Answered step by step

Verified Expert Solution

Question

1 Approved Answer

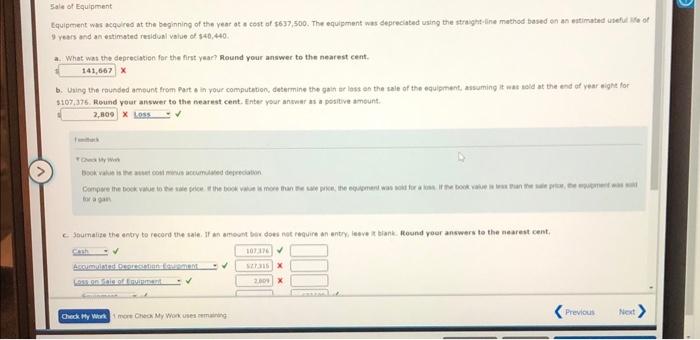

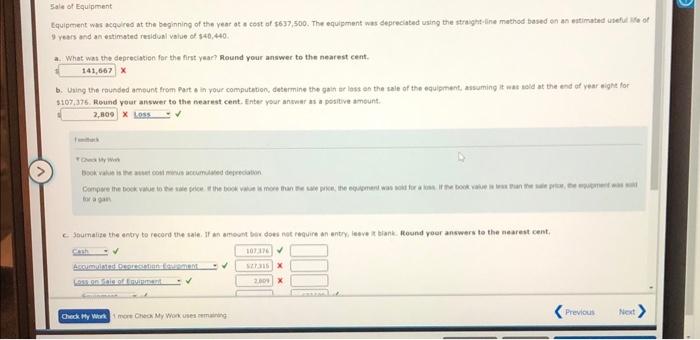

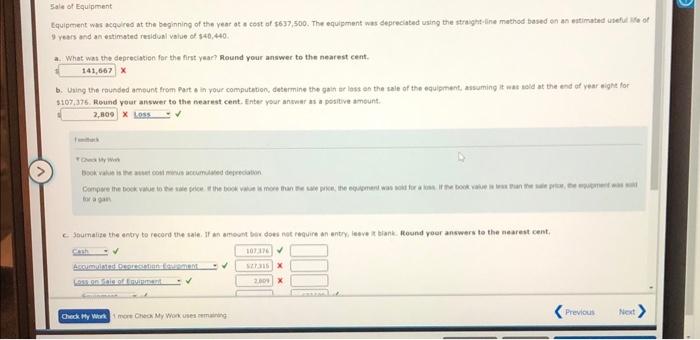

please help with all boxes marked wrong Cquipment was acquired at the beginning of the year at o cost of $637,500. The equipment was depreciated

please help with all boxes marked wrong

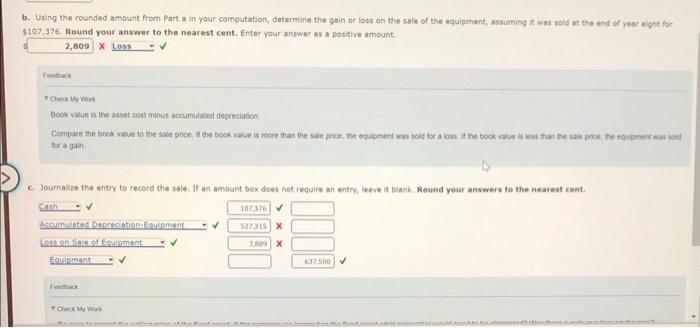

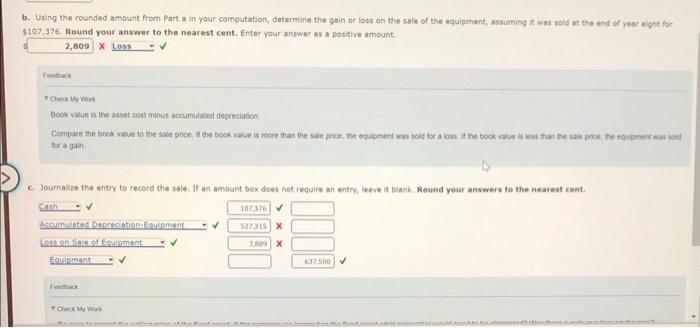

Cquipment was acquired at the beginning of the year at o cost of $637,500. The equipment was depreciated using the straght-line mathod based on an eationated uteful iGe of 9 vears and an estimated residual valie of 140,440 . a.- What was the deprecition for the first year? lound your answer to the nearest cent. x b. Uning the raunded ameung from Part a in your computabon, determine the gait ar loss on the sale of the eguigmant, assuming it was aeld at the end of year eight for S107iats. Round your answer to the nearest cent. Inter your anwem is a positive amount. x Fcona ity wh Book value is the acket coli meus accumiated degreciatoin thas a gan c. Sbumalize the entry to record the saie. If th ameunt ber does not require an entry, ieove it tiank. Round yoer answers to the searest cent. A mort Cheon My Won oses remainitich b. Using the rounded amount from fart a in your computation, determine the gain or loss on the sale of the equipmant, assuming it was sold at the and of ,esr a ghe for 4107,376. Round your answer to the nearest cent. Enter your answer as a positive amount: * checs Ary Was Book value is the atset cost minus acoumulabed depreciation for a gain

Cquipment was acquired at the beginning of the year at o cost of $637,500. The equipment was depreciated using the straght-line mathod based on an eationated uteful iGe of 9 vears and an estimated residual valie of 140,440 . a.- What was the deprecition for the first year? lound your answer to the nearest cent. x b. Uning the raunded ameung from Part a in your computabon, determine the gait ar loss on the sale of the eguigmant, assuming it was aeld at the end of year eight for S107iats. Round your answer to the nearest cent. Inter your anwem is a positive amount. x Fcona ity wh Book value is the acket coli meus accumiated degreciatoin thas a gan c. Sbumalize the entry to record the saie. If th ameunt ber does not require an entry, ieove it tiank. Round yoer answers to the searest cent. A mort Cheon My Won oses remainitich b. Using the rounded amount from fart a in your computation, determine the gain or loss on the sale of the equipmant, assuming it was sold at the and of ,esr a ghe for 4107,376. Round your answer to the nearest cent. Enter your answer as a positive amount: * checs Ary Was Book value is the atset cost minus acoumulabed depreciation for a gain

please help with all boxes marked wrong

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started