Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with all #4. Consignment Goods Are Described As: A. Reported in the Consignee's Books as Inventory. B. Goods shipped to the Consignor who

please help with all

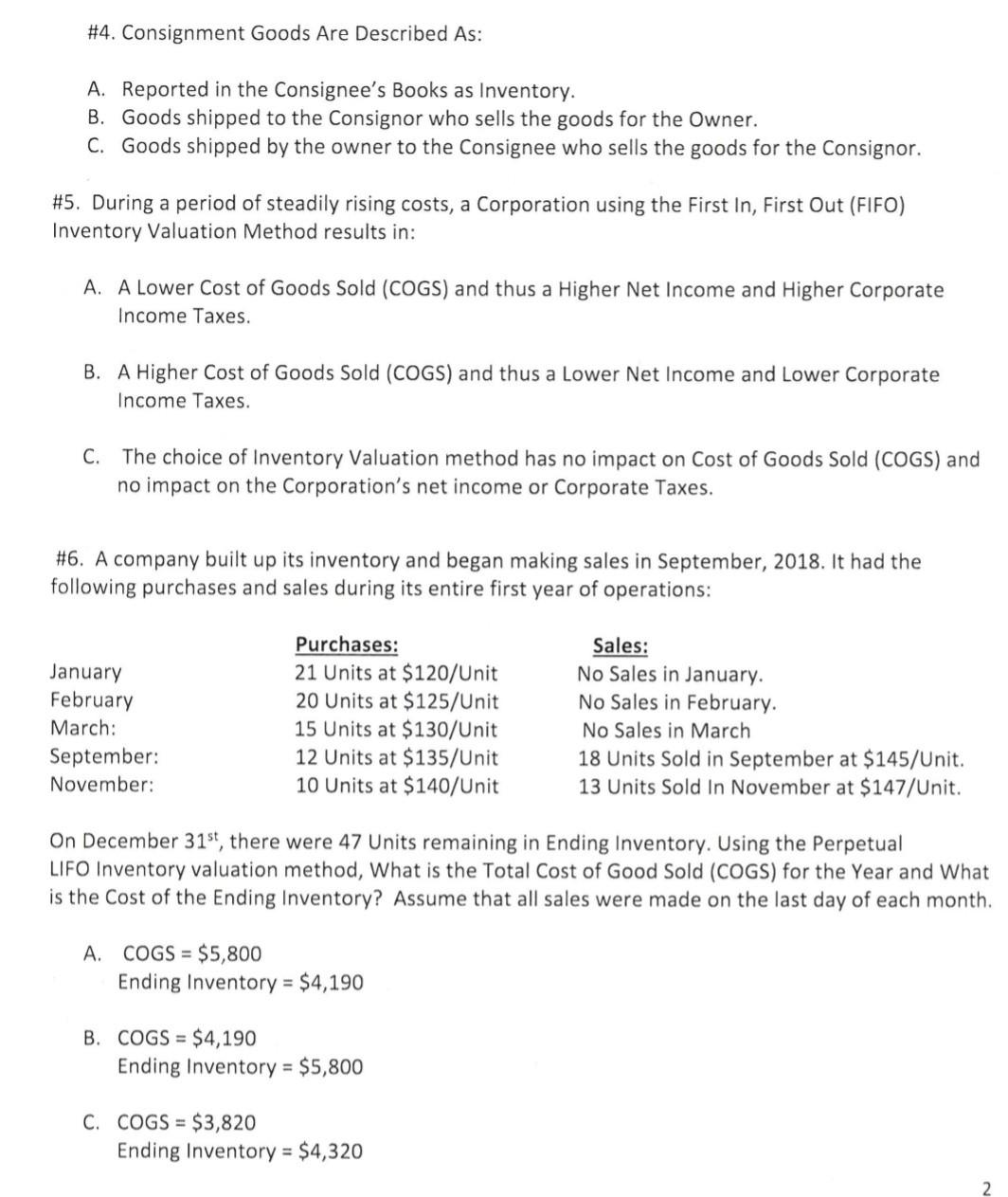

#4. Consignment Goods Are Described As: A. Reported in the Consignee's Books as Inventory. B. Goods shipped to the Consignor who sells the goods for the Owner. C. Goods shipped by the owner to the Consignee who sells the goods for the Consignor. #5. During a period of steadily rising costs, a Corporation using the First In, First Out (FIFO) Inventory Valuation Method results in: A. A Lower Cost of Goods Sold (COGS) and thus a Higher Net Income and Higher Corporate Income Taxes. B. A Higher Cost of Goods Sold (COGS) and thus a Lower Net Income and Lower Corporate Income Taxes. C. The choice of Inventory Valuation method has no impact on Cost of Goods Sold (COGS) and no impact on the Corporation's net income or Corporate Taxes. #6. A company built up its inventory and began making sales in September, 2018. It had the following purchases and sales during its entire first year of operations: January February March: September: November: Purchases: 21 Units at $120/Unit 20 Units at $125/Unit 15 Units at $130/Unit 12 Units at $135/Unit 10 Units at $140/Unit Sales: No Sales in January. No Sales in February No Sales in March 18 Units Sold in September at $145/Unit. 13 Units Sold In November at $147/Unit. On December 31st, there were 47 Units remaining in Ending Inventory. Using the Perpetual LIFO Inventory valuation method, What is the Total Cost of Good Sold (COGS) for the Year and What is the Cost of the Ending Inventory? Assume that all sales were made on the last day of each month. A. COGS = $5,800 Ending Inventory = $4,190 B. COGS = $4,190 Ending Inventory = $5,800 C. COGS = $3,820 Ending Inventory = $4,320Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started