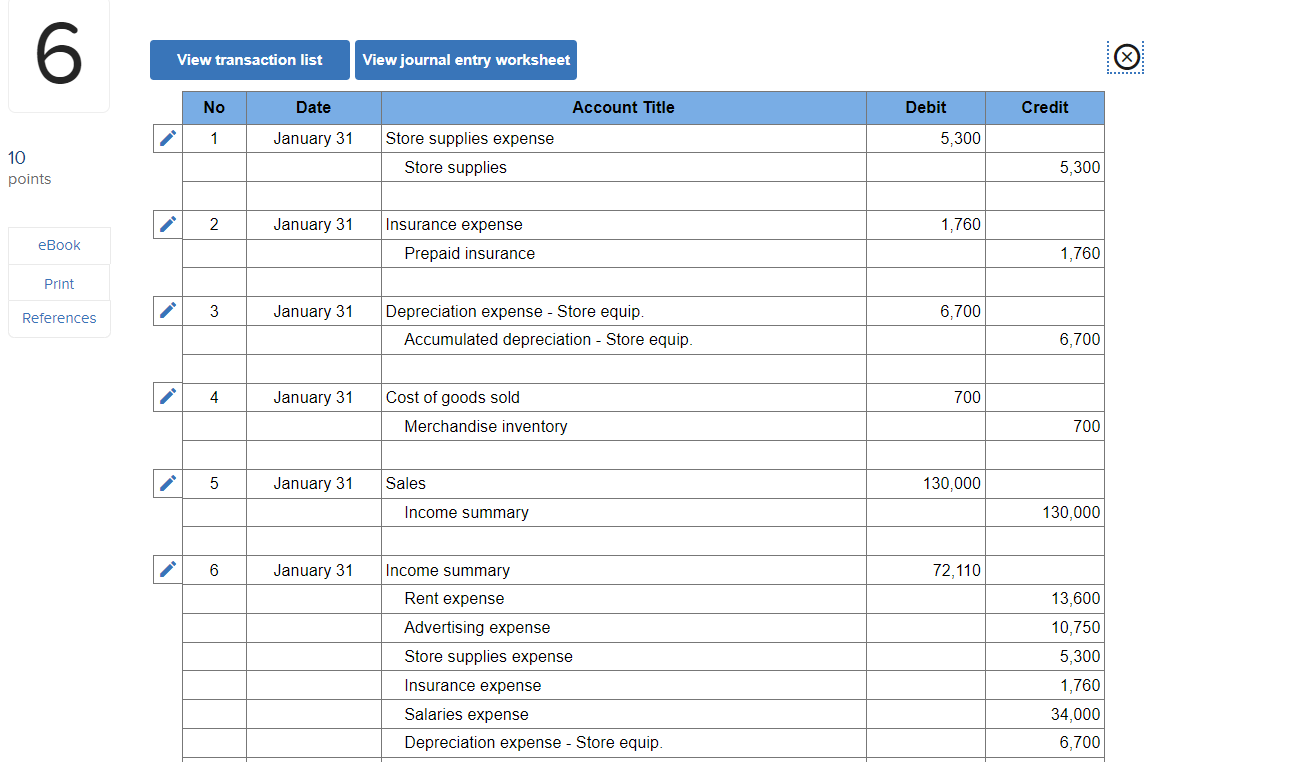

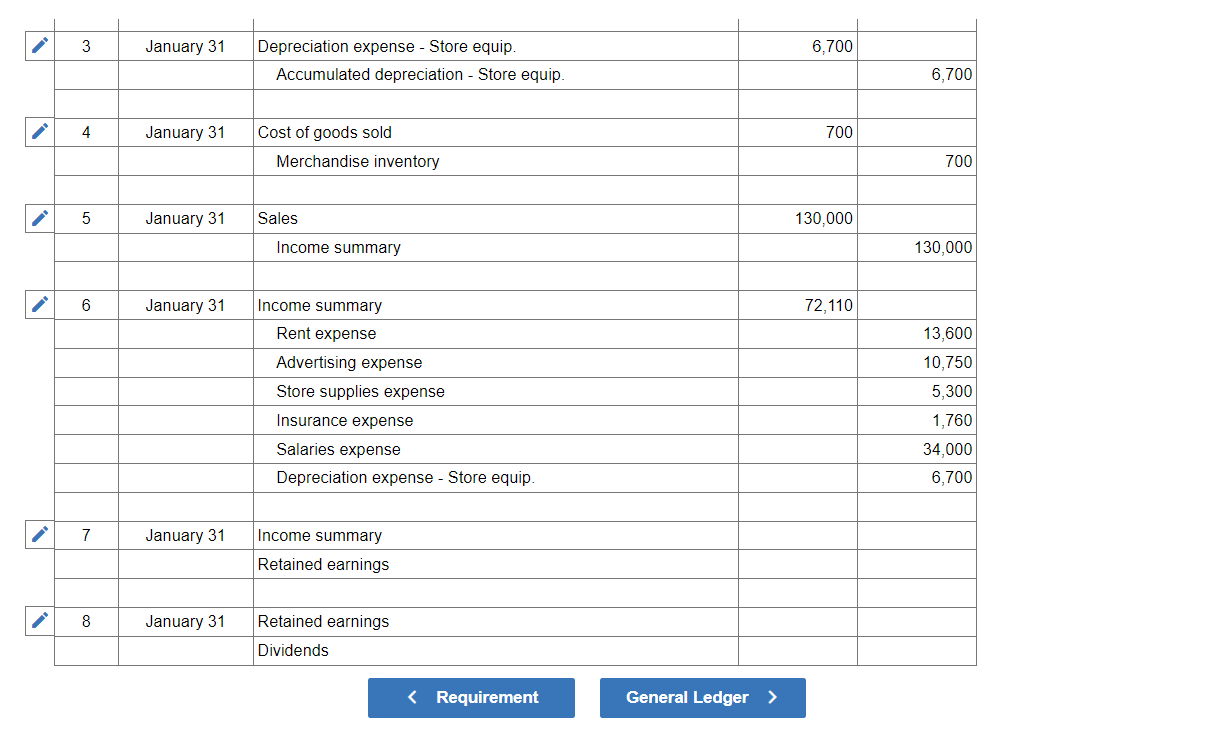

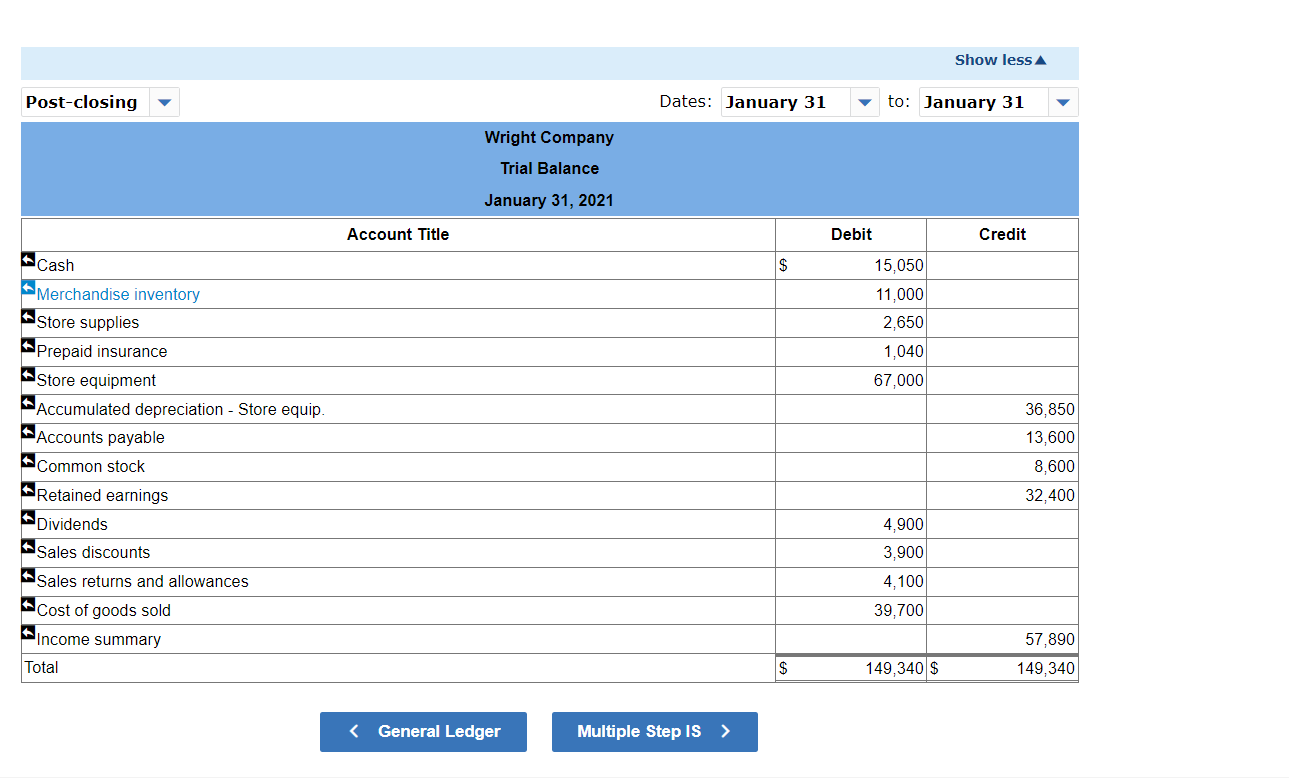

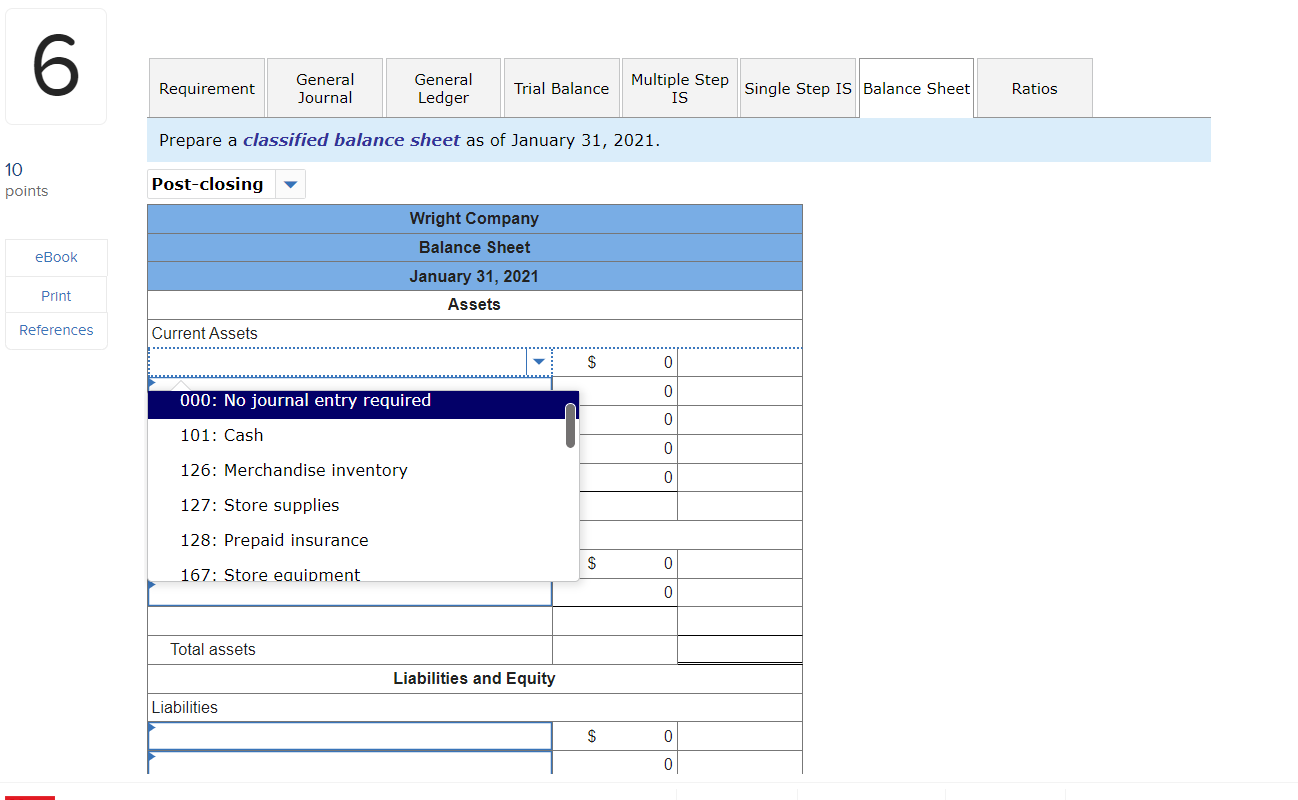

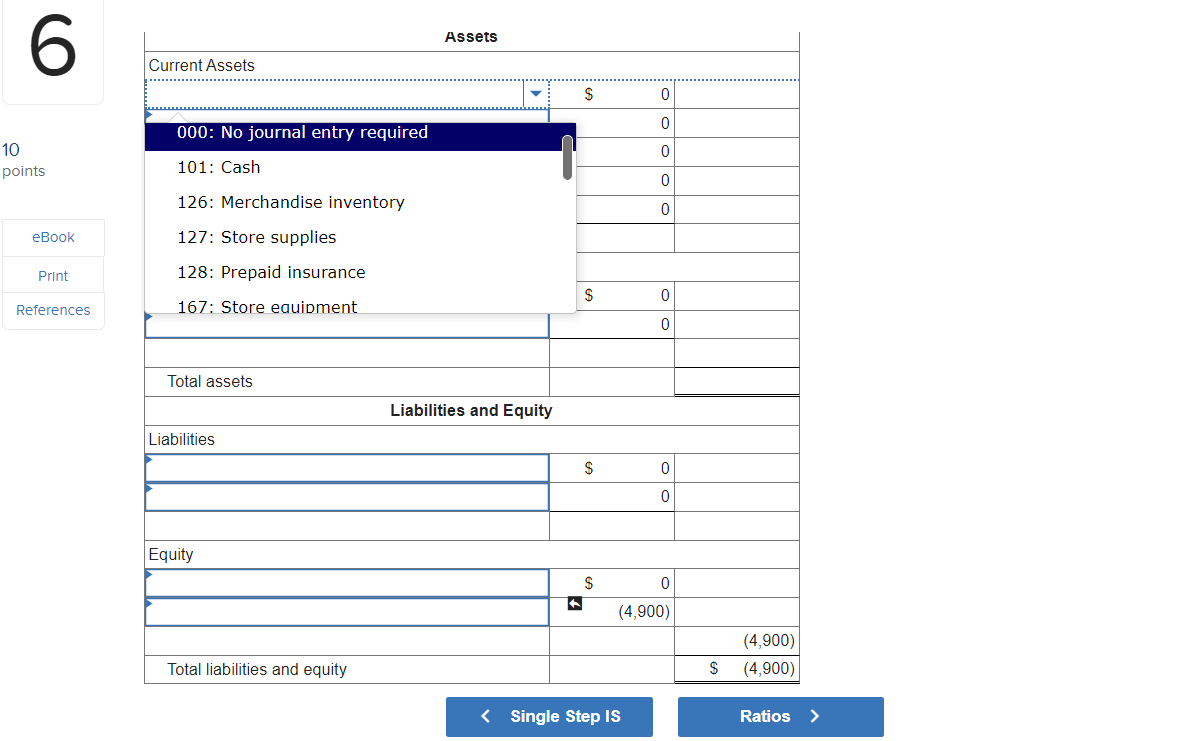

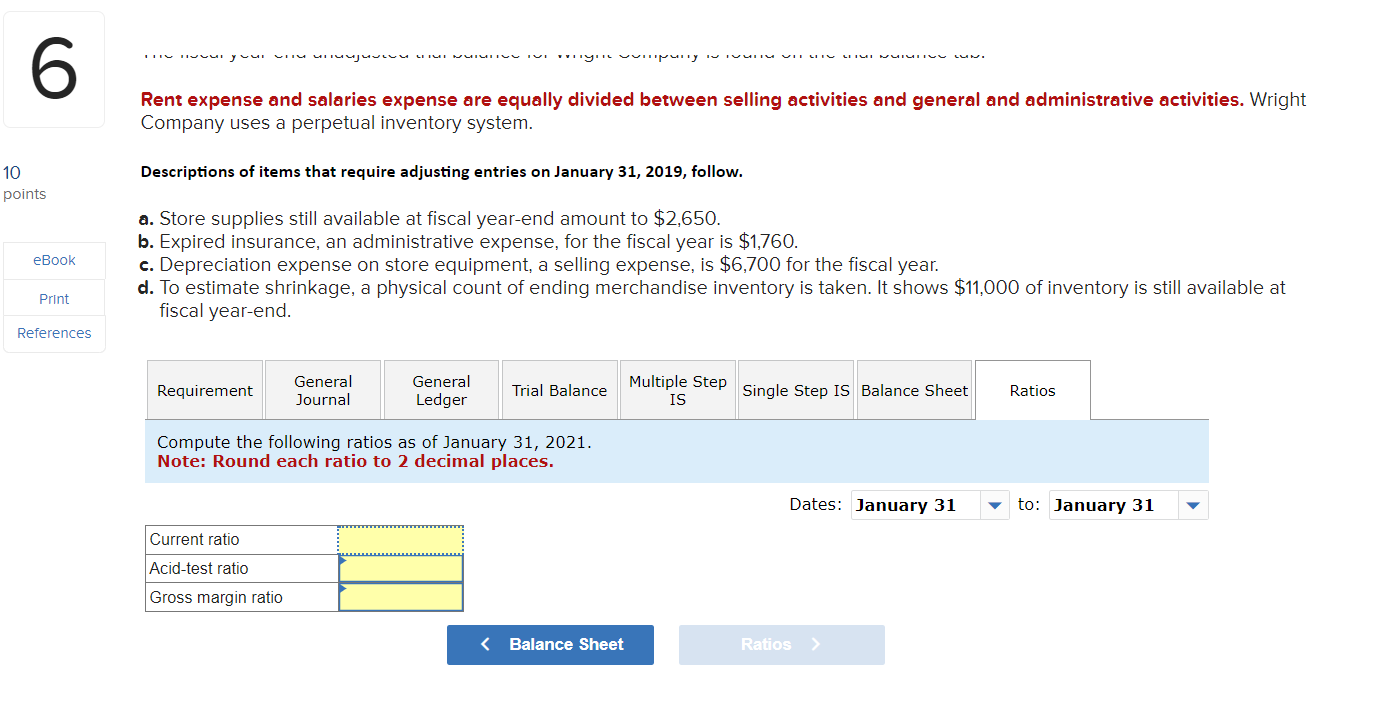

View transaction list View journal entry worksheet \begin{tabular}{l} 10 \\ points \\ \hline eBook \\ \hline Print \\ \hline References \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & Account Title & Debit & Credit \\ \hline \multirow[t]{2}{*}{} & 1 & January 31 & Store supplies expense & 5,300 & \\ \hline & & & Store supplies & & 5,300 \\ \hline \multirow[t]{2}{*}{} & 2 & January 31 & Insurance expense & 1,760 & \\ \hline & & & Prepaid insurance & & 1,760 \\ \hline \multirow[t]{2}{*}{} & 3 & January 31 & Depreciation expense - Store equip. & 6,700 & \\ \hline & & & Accumulated depreciation - Store equip. & & 6,700 \\ \hline & 4 & January 31 & Cost of goods sold & 700 & \\ \hline & & & Merchandise inventory & & 700 \\ \hline \multirow[t]{2}{*}{} & 5 & January 31 & Sales & 130,000 & \\ \hline & & & Income summary & & 130,000 \\ \hline & 6 & January 31 & Income summary & 72,110 & \\ \hline & & & Rent expense & & 13,600 \\ \hline & & & Advertising expense & & 10,750 \\ \hline & & & Store supplies expense & & 5,300 \\ \hline & & & Insurance expense & & 1,760 \\ \hline & & & Salaries expense & & 34,000 \\ \hline & & & Depreciation expense - Store equip. & & 6,700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline & 3 & January 31 & Depreciation expense - Store equip. & 6,700 & \\ \hline & & & Accumulated depreciation - Store equip. & & 6,700 \\ \hline \multirow[t]{2}{*}{} & 4 & January 31 & Cost of goods sold & 700 & \\ \hline & & & Merchandise inventory & & 700 \\ \hline \multirow[t]{2}{*}{} & 5 & January 31 & Sales & 130,000 & \\ \hline & & & Income summary & & 130,000 \\ \hline \multirow[t]{7}{*}{} & 6 & January 31 & Income summary & 72,110 & \\ \hline & & & Rent expense & & 13,600 \\ \hline & & & Advertising expense & & 10,750 \\ \hline & & & Store supplies expense & & 5,300 \\ \hline & & & Insurance expense & & 1,760 \\ \hline & & & Salaries expense & & 34,000 \\ \hline & & & Depreciation expense - Store equip. & & 6,700 \\ \hline \multirow[t]{2}{*}{%} & 7 & January 31 & Income summary & & \\ \hline & & & Retained earnings & & \\ \hline \multirow[t]{2}{*}{} & 8 & January 31 & Retained earnings & & \\ \hline & & & Dividends & & \\ \hline \end{tabular} Prepare a classified balance sheet as of January 31, 2021. Post-closing Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Wright Company uses a perpetual inventory system. Descriptions of items that require adjusting entries on January 31, 2019, follow. a. Store supplies still available at fiscal year-end amount to $2,650. b. Expired insurance, an administrative expense, for the fiscal year is $1,760. c. Depreciation expense on store equipment, a selling expense, is $6,700 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $11,000 of inventory is still available at fiscal year-end. Compute the following ratios as of January 31, 2021. Note: Round each ratio to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started