Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with adjusting these numbers. thank you! Check your worksheet setup and formulas by changing the Original Cost to $100,000, the Estimated Residual Value

Please help with adjusting these numbers. thank you!

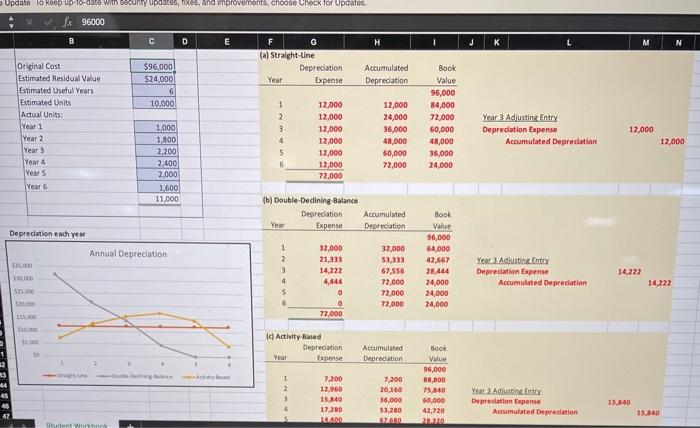

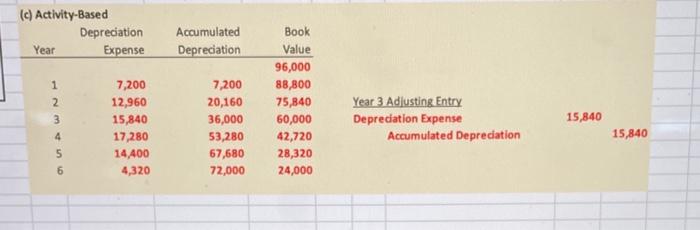

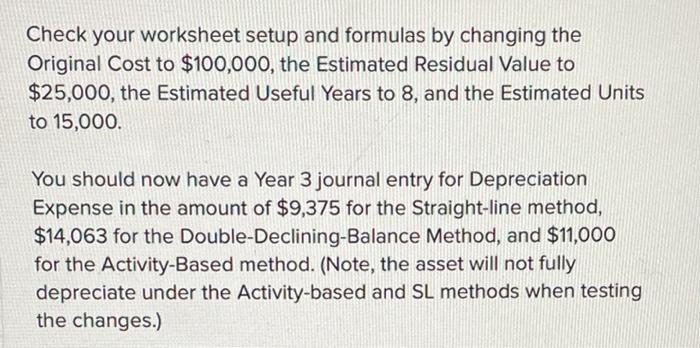

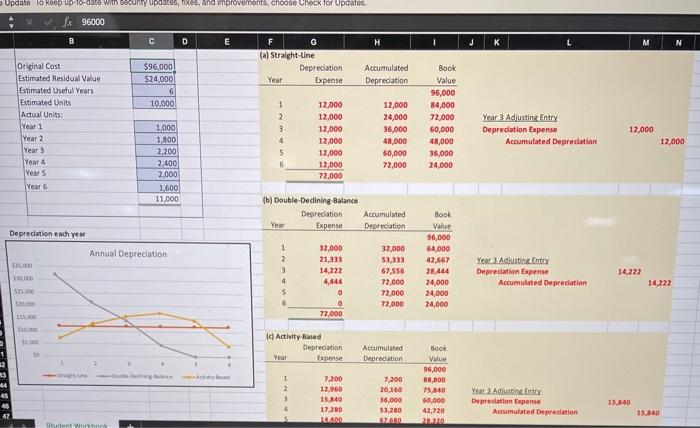

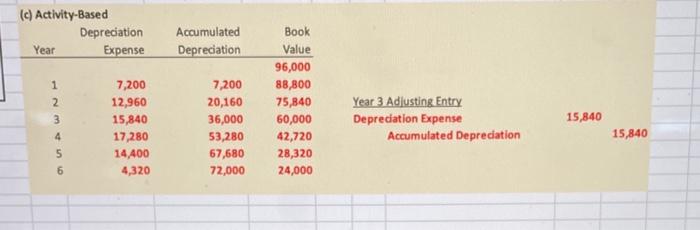

Check your worksheet setup and formulas by changing the Original Cost to $100,000, the Estimated Residual Value to $25,000, the Estimated Useful Years to 8, and the Estimated Units to 15,000. You should now have a Year 3 journal entry for Depreciation Expense in the amount of $9,375 for the Straight-line method, $14,063 for the Double-Declining-Balance Method, and $11,000 for the Activity-Based method. (Note, the asset will not fully depreciate under the Activity-based and SL methods when testing the changes.) M Book Value 12.000 96,000 84,000 72,000 60,000 43,000 36,000 24,000 Year 3 Adiusting Entry Depreciation Expense Accumulated Depreciation 12,000 Updato lo keep up-to-date with security updates, lixes, and improvements, choose Check for Updates. Xfx 96000 C D E F G H (a) Straight-Line Original Cost $96,000 Depreciation Accumulated Estimated Residual Value $24.000 Year Expense Depreciation Estimated Useful Years 6 Estimated Units 10.000 1 12,000 Actual Units 2 12,000 24,000 Year 1 1,000 3 12,000 36,000 Year 2 1,800 4 12,000 48.000 Year 3 2,200 5 12,000 60,000 Year 4 2.400 6 12,000 72,000 Years 2,000 72,000 Year 6 1,500 11,000 (b) Double-Dedining-Balance Depreciation Accumulated Year Expense Depreciation Depreciation each year 1 Annual Depreciation 32,000 37,000 2 21,333 53,33) 000 3 14.222 67,556 110.000 4 4.444 72,000 125.000 5 0 72,000 6 0 72.000 22.000 12,000 Book Value 96,000 54,000 42,567 28.444 24.000 24,000 24,000 Year 3 Adjusting Entry Depreciation Expense Accumulated Depreciation 14,222 14,222 Sino d) Activity Based Depreciation Year Book Accumulated Depreciation 1 12 3 Value 1 7,200 12.000 15,840 2 3 45 96,000 88.000 751840 60,000 42.720 7,200 20,160 36,000 53,200 17.00 Year 3 Adiustin Entry Deprecation Expense Accumulated Deprecation 15,840 17,280 47 15.00 Studer Wur (c) Activity-Based Depreciation Year Expense Accumulated Depreciation 1 2 3 4 S 6 7,200 12,960 15,840 17,280 14,400 4,320 15,840 Book Value 96,000 88,800 75,840 60,000 42,720 28,320 24,000 7,200 20,160 36,000 53,280 67,680 72,000 Year 3 Adlusting Entry Depreciation Expense Accumulated Depreciation 15,840

