Answered step by step

Verified Expert Solution

Question

1 Approved Answer

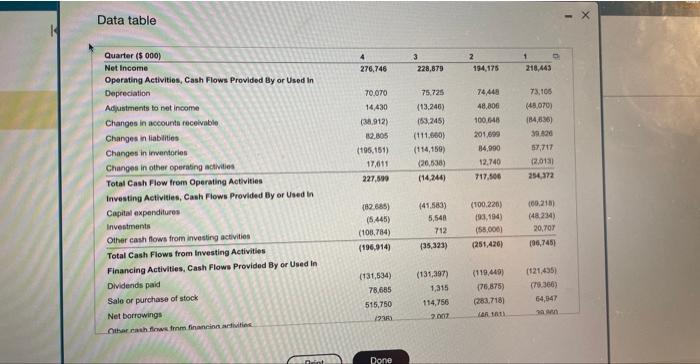

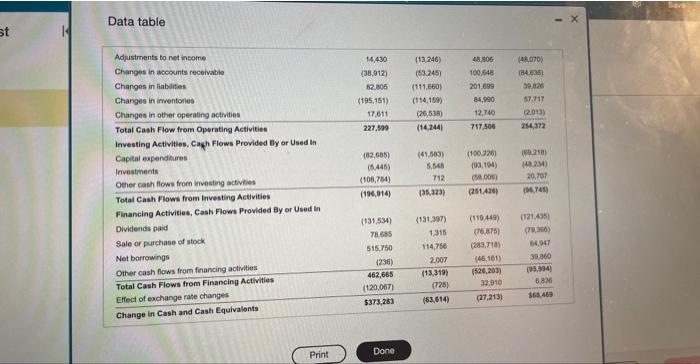

Please help will upvote if correct! Consider the following cash flow statement. Click the icon to viaw the cash fow statement. a. What were the

Please help will upvote if correct!

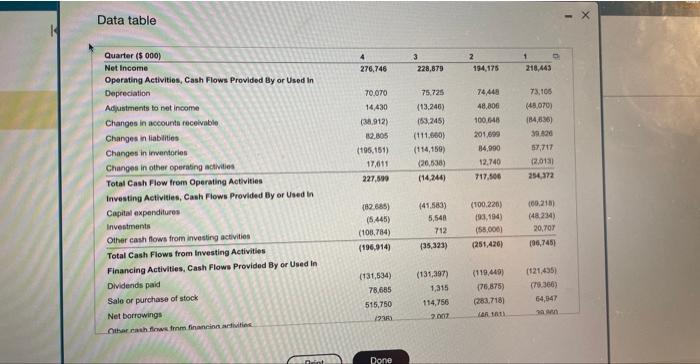

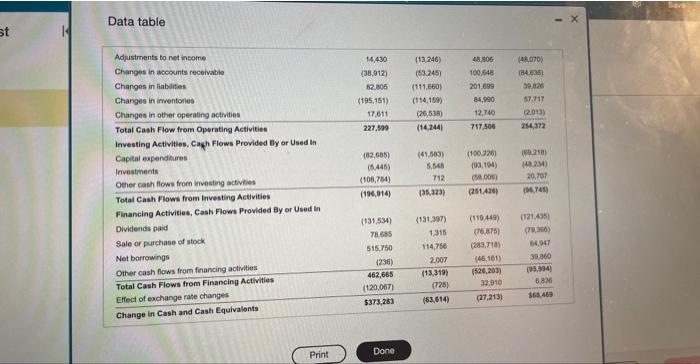

Consider the following cash flow statement. Click the icon to viaw the cash fow statement. a. What were the company's cumulative earnings ovar these four quarters? What wore is cumulative cash flows from operating activised? b. What fraction of the cash from operating activities was used for investment over the four quarters? c. What fraction of the cash from operating activities was used for financing activities over the four quarters? a. What were the oompany's cumulative eamings over these four quasters? The cumulabve earnings were $918243(000). (Round to the nearest inleger.) What were is cumulative canh fiows trom operating activitiee? The cumidative cash flows from the operating activities were $1185233(000), (Round to the nearest inseger.) b. What fraction of the cash from operating activities was used for imvestment over the four quarters? The fraction of the cash from opera6ing activities used for investment was 48.97 \%. (Round to two decimal places) c. What fraction of the cash from operating activites was used foe financing activilies over the four quarters? The fraction of the cash from operating activities used for financing activities was \%e (Round to two decimal places.) Data table Data table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started