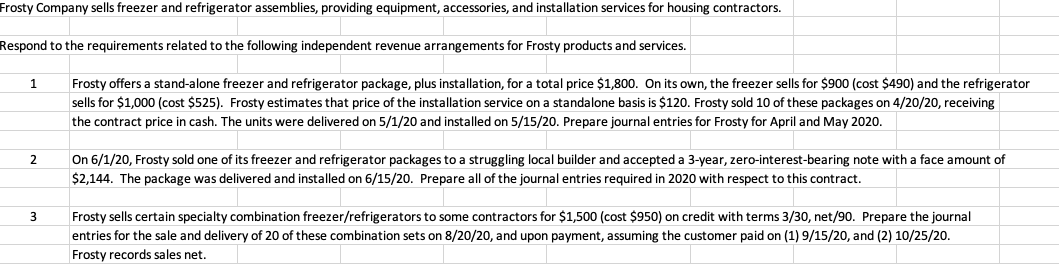

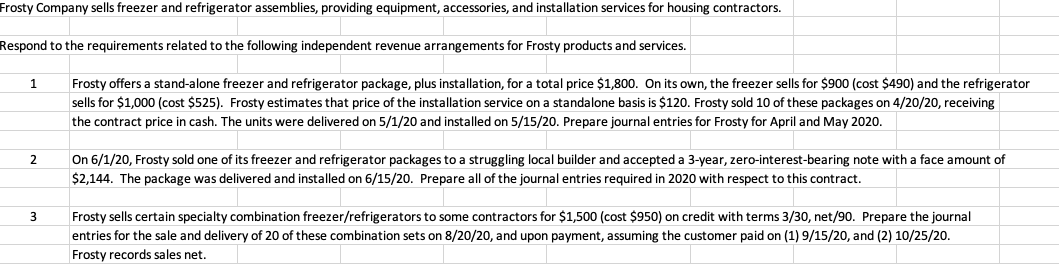

Please help with #2 and 3

Frosty Company sells freezer and refrigerator assemblies, providing equipment, accessories, and installation services for housing contractors. Respond to the requirements related to the following independent revenue arrangements for Frosty products and services. 1 Frosty offers a stand-alone freezer and refrigerator package, plus installation, for a total price $1,800. On its own, the freezer sells for $900 (cost $490) and the refrigerator sells for $1,000 (cost $525). Frosty estimates that price of the installation service on a standalone basis is $120. Frosty sold 10 of these packages on 4/20/20, receiving the contract price in cash. The units were delivered on 5/1/20 and installed on 5/15/20. Prepare journal entries for Frosty for April and May 2020. 2 On 6/1/20, Frosty sold one of its freezer and refrigerator packages to a struggling local builder and accepted a 3-year, zero-interest-bearing note with a face amount of $2,144. The package was delivered and installed on 6/15/20. Prepare all of the journal entries required in 2020 with respect to this contract. 3 Frosty sells certain specialty combination freezer/refrigerators to some contractors for $1,500 (cost $950) on credit with terms 3/30, net/90. Prepare the journal entries for the sale and delivery of 20 of these combination sets on 8/20/20, and upon payment, assuming the customer paid on (1) 9/15/20, and (2) 10/25/20. Frosty records sales net. Frosty Company sells freezer and refrigerator assemblies, providing equipment, accessories, and installation services for housing contractors. Respond to the requirements related to the following independent revenue arrangements for Frosty products and services. 1 Frosty offers a stand-alone freezer and refrigerator package, plus installation, for a total price $1,800. On its own, the freezer sells for $900 (cost $490) and the refrigerator sells for $1,000 (cost $525). Frosty estimates that price of the installation service on a standalone basis is $120. Frosty sold 10 of these packages on 4/20/20, receiving the contract price in cash. The units were delivered on 5/1/20 and installed on 5/15/20. Prepare journal entries for Frosty for April and May 2020. 2 On 6/1/20, Frosty sold one of its freezer and refrigerator packages to a struggling local builder and accepted a 3-year, zero-interest-bearing note with a face amount of $2,144. The package was delivered and installed on 6/15/20. Prepare all of the journal entries required in 2020 with respect to this contract. 3 Frosty sells certain specialty combination freezer/refrigerators to some contractors for $1,500 (cost $950) on credit with terms 3/30, net/90. Prepare the journal entries for the sale and delivery of 20 of these combination sets on 8/20/20, and upon payment, assuming the customer paid on (1) 9/15/20, and (2) 10/25/20. Frosty records sales net