Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with 2-5 2. During 2021, Carl Cox receives _ Wages of $95,000 Qualifying group medical/hospitalization insurance coveraze (premium payments paid by Cat's employer

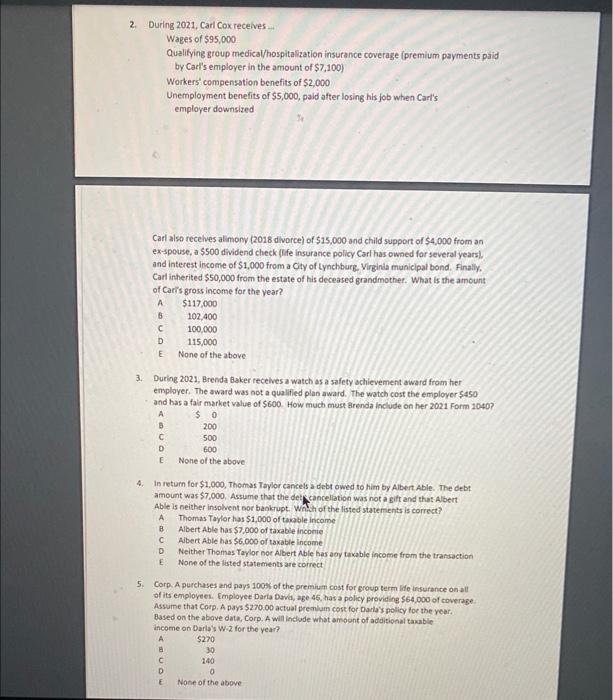

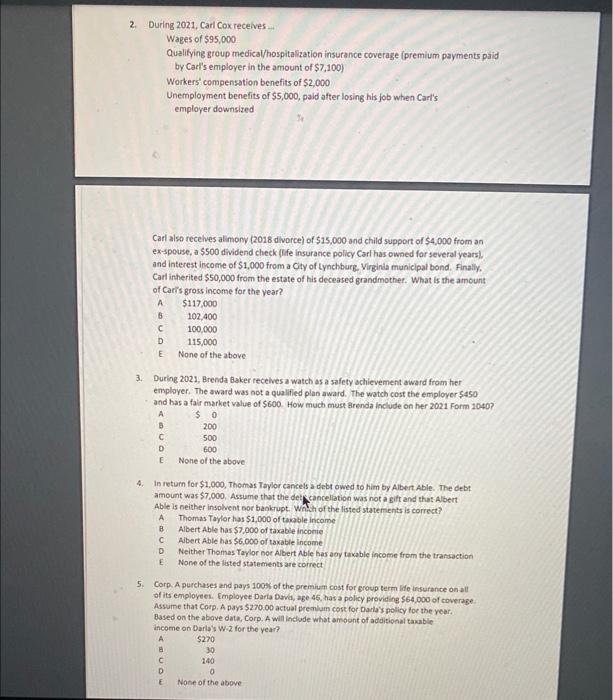

please help with 2-5  2. During 2021, Carl Cox receives _ Wages of $95,000 Qualifying group medical/hospitalization insurance coveraze (premium payments paid by Cat's employer in the amount of $7,100 ) Workers' compensation benefits of $2,000 Unemplayment benefits of $5,000, paid after losing his job when Cart's employer downsized Carl also recehves alimony (2018 divorce) of $15,000 and child support of $4,000 from an ex-spouse, a $500 dividend check (life insurance policy Cart has owned for several years). and interest income of $1,000 from a Oiy of tynchburg. Virginia municipal bond. Finally, Carl intherited $50,000 from the estate of his deceased grandmother. What is the amount of Caris gross income for the year? ABCDE.Noneoftheabove$117,000102,400100,000115,000 3. During 2021, Brenda Baker recelves a watch as a safety achievement award from her emplayer. The award was not a qualified plan award. The watch cost the employer $450 and has a fair market value of $600. How much must Alrenda include on her 2021 Form 1040 ? A3C0E50200500600Noneoftheabove 4. In return for $1,000, Thomas Toylor cancels a debt owed to him by Albert able. The debt amount was $7,000, Assume that the det cancellation was not a gitt and that Albert Able is neither insolvent nor bankrupt. Whth of the listed statements is correct? A Thomas Taylor has $1,000 of taxable income B. Albert Able has $7.000 of taxable incomie C. Abert Able has $6,000 of taxable income D. Neither Thomas Taylor nor Abert Able has aey taxable income from the transaction E. None of the listed statements are correct 5. Corp. A purchases and pays 1005 of the premium cost for group term life insurance on all of its employees. Employee Darta Davi, age 46 , has a policy provicing $64,000 of coverage Assume that Corp. A pays $270.00 actual premium cort for Darlay polity foe the year. Based on the above date, Corp. A will include what amount of additional tawable income on Darla's wiz for the year? ABCDE$270301400Noneoftheabove

2. During 2021, Carl Cox receives _ Wages of $95,000 Qualifying group medical/hospitalization insurance coveraze (premium payments paid by Cat's employer in the amount of $7,100 ) Workers' compensation benefits of $2,000 Unemplayment benefits of $5,000, paid after losing his job when Cart's employer downsized Carl also recehves alimony (2018 divorce) of $15,000 and child support of $4,000 from an ex-spouse, a $500 dividend check (life insurance policy Cart has owned for several years). and interest income of $1,000 from a Oiy of tynchburg. Virginia municipal bond. Finally, Carl intherited $50,000 from the estate of his deceased grandmother. What is the amount of Caris gross income for the year? ABCDE.Noneoftheabove$117,000102,400100,000115,000 3. During 2021, Brenda Baker recelves a watch as a safety achievement award from her emplayer. The award was not a qualified plan award. The watch cost the employer $450 and has a fair market value of $600. How much must Alrenda include on her 2021 Form 1040 ? A3C0E50200500600Noneoftheabove 4. In return for $1,000, Thomas Toylor cancels a debt owed to him by Albert able. The debt amount was $7,000, Assume that the det cancellation was not a gitt and that Albert Able is neither insolvent nor bankrupt. Whth of the listed statements is correct? A Thomas Taylor has $1,000 of taxable income B. Albert Able has $7.000 of taxable incomie C. Abert Able has $6,000 of taxable income D. Neither Thomas Taylor nor Abert Able has aey taxable income from the transaction E. None of the listed statements are correct 5. Corp. A purchases and pays 1005 of the premium cost for group term life insurance on all of its employees. Employee Darta Davi, age 46 , has a policy provicing $64,000 of coverage Assume that Corp. A pays $270.00 actual premium cort for Darlay polity foe the year. Based on the above date, Corp. A will include what amount of additional tawable income on Darla's wiz for the year? ABCDE$270301400Noneoftheabove

please help with 2-5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started