Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with A and B Your firm imports manufactured goods from China. You are worried that U.S.-China trade negotiations could break down next year,

please help with A and B

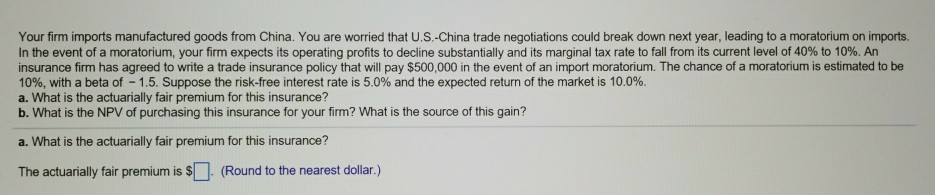

Your firm imports manufactured goods from China. You are worried that U.S.-China trade negotiations could break down next year, leading to a moratorium on imports. In the event of a moratorium, your firm expects its operating profits to decline substantially and its marginal tax rate to fall from its current level of 40% to 10%. An insurance firm has agreed to write a trade insurance policy that will pay $500,000 in the event of an import moratorium. The chance of a moratorium is estimated to be 10%, with a beta of-1.5. Suppose the risk-free interest rate is 5.0% and the expected return of the market is 10.0%. a. What is the actuarially fair premium for this insurance? b. What is the NPV of purchasing this insurance for your firm? What is the source of this gain? a. What is the actuarially fair premium for this insurance? The actuarially fair premium is (Round to the nearest dollar.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started