Answered step by step

Verified Expert Solution

Question

1 Approved Answer

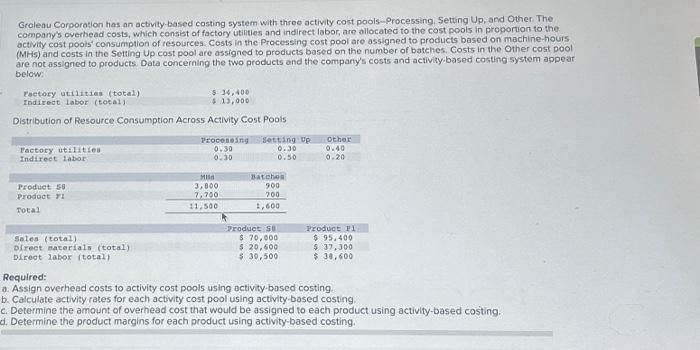

please help!!!!! will give a thumbs up Groleau Corporation has an activity-based costing system with three octivity cost pools-Processing. Setting Up, and Other. The company's

please help!!!!! will give a thumbs up

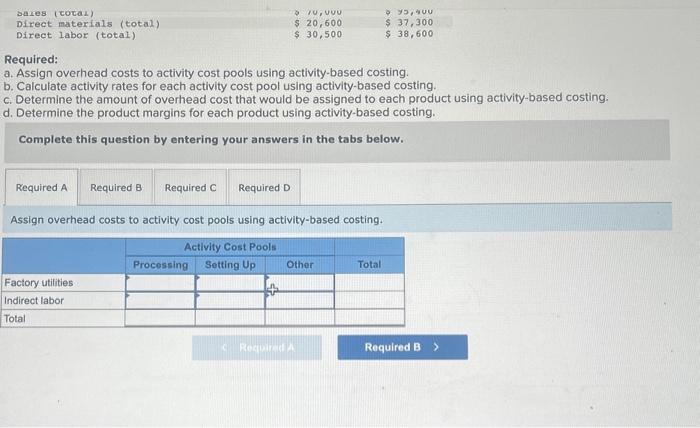

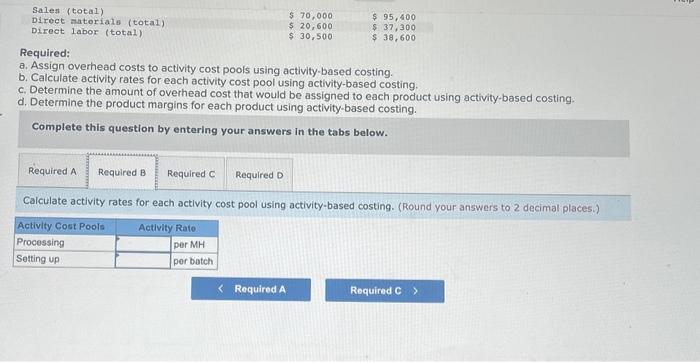

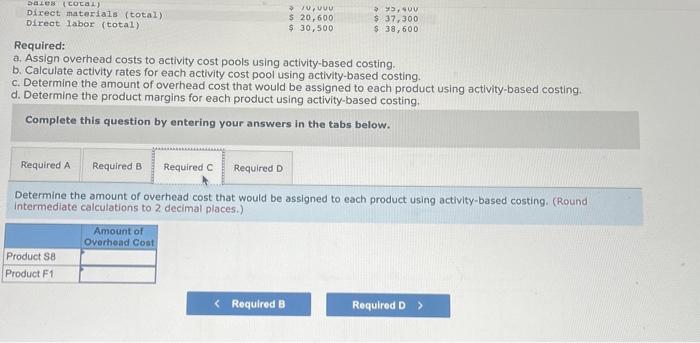

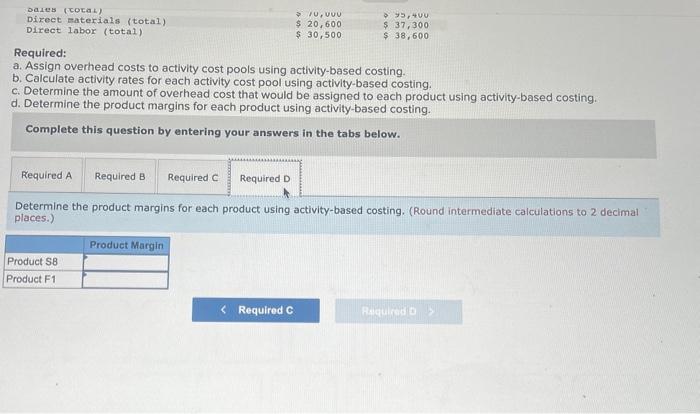

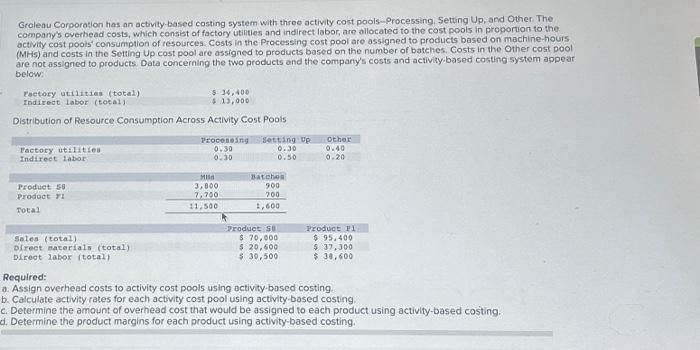

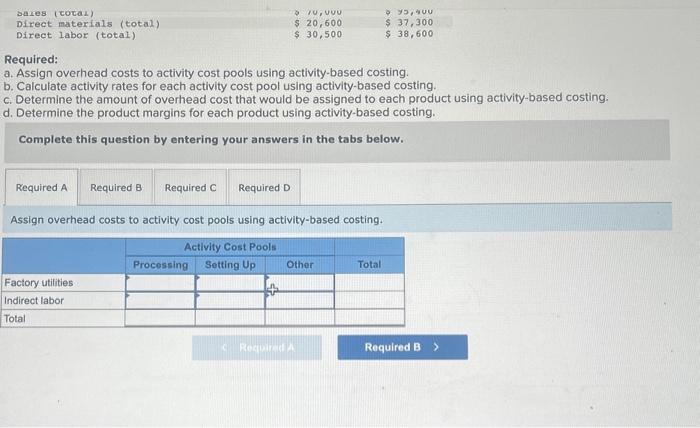

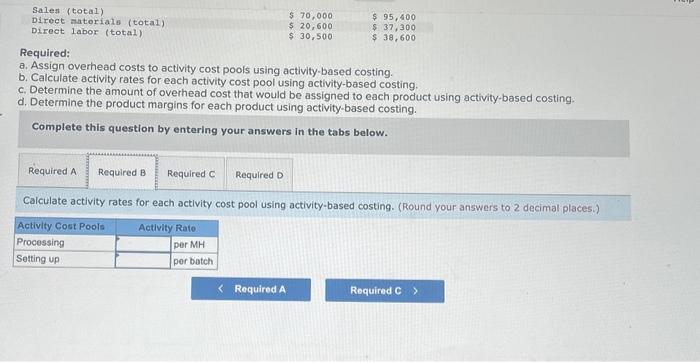

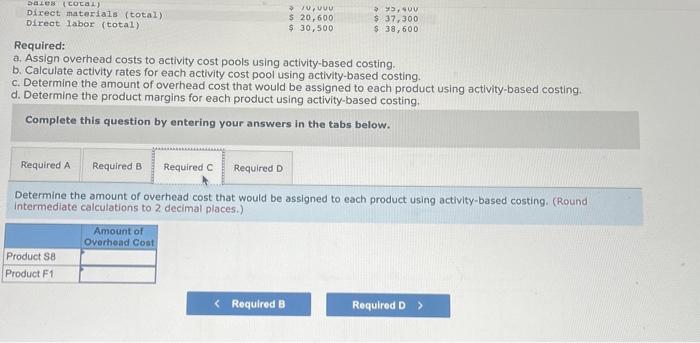

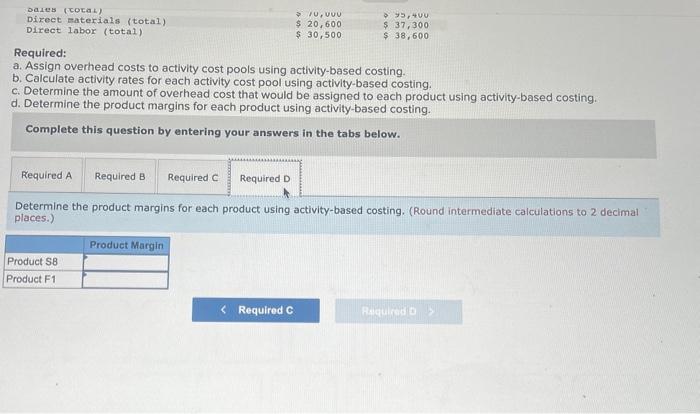

Groleau Corporation has an activity-based costing system with three octivity cost pools-Processing. Setting Up, and Other. The company's overbead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the octivity cost pools' consumption of resources costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products bosed on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appeat below: Distribution of Resource Consumption Across Activity Cost Pools Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-bosed costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing. Required: . Assign overhead costs to activity cost pools using activity-based costing. . Calculate activity rates for each activity cost pool using activity-based costing. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. 1. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Assign overhead costs to activity cost pools using activity-based costing. Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.) Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Round intermediate calculations to 2 decimal places.) Required: a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing. Complete this question by entering your answers in the tabs below. Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started