Answered step by step

Verified Expert Solution

Question

1 Approved Answer

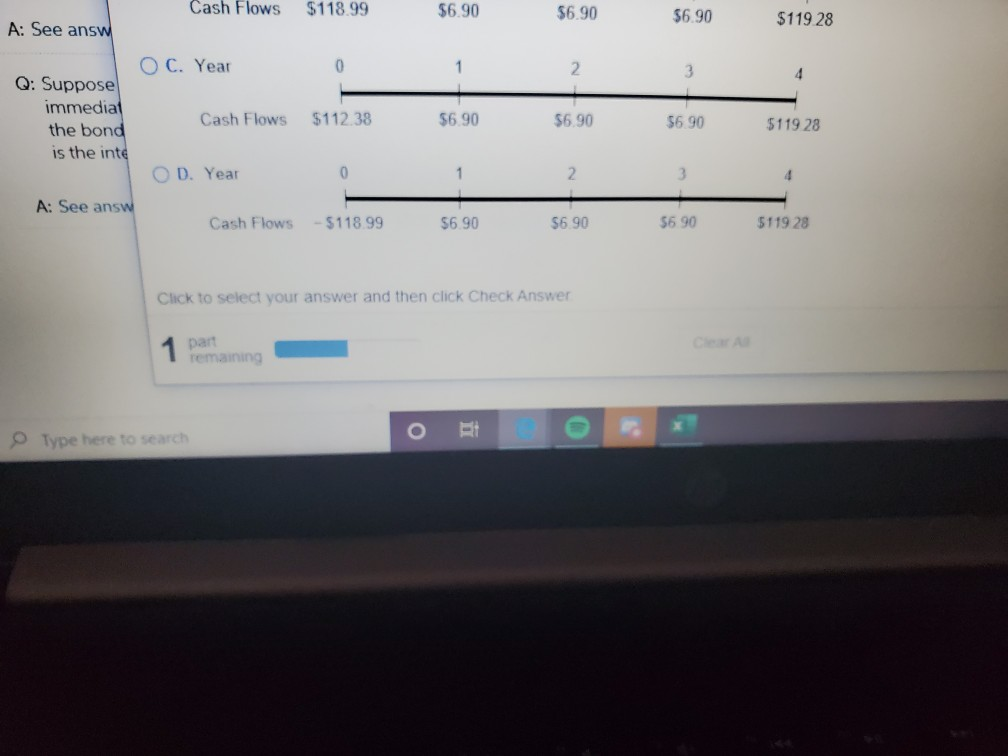

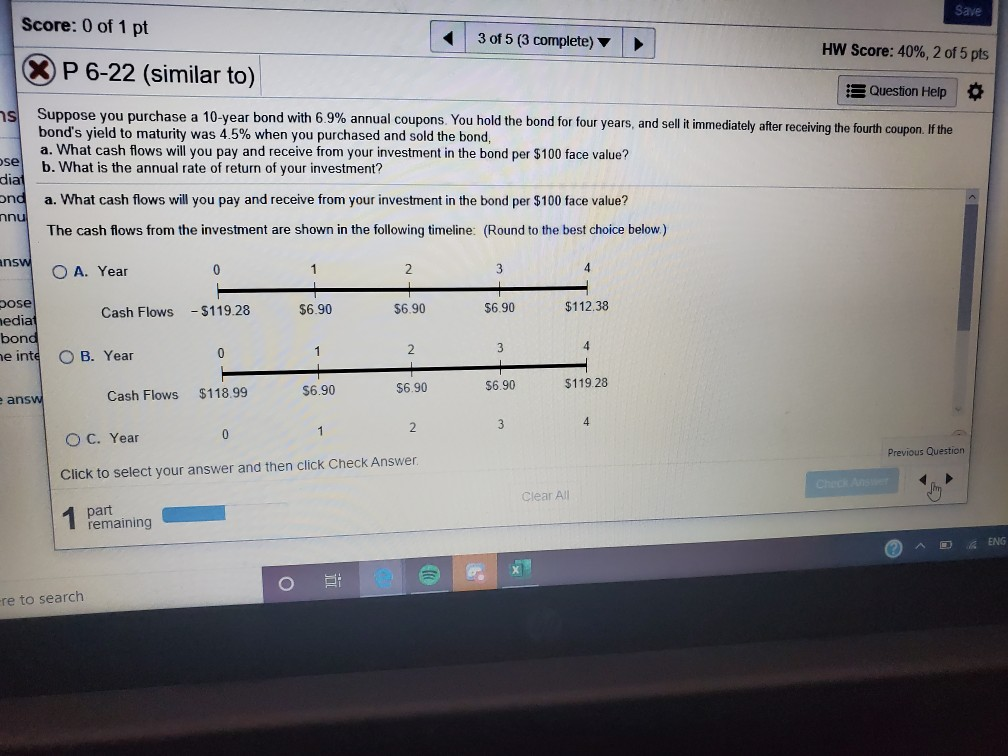

please help with a and b What is unclear? the second photo is the first part Cash Flows $118.99 $6.90 $6.90 $6.90 $119 28 A:

please help with a and b

What is unclear? the second photo is the first part

Cash Flows $118.99 $6.90 $6.90 $6.90 $119 28 A: See answ a Oc. Yet O C. Year Q: Suppose immediat the bond is the inte Cash Flows $112.38 $6.90 $6.90 $6.90 $11928 D. Year 0 2 A: See answ Cash Flows - $118.99 $6.90 $6.90 56.90 $119 28 Click to select your answer and then click Check Answer part remaining Type here to seare Save Score: 0 of 1 pt 3 of 5 (3 complete) HW Score: 40%, 2 of 5 pts XP 6-22 (similar to) Question Help $ ns Suppose you purchase a 10-year bond with 6.9% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.5% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the annual rate of return of your investment? ose dia and nnu a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flows from the investment are shown in the following timeline: (Round to the best choice below) answ O A. Year Cash Flows - $119.28 $6.90 $6.90 $6.90 $112.38 pose media bond he inte O B. Year $119.28 Cash Flows $118.99 $6.90 $6.90 $6.90 e answ O C. Year Previous Question Click to select your answer and then click Check Answer Clear All 1 part 1 remaining ENG re to searchStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started