Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with # 3 Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and

please help with # 3

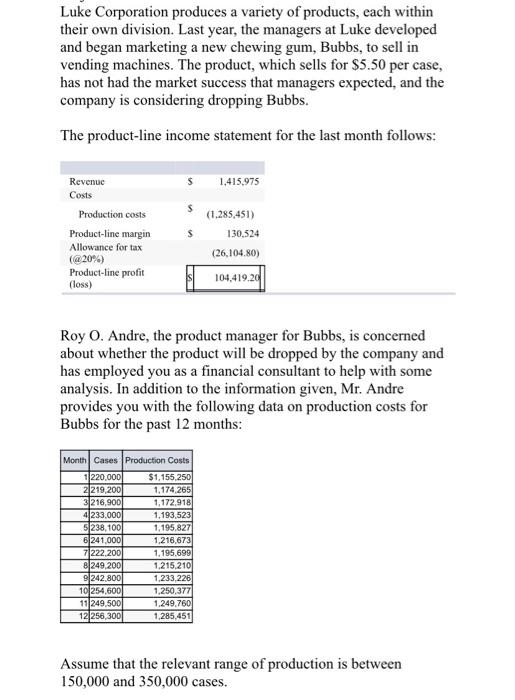

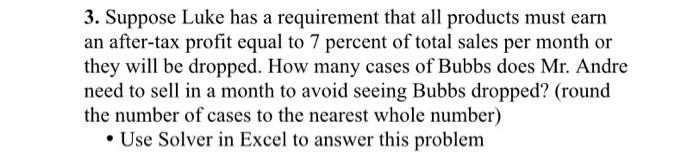

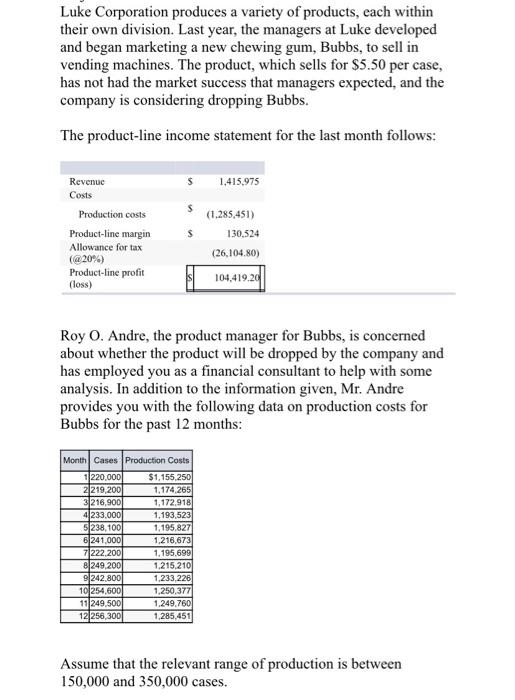

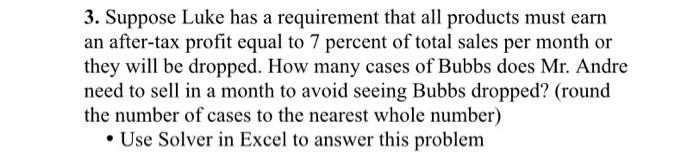

Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for $5.50 per case, has not had the market success that managers expected, and the company is considering dropping Bubbs. The product-line income statement for the last month follows: 1,415,975 Revenue Costs Production costs Product-line margin Allowance for tax (20%) Product-line profit (loss) s (1.285.451) 130.524 (26,104.80) 104,419.20 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addition to the information given, Mr. Andre provides you with the following data on production costs for Bubbs for the past 12 months: Month Cases Production Costs 11220.000 $1,155.250 2/219,200 1.174.265 3216,900 1,172,918 4/233,000 1,193,523 5|238,100 1.195.827 6|241,000 1,216,673 71222.200 1.195.699 8|249,200 1.215,210 9 242,800 1.233,2261 10 254,600 1.250,377 11/249.500 1.249.760 12 256,3001 1,285,451 Assume that the relevant range of production is between 150,000 and 350,000 cases. 3. Suppose Luke has a requirement that all products must earn an after-tax profit equal to 7 percent of total sales per month or they will be dropped. How many cases of Bubbs does Mr. Andre need to sell in a month to avoid seeing Bubbs dropped? (round the number of cases to the nearest whole number) Use Solver in Excel to answer this problem Luke Corporation produces a variety of products, each within their own division. Last year, the managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for $5.50 per case, has not had the market success that managers expected, and the company is considering dropping Bubbs. The product-line income statement for the last month follows: 1,415,975 Revenue Costs Production costs Product-line margin Allowance for tax (20%) Product-line profit (loss) s (1.285.451) 130.524 (26,104.80) 104,419.20 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addition to the information given, Mr. Andre provides you with the following data on production costs for Bubbs for the past 12 months: Month Cases Production Costs 11220.000 $1,155.250 2/219,200 1.174.265 3216,900 1,172,918 4/233,000 1,193,523 5|238,100 1.195.827 6|241,000 1,216,673 71222.200 1.195.699 8|249,200 1.215,210 9 242,800 1.233,2261 10 254,600 1.250,377 11/249.500 1.249.760 12 256,3001 1,285,451 Assume that the relevant range of production is between 150,000 and 350,000 cases. 3. Suppose Luke has a requirement that all products must earn an after-tax profit equal to 7 percent of total sales per month or they will be dropped. How many cases of Bubbs does Mr. Andre need to sell in a month to avoid seeing Bubbs dropped? (round the number of cases to the nearest whole number) Use Solver in Excel to answer this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started