Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP WILL LEAVE THUMBS UP Cathy operates a photography business. Customers book her services in advance of the event. A 50% deposit is required

PLEASE HELP WILL LEAVE THUMBS UP

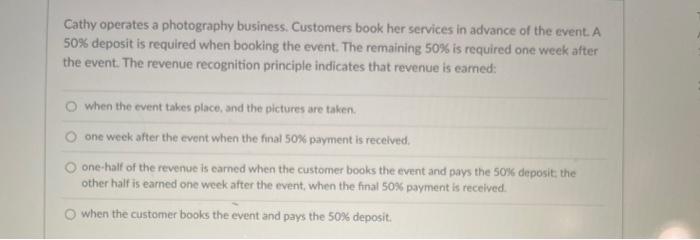

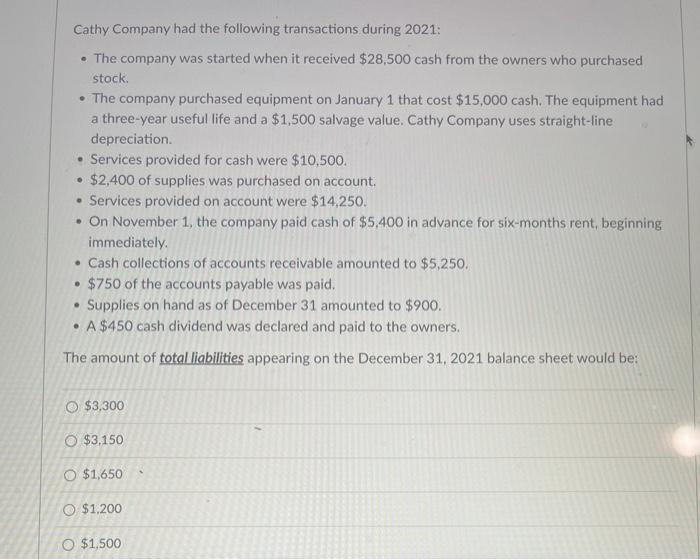

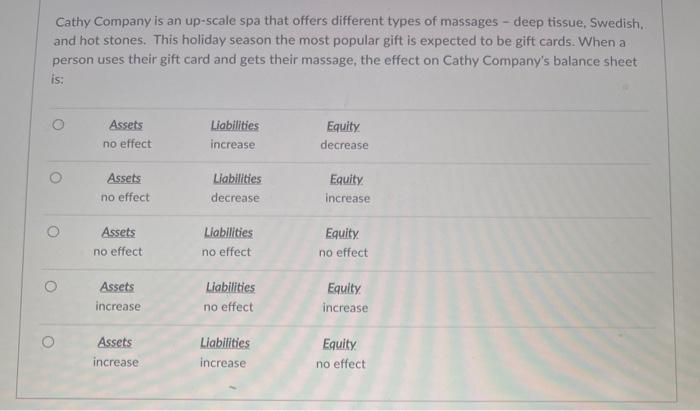

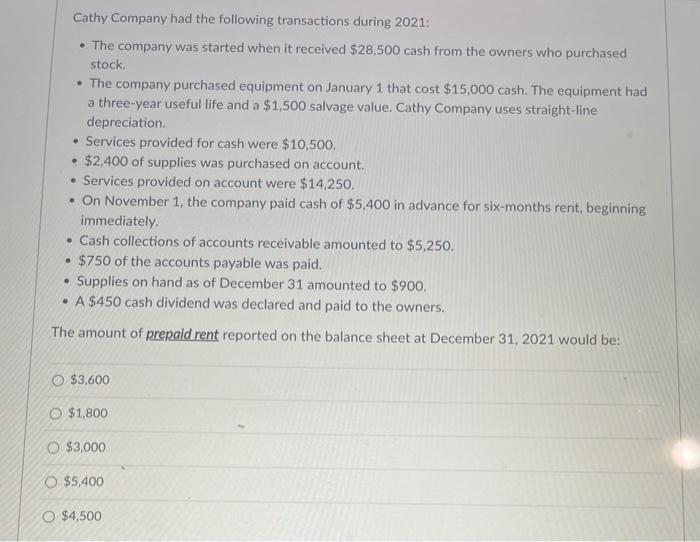

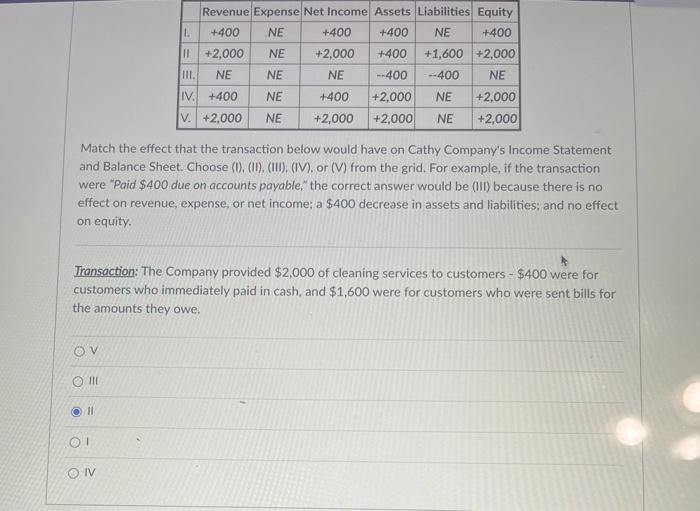

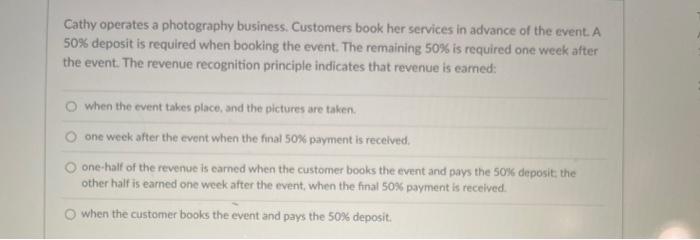

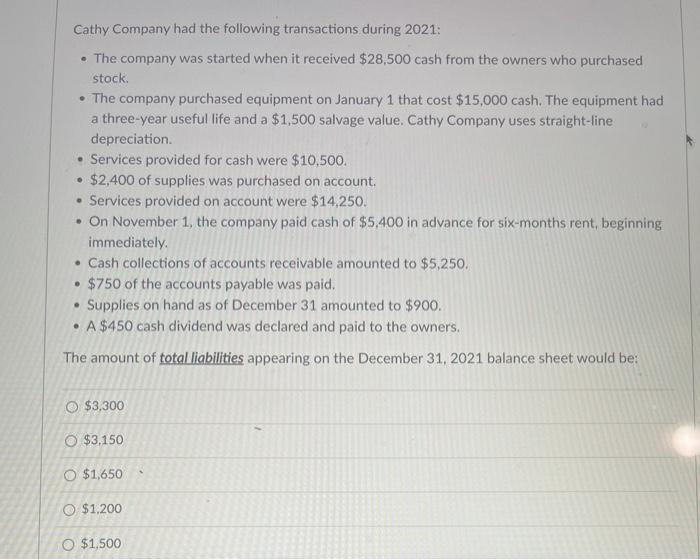

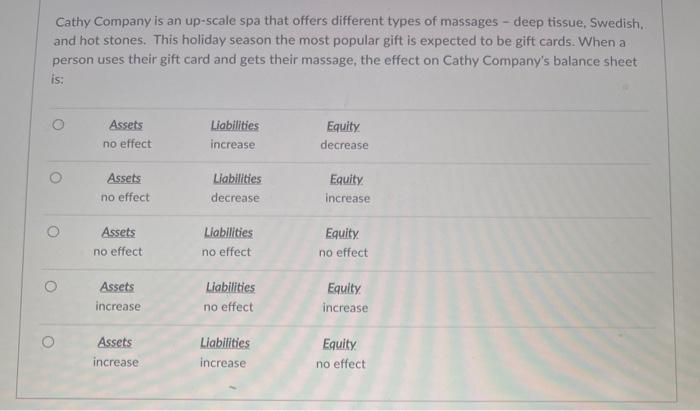

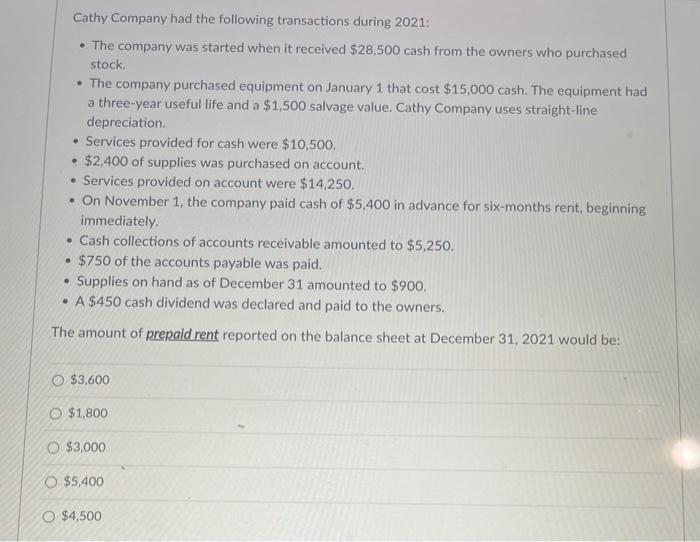

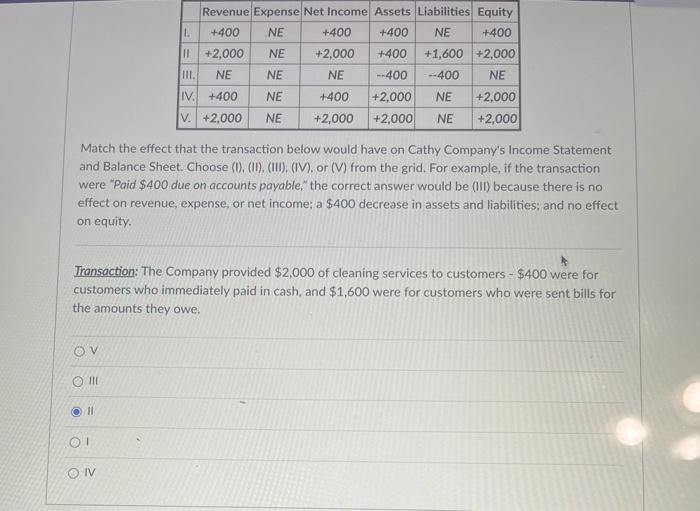

Cathy operates a photography business. Customers book her services in advance of the event. A 50% deposit is required when booking the event. The remaining 50% is required one week after the event. The revenue recognition principle indicates that revenue is earned: o when the event takes place, and the pictures are taken one week after the event when the final 50% payment is received one-half of the revenue is carned when the customer books the event and pays the 50% deposit the other half is earned one week after the event when the final 50% payment is received when the customer books the event and pays the 50% deposit. Cathy Company had the following transactions during 2021: The company was started when it received $28,500 cash from the owners who purchased stock The company purchased equipment on January 1 that cost $15,000 cash. The equipment had a