Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with all parts , thank you(: will give thumbs up!! 1-(3) Explain your calculation logic and show the following table: Explain: Upfront Payment

please help with all parts , thank you(: will give thumbs up!!

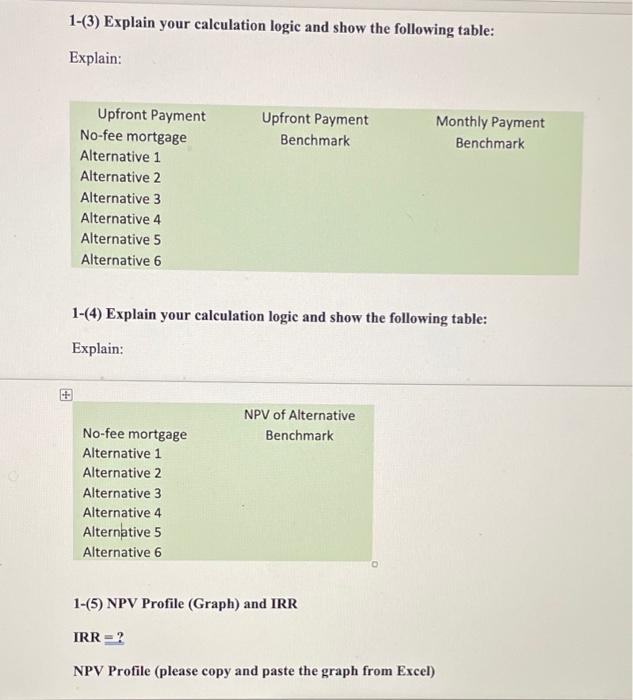

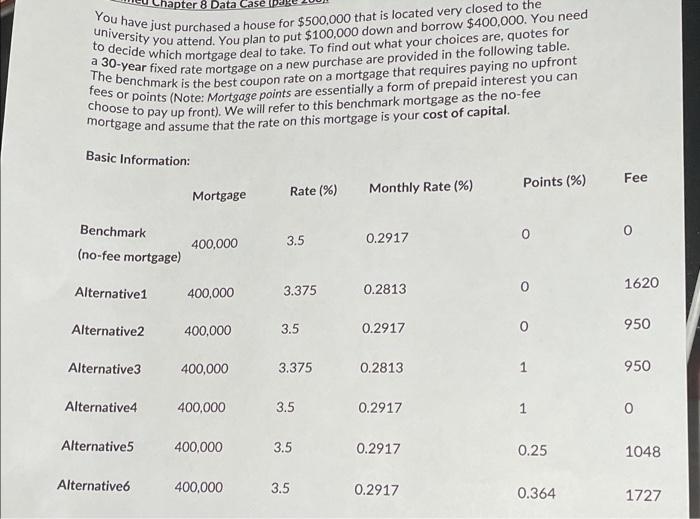

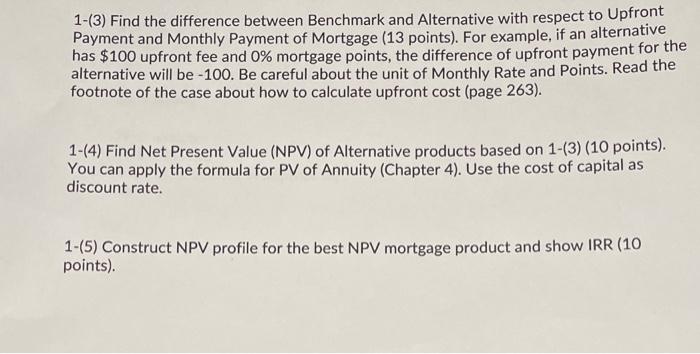

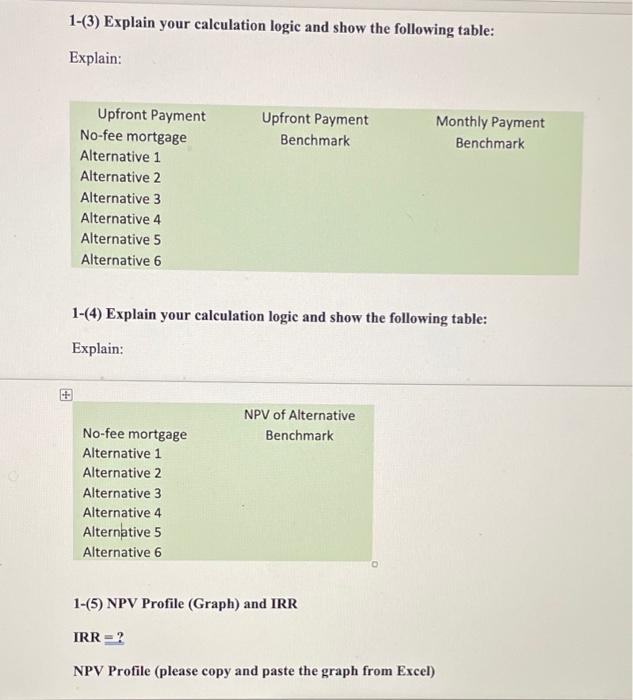

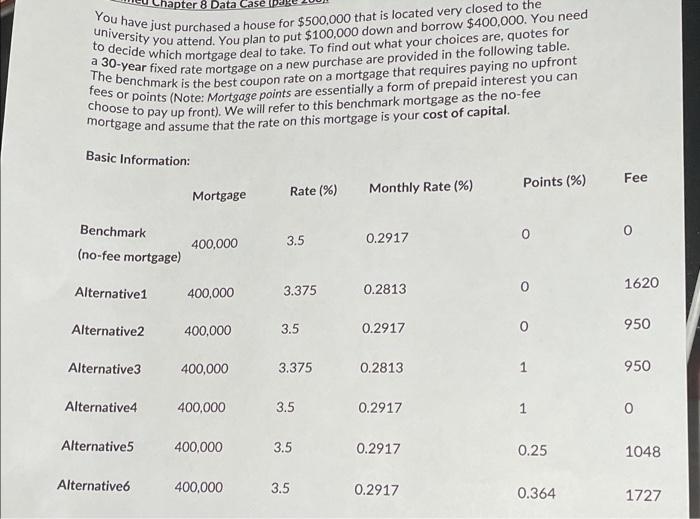

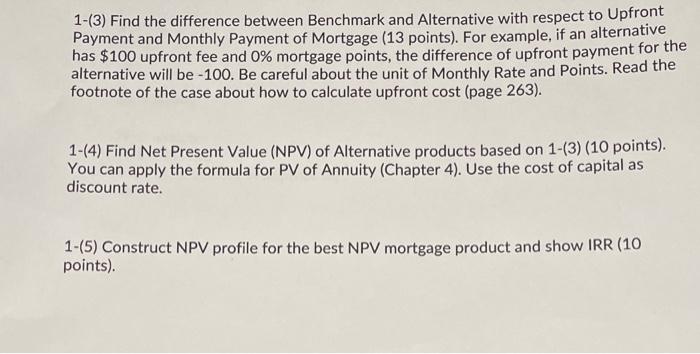

1-(3) Explain your calculation logic and show the following table: Explain: Upfront Payment Benchmark Monthly Payment Benchmark Upfront Payment No-fee mortgage Alternative 1 Alternative 2 Alternative 3 Alternative 4 Alternative 5 Alternative 6 1-(4) Explain your calculation logic and show the following table: Explain: NPV of Alternative Benchmark No-fee mortgage Alternative 1 Alternative 2 Alternative 3 Alternative 4 Alternative 5 Alternative 6 1-(5) NPV Profile (Graph) and IRR IRR = ? NPV Profile (please copy and paste the graph from Excel) hapter 8 Data Case You have just purchased a house for $500,000 that is located very closed to the to decide which mortgage deal to take. To find out what your choices are, quotes for university you attend. You plan to put $100.000 down and borrow $400,000. You need a 30-year fixed rate mortgage on a new purchase are provided in the following table. fees or points (Note: Mortgage points are essentially a form of prepaid interest you can The benchmark is the best coupon rate on a mortgage that requires paying no upfront choose to pay up front). We will refer to this benchmark mortgage as the no-fee mortgage and