Answered step by step

Verified Expert Solution

Question

1 Approved Answer

********Produce a 1040 & Schedule 1****** CORRECTED (if checked) Form 1099-R wwe.h gowform 1099R 2B. Carl Conch and Mary Duval are married and file a

********Produce a 1040 & Schedule 1******

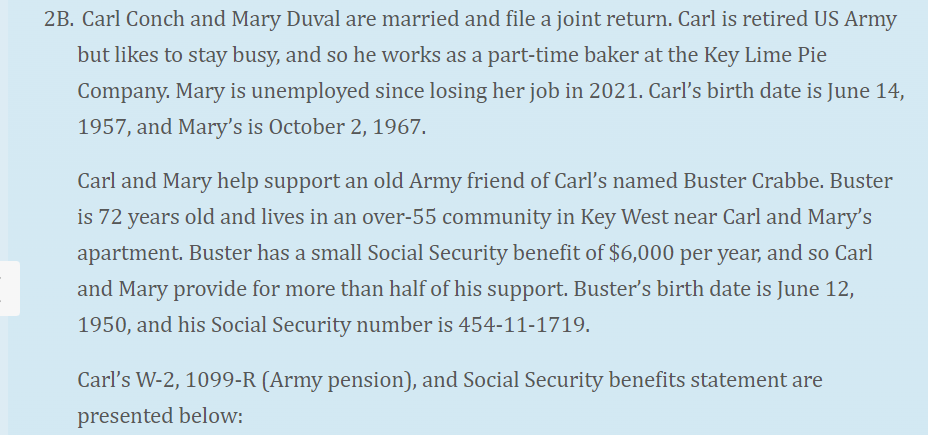

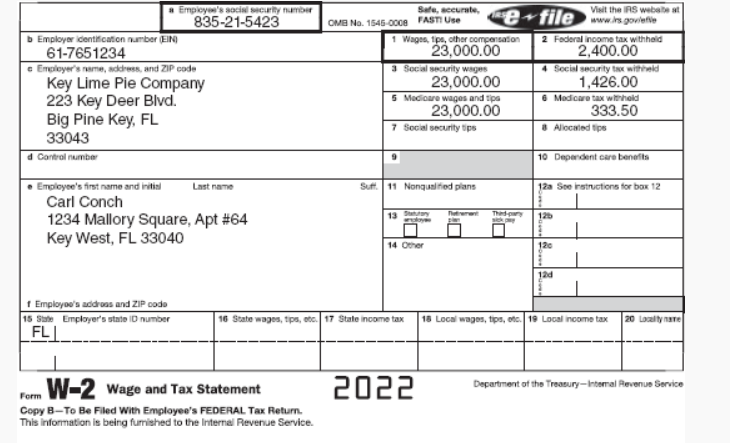

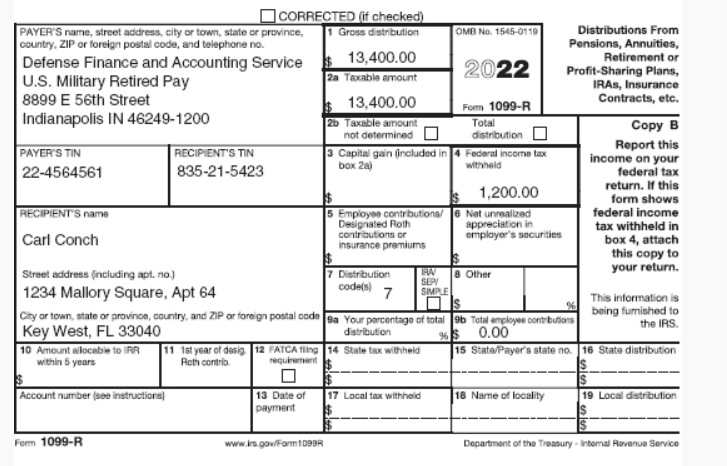

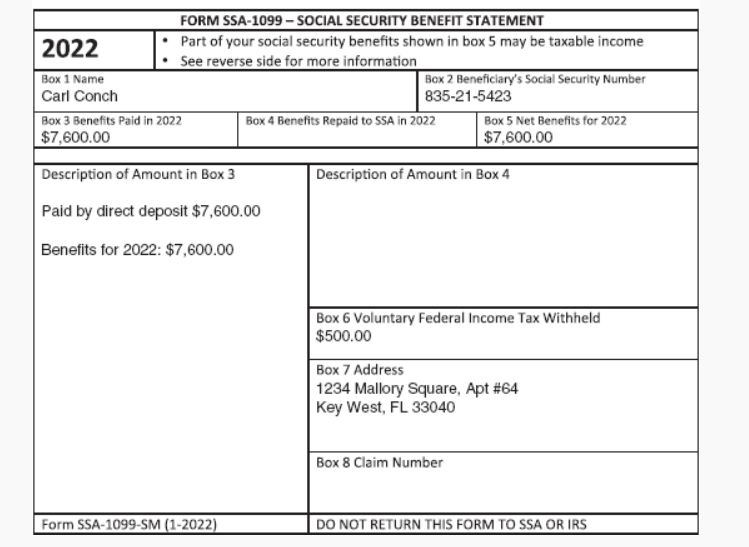

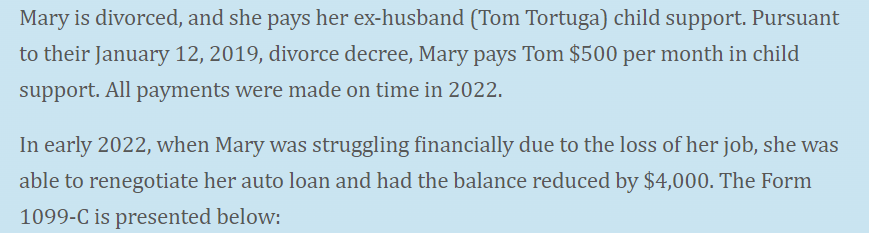

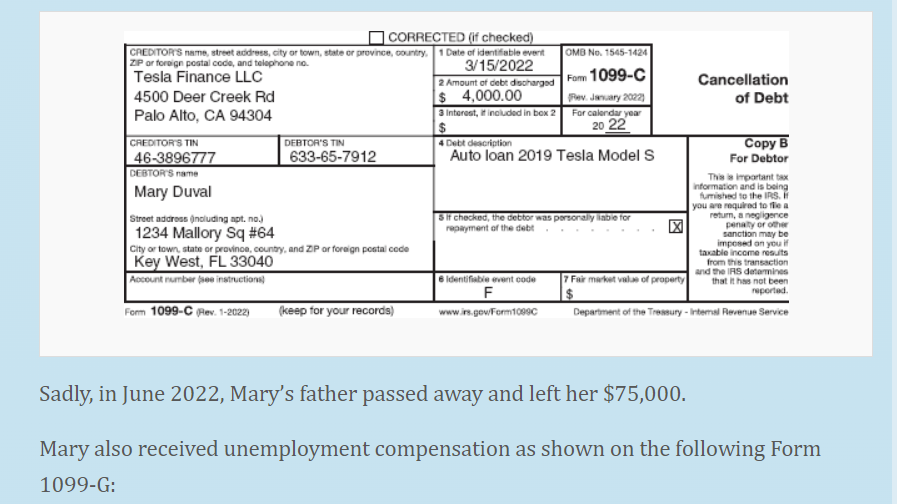

CORRECTED (if checked) Form 1099-R wwe.h gowform 1099R 2B. Carl Conch and Mary Duval are married and file a joint return. Carl is retired US Army but likes to stay busy, and so he works as a part-time baker at the Key Lime Pie Company. Mary is unemployed since losing her job in 2021. Carl's birth date is June 14, 1957, and Mary's is October 2, 1967. Carl and Mary help support an old Army friend of Carl's named Buster Crabbe. Buster is 72 years old and lives in an over-55 community in Key West near Carl and Mary's apartment. Buster has a small Social Security benefit of $6,000 per year, and so Carl and Mary provide for more than half of his support. Buster's birth date is June 12, 1950, and his Social Security number is 454-11-1719. Carl's W-2, 