Answered step by step

Verified Expert Solution

Question

1 Approved Answer

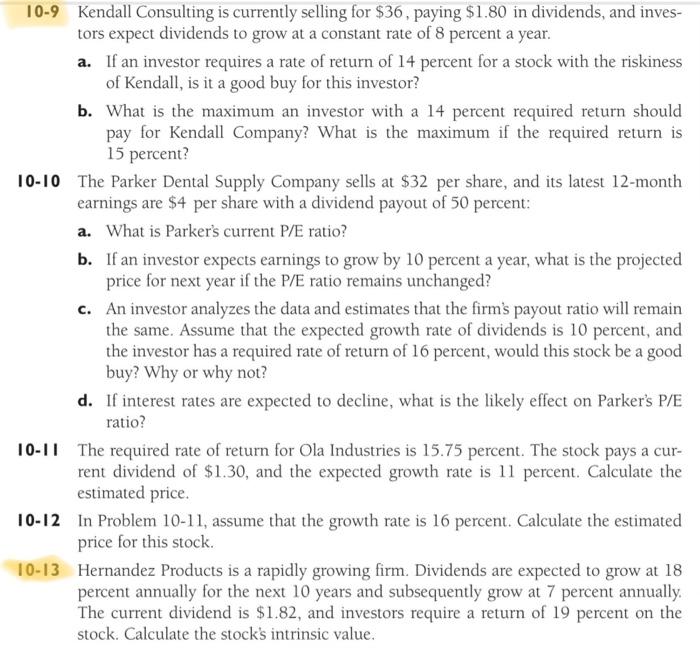

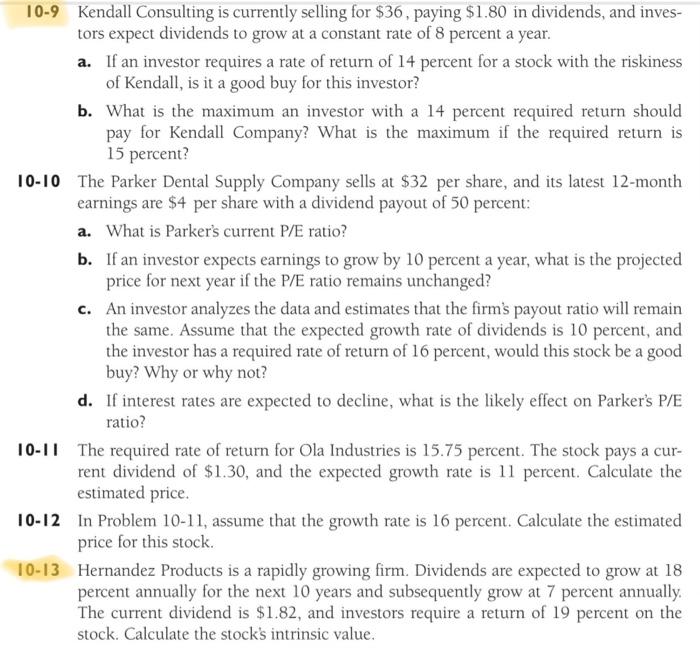

Please Help with 10-13! 10-9 Kendall Consulting is currently selling for $36, paying $1.80 in dividends, and investors expect dividends to grow at a constant

Please Help with 10-13!

10-9 Kendall Consulting is currently selling for $36, paying $1.80 in dividends, and investors expect dividends to grow at a constant rate of 8 percent a year. a. If an investor requires a rate of return of 14 percent for a stock with the riskiness of Kendall, is it a good buy for this investor? b. What is the maximum an investor with a 14 percent required return should pay for Kendall Company? What is the maximum if the required return is 15 percent? 10-10 The Parker Dental Supply Company sells at $32 per share, and its latest 12-month earnings are $4 per share with a dividend payout of 50 percent: a. What is Parker's current P/E ratio? b. If an investor expects earnings to grow by 10 percent a year, what is the projected price for next year if the P/E ratio remains unchanged? c. An investor analyzes the data and estimates that the firm's payout ratio will remain the same. Assume that the expected growth rate of dividends is 10 percent, and the investor has a required rate of return of 16 percent, would this stock be a good buy? Why or why not? d. If interest rates are expected to decline, what is the likely effect on Parker's P/E ratio? 10-1I The required rate of return for Ola Industries is 15.75 percent. The stock pays a current dividend of $1.30, and the expected growth rate is 11 percent. Calculate the estimated price. 10-12 In Problem 10-11, assume that the growth rate is 16 percent. Calculate the estimated price for this stock. 10-13 Hernandez Products is a rapidly growing firm. Dividends are expected to grow at 18 percent annually for the next 10 years and subsequently grow at 7 percent annually. The current dividend is $1.82, and investors require a return of 19 percent on the stock. Calculate the stock's intrinsic value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started