assume that the rate on this mortgage is your cost of capital. Basic Information: Fee Points (%) Mortgage Rate(%) Monthly Rate (%) 0 Benchmark (no-fee mortgage) 400,000 3.5 0.2917 Alternative1 400,000 3.375 1620 0.2813 Alternative2 400,000 3.5 0.2917 950 Alternative3 400,000 3.375 0.2813 1 950 Alternative4 400,000 3.5 0.2917 1 0 Alternative 400.000 3.5 0.2917 0.25 1048 Alternative 400,000 3.5 0.2917 0.364 1727 1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of Mortgage (13 points). For example, if an alternative has $100 upfront fee and 0% mortgage points, the difference of upfront payment for the alternative will be -100. Be careful about the unit of Monthly Rate and points. Read the footnote of the case about how to calculate upfront cost (page 263). 1-(4) Find Net Present Value (NPV) of Alternative products based on 1-(3) (10 points). You can apply the formula for PV of Annuity (Chapter 4). Use the cost of capital as discount rate. 1-(5) Construct NPV profile for the best NPV mortgage product and show IRR (10 points). 1-(3) Explain your calculation logic and show the following table: Explain: Upfront Payment Benchmark Monthly Payment Benchmark Upfront Payment No-fee mortgage Alternative 1 Alternative 2 Alternative 3 Alternative 4 Alternative 5 Alternative 6 1-(4) Explain your calculation logic and show the following table: Explain: NPV of Alternative Benchmark No-fee mortgage Alternative 1 Alternative 2 Alternative 3 Alternative 4 Alternative 5 Alternative 6 1-(5) NPV Profile (Graph) and IRR IRR = ? NPV Profile (please copy and paste the graph from Excel) hapter 8 Data Case You have just purchased a house for $500,000 that is located very