three-year useful life and a $1,500 salvage value. Cathy Company uses straight-line depreciation Services provided for cash were $10,500. $2,400 of supplies was purchased on account. Services provided on account were $14,250. On November 1, the company paid cash of $5,400 in advance for six-months rent, beginning immediately Cash collections of accounts receivable amounted to $5,250. $750 of the accounts payable was paid. Supplies on hand as of December 31 amounted to $900. A $450 cash dividend was declared and paid to the owners. The amount of total liabilities appearing on the December 31, 2021 balance sheet would be: $3,300 O $3,150 $1,650 O $1,200 O $1,500 Cathy Company is an up-scale spa that offers different types of massages - deep tissue, Swedish and hot stones. This holiday season the most popular gift is expected to be gift cards. When a person uses their gift card and gets their massage, the effect on Cathy Company's balance sheet is: o Assets no effect Liabilities increase Equity decrease Liabilities Assets no effect Equity increase decrease O Assets no effect Liabilities no effect Equity no effect Assets increase Liabilities no effect Equity increase Assets increase Liabilities increase Equity no effect Cathy Company had the following transactions during 2021: The company was started when it received $28,500 cash from the owners who purchased stock. The company purchased equipment on January 1 that cost $15,000 cash. The equipment had a three-year useful life and a $1,500 salvage