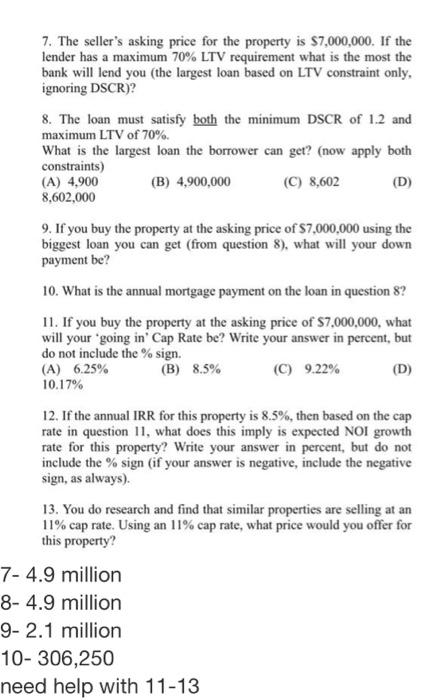

7. The seller's asking price for the property is $7,000,000. If the lender has a maximum 70% LTV requirement what is the most the bank will lend you the largest loan based on LTV constraint only, ignoring DSCR)? 8. The loan must satisfy both the minimum DSCR of 1.2 and maximum LTV of 70% What is the largest loan the borrower can get? (now apply both constraints) (A) 4,900 (B) 4,900,000 (C) 8,602 (D) 8,602,000 9. If you buy the property at the asking price of $7,000,000 using the biggest loan you can get (from question 8), what will your down payment be? 10. What is the annual mortgage payment on the loan in question 8? 11. If you buy the property at the asking price of $7,000,000, what will your 'going in' Cap Rate be? Write your answer in percent, but do not include the % sign. (A) 6.25% (B) 8.5% (C) 9.22% 10.17% (D) 12. If the annual IRR for this property is 8.5%, then based on the cap rate in question 11, what does this imply is expected NOI growth rate for this property? Write your answer in percent, but do not include the % sign (if your answer is negative, include the negative sign, as always). 13. You do research and find that similar properties are selling at an 11% cap rate. Using an 11% cap rate, what price would you offer for this property? 7- 4.9 million 8- 4.9 million 9- 2.1 million 10-306,250 need help with 11-13 7. The seller's asking price for the property is $7,000,000. If the lender has a maximum 70% LTV requirement what is the most the bank will lend you the largest loan based on LTV constraint only, ignoring DSCR)? 8. The loan must satisfy both the minimum DSCR of 1.2 and maximum LTV of 70% What is the largest loan the borrower can get? (now apply both constraints) (A) 4,900 (B) 4,900,000 (C) 8,602 (D) 8,602,000 9. If you buy the property at the asking price of $7,000,000 using the biggest loan you can get (from question 8), what will your down payment be? 10. What is the annual mortgage payment on the loan in question 8? 11. If you buy the property at the asking price of $7,000,000, what will your 'going in' Cap Rate be? Write your answer in percent, but do not include the % sign. (A) 6.25% (B) 8.5% (C) 9.22% 10.17% (D) 12. If the annual IRR for this property is 8.5%, then based on the cap rate in question 11, what does this imply is expected NOI growth rate for this property? Write your answer in percent, but do not include the % sign (if your answer is negative, include the negative sign, as always). 13. You do research and find that similar properties are selling at an 11% cap rate. Using an 11% cap rate, what price would you offer for this property? 7- 4.9 million 8- 4.9 million 9- 2.1 million 10-306,250 need help with 11-13