closed to the to decide which mortgage deal to take. To find out what your choices are, quotes for university you attend. You plan to put $100.000 down and borrow $400,000. You need a 30-year fixed rate mortgage on a new purchase are provided in the following table. fees or points (Note: Mortgage points are essentially a form of prepaid interest you can The benchmark is the best coupon rate on a mortgage that requires paying no upfront choose to pay up front). We will refer to this benchmark mortgage as the no-fee mortgage and assume that the rate on this mortgage is your cost of capital. Basic Information: Fee Points (%) Mortgage Rate(%) Monthly Rate (%) 0 Benchmark (no-fee mortgage) 400,000 3.5 0.2917 Alternative1 400,000 3.375 1620 0.2813 Alternative2 400,000 3.5 0.2917 950 Alternative3 400,000 3.375 0.2813 1 950 Alternative4 400,000 3.5 0.2917 1 0 Alternative 400.000 3.5 0.2917 0.25 1048 Alternative 400,000 3.5 0.2917 0.364 1727 1-(3) Find the difference between Benchmark and Alternative with respect to Upfront Payment and Monthly Payment of Mortgage (13 points). For example, if an alternative has $100 upfront fee and 0% mortgage points, the difference of upfront payment for the alternative will be -100. Be careful about the unit of Monthly Rate and points. Read the footnote of the case about how to calculate upfront cost (page 263). 1-(4) Find Net Present Value (NPV) of Alternative products based on 1-(3) (10 points). You can apply the formula for PV of Annuity (Chapter 4). Use the cost of capital as discount rate. 1-(5) Construct NPV profile for the best NPV mortgage product and show IRR (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started