value. Cathy Company uses straight-line depreciation Services provided for cash were $10,500. $2,400 of supplies was purchased on account. Services provided on account were $14,250. On November 1, the company paid cash of $5,400 in advance for six-months rent, beginning immediately Cash collections of accounts receivable amounted to $5,250. $750 of the accounts payable was paid. Supplies on hand as of December 31 amounted to $900. A $450 cash dividend was declared and paid to the owners. The amount of prepaid rent reported on the balance sheet at December 31, 2021 would be: O $3,600 $1,800 $3,000 O $5,400 O $4,500 Revenue Expense Net Income Assets Liabilities Equity L +400 NE +400 +400 NE +400 1 +2,000 NE +2,000 +400 +1,600 +2,000 III. NE NE NE --400 --400 NE IV. +400 NE +400 +2,000 NE +2,000 V. +2,000 NE +2,000 +2,000 NE +2,000 Match the effect that the transaction below would have on Cathy Company's Income Statement and Balance Sheet. Choose (1). (10). (III). (IV) or (V) from the grid. For example, if the transaction were "Paid $400 due on accounts payable" the correct answer would be (III) because there is no effect on revenue, expense, or net income; a $400 decrease in assets and liabilities: and no effect on equity. Transaction: The Company provided $2,000 of cleaning services to customers - $400 were for customers who immediately paid in cash, and $1,600 were for customers who were sent bills for the amounts they owe. w OV ODIO O O IV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started