Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help!!! will leave immediate feedback!! thank you!! Question 19 2 pts The owners of Jakobs Industries are preparing to take it public and are

please help!!! will leave immediate feedback!! thank you!!

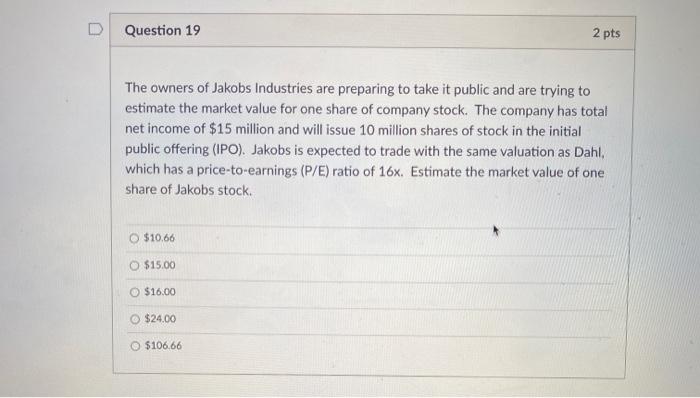

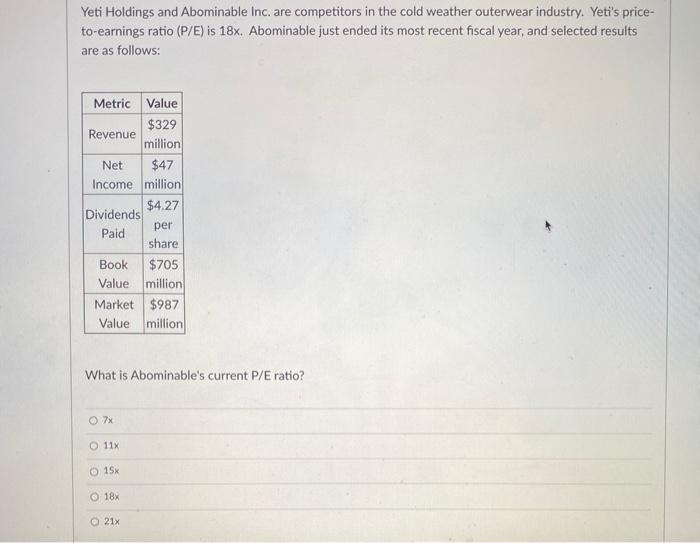

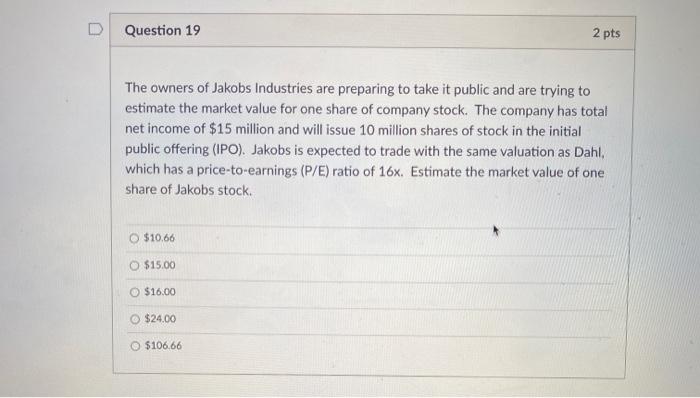

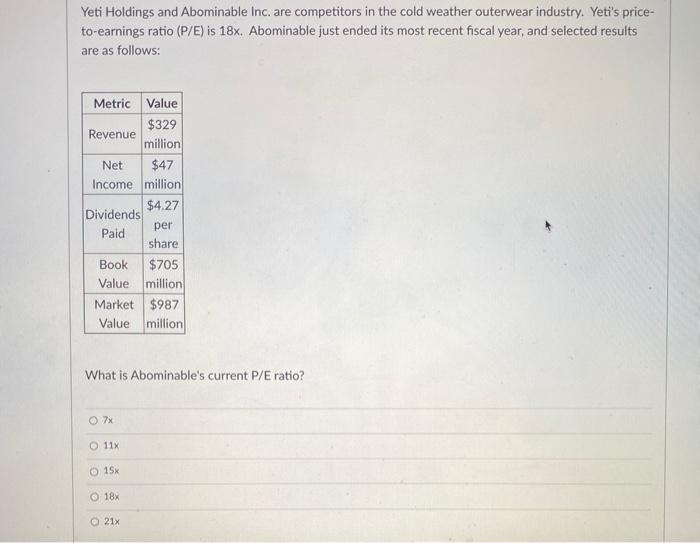

Question 19 2 pts The owners of Jakobs Industries are preparing to take it public and are trying to estimate the market value for one share of company stock. The company has total net income of $15 million and will issue 10 million shares of stock in the initial public offering (IPO). Jakobs is expected to trade with the same valuation as Dahl, which has a price-to-earnings (P/E) ratio of 16x. Estimate the market value of one share of Jakobs stock. $10.66 O $15.00 $16.00 $24.00 $106.66 Yeti Holdings and Abominable Inc. are competitors in the cold weather outerwear industry. Yeti's price- to-earnings ratio (P/E) is 18x. Abominable just ended its most recent fiscal year, and selected results are as follows: Metric Value $329 Revenue million Net $47 Income million $4.27 Dividends per Paid share Book $705 Value million Market $987 Value million What is Abominable's current P/E ratio? 7x 11% O 15 18x 21x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started