Check your worksheet setup and formulas by changing the Original Cost to $100,000, the Estimated Residual Value to $25,000, the Estimated Useful Years to 8, and the Estimated Units to 15,000. You should now have a Year 3 journal entry for Depreciation Expense in the amount of $9,375 for the Straight-line method, $14,063 for the Double-Declining-Balance Method, and $11,000 for the Activity-Based method. (Note, the asset will not fully depreciate under the Activity-based and SL methods when testing the changes.) M Book Value 12.000 96,000 84,000 72,000 60,000 43,000 36,000 24,000 Year 3 Adiusting Entry Depreciation Expense Accumulated Depreciation 12,000 Updato lo keep up-to-date with security updates, lixes, and improvements, choose Check for Updates. Xfx 96000 C D E F G H (a) Straight-Line Original Cost $96,000 Depreciation Accumulated Estimated Residual Value $24.000 Year Expense Depreciation Estimated Useful Years 6 Estimated Units 10.000 1 12,000 Actual Units 2 12,000 24,000 Year 1 1,000 3 12,000 36,000 Year 2 1,800 4 12,000 48.000 Year 3 2,200 5 12,000 60,000 Year 4 2.400 6 12,000 72,000 Years 2,000 72,000 Year 6 1,500 11,000 (b) Double-Dedining-Balance Depreciation Accumulated Year Expense Depreciation Depreciation each year 1 Annual Depreciation 32,000 37,000 2 21,333 53,33) 000 3 14.222 67,556 110.000 4 4.444 72,000 125.000 5 0 72,000 6 0 72.000 22.000 12,000 Book Value 96,000 54,000 42,567 28.444 24.000 24,000 24,000 Year 3 Adjusting Entry Depreciation Expense Accumulated Depreciation 14,222 14,222 Sino d) Activity Based Depreciation Year Book Accumulated Depreciation 1 12 3 Value 1 7,200 12.000 15,840 2 3 45 96,000 88.000 751840 60,000 42.720 7,200 20,160 36,000 53,200 17.00 Year 3 Adiustin Entry Deprecation Expense Accumulated Deprecation 15,840 17,280 47 15.00 Studer Wur (c) Activity-Based Depreciation Year Expense Accumulated Depreciation 1 2 3 4 S 6 7,200 12,960 15,840 17,280 14,400 4,320 15,840 Book Value 96,000 88,800 75,840 60,000 42,720 28,320 24,000 7,200 20,160 36,000 53,280 67,680 72,000 Year 3 Adlusting Entry Depreciation Expense Accumulated Depreciation 15,840

Please help with adjusting these numbers. thank you!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started