Answered step by step

Verified Expert Solution

Question

1 Approved Answer

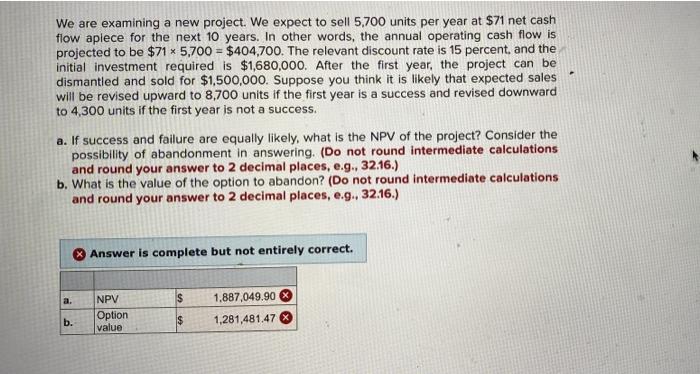

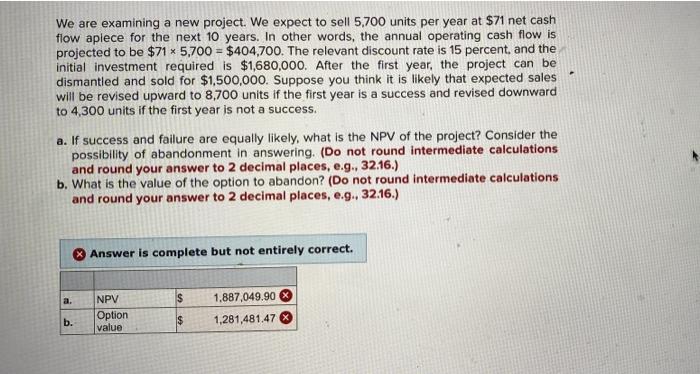

please help with A and B . struggling to get right answer We are examining a new project. We expect to sell 5,700 units per

please help with A and B . struggling to get right answer

We are examining a new project. We expect to sell 5,700 units per year at $71 net cash flow aplece for the next 10 years. In other words, the annual operating cash flow is projected to be $71 5,700 = $404,700. The relevant discount rate is 15 percent, and the initial investment required is $1,680,000. After the first year, the project can be dismantled and sold for $1,500,000. Suppose you think it is likely that expected sales will be revised upward to 8,700 units if the first year is a success and revised downward to 4,300 units if the first year is not a success. a. If success and failure are equally likely, what is the NPV of the project? Consider the possibility of abandonment in answering. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the value of the option to abandon? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. S NPV Option value 1,887,049.90 1,281,481.47 b. $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started