Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with accounting 1 question with 5 parts :) Blue Co. had net sales of $200,000, operating income of $125,000, and net income of

please help with accounting

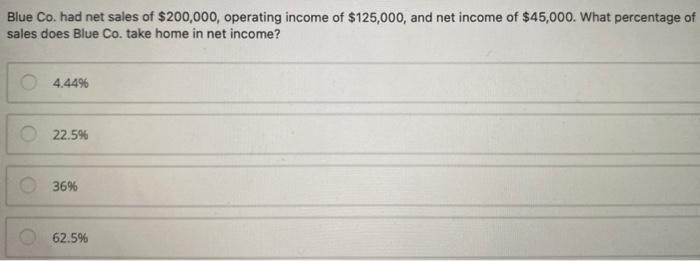

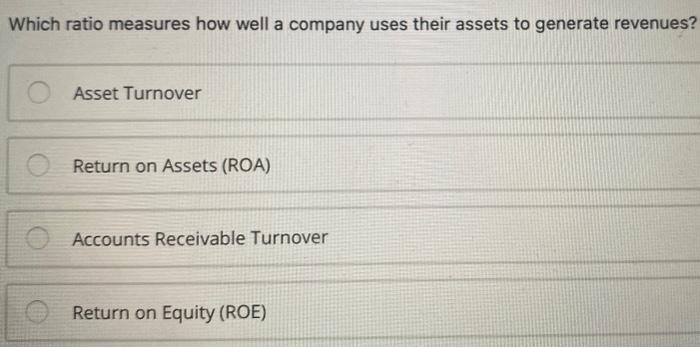

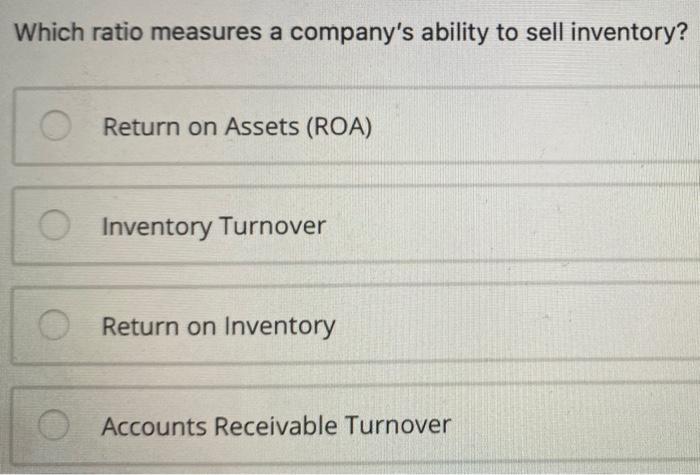

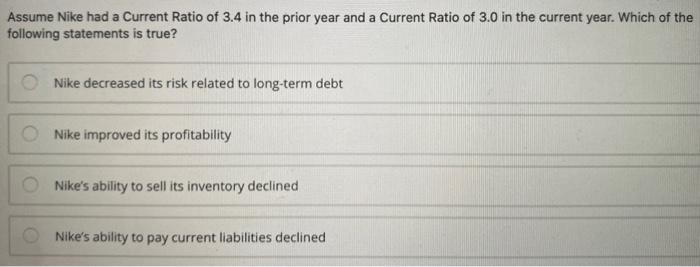

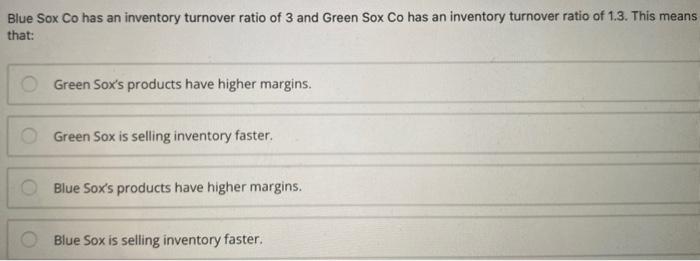

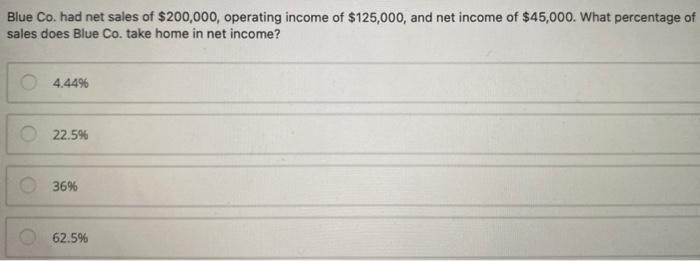

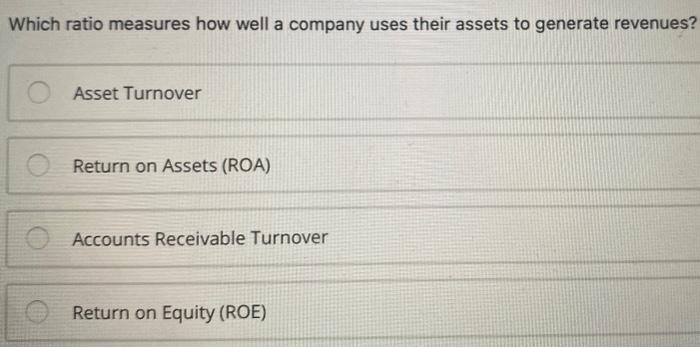

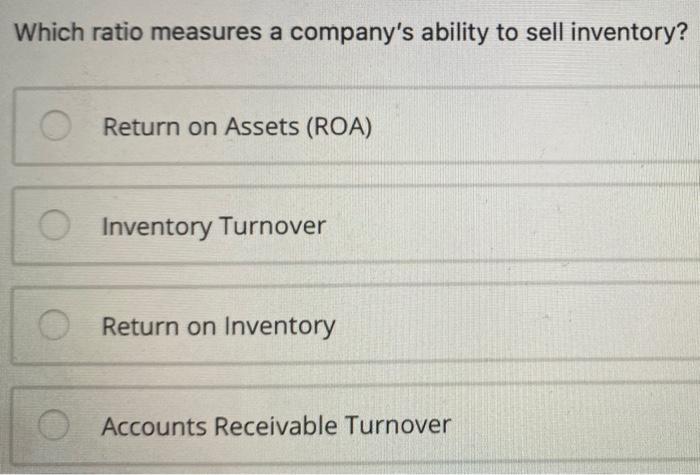

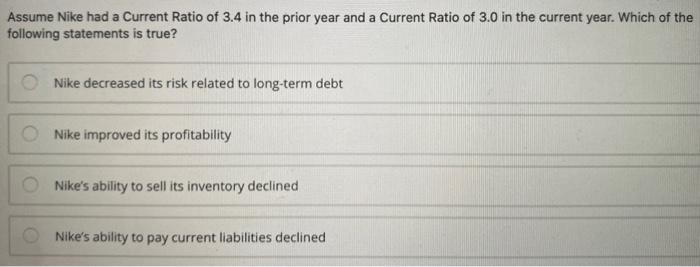

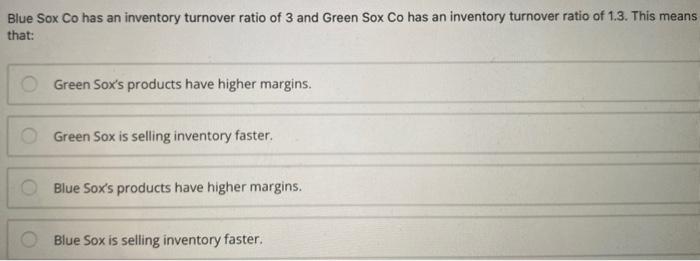

Blue Co. had net sales of $200,000, operating income of $125,000, and net income of $45,000. What percentage of sales does Blue Co. take home in net income? 4.449 22.5% 36% 62.5% Which ratio measures how well a company uses their assets to generate revenues? Asset Turnover Return on Assets (ROA) Accounts Receivable Turnover Return on Equity (ROE) Which ratio measures a company's ability to sell inventory? Return on Assets (ROA) Inventory Turnover Return on Inventory Accounts Receivable Turnover Assume Nike had a Current Ratio of 3.4 in the prior year and a Current Ratio of 3.0 in the current year. Which of the following statements is true? Nike decreased its risk related to long-term debt Nike improved its profitability Nike's ability to sell its inventory declined Nike's ability to pay current liabilities declined Blue Sox Co has an inventory turnover ratio of 3 and Green Sox Co has an inventory turnover ratio of 1.3. This means that: Green Sox's products have higher margins. Green Sox is selling inventory faster. Blue Sox's products have higher margins. Blue Sox is selling inventory faster 1 question with 5 parts :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started