Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with 1.3 will upvote if helpful 1.3 You own a small startup company, called MetSo Pty that does recycling of metal cans. You

Please help with 1.3 will upvote if helpful

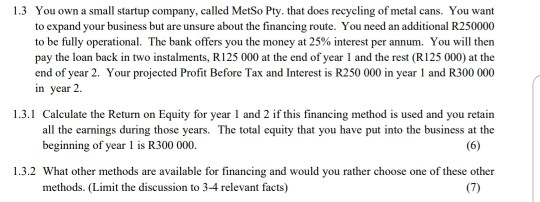

1.3 You own a small startup company, called MetSo Pty that does recycling of metal cans. You want to expand your business but are unsure about the financing route. You need an additional R250000 to be fully operational. The bank offers you the money at 25% interest per annum. You will then pay the loan back in two instalments, R125 000 at the end of year 1 and the rest (R125 000) at the end of year 2. Your projected Profit Before Tax and Interest is R250 000 in year 1 and R300 000 in year 2. 1.3.1 Calculate the Return on Equity for year 1 and 2 if this financing method is used and you retain all the earnings during those years. The total equity that you have put into the business at the beginning of year 1 is R300 000. (6) 1.3.2 What other methods are available for financing and would you rather choose one of these other methods. (Limit the discussion to 3-4 relevant facts)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started