1099-R (Army pension), and Social Security benefits statement are presented below: Sadly, in June 2022, Mary's father passed away and left her $75,000. Mary also received unemployment compensation as shown on the following Form 1099-G: Mary is divorced, and she pays her ex-husband (Tom Tortuga) child support. Pursuant to their January 12,2019 , divorce decree, Mary pays Tom $500 per month in child support. All payments were made on time in 2022. In early 2022, when Mary was struggling financially due to the loss of her job, she was able to renegotiate her auto loan and had the balance reduced by $4,000. The Form 1099-C is presented below: The Key Lime Pie Company provides all employees with a gym on the premises of the pie factory that Carl works at. Carl uses the gym at least three days a week. The value of a similar gym membership would be $1,200. Required: Complete Carl and Mary's federal tax return for 2022 on Form 1040 and Schedule 1. \begin{tabular}{|c|c|c|c|c|c|c|} \hline & & \\ \hline \multicolumn{3}{|c|}{bEmployeridentifoationnumber(Elive)617651234} & & \multicolumn{2}{|c|}{2Fodoralinoometaxwethiheid2,400.00} \\ \hline \multirow{3}{*}{\multicolumn{3}{|c|}{"Eneloyersname,sddess,andZiPcodeKeyLimePieCompany223KeyDeerBlvd.BigPineKey,FL33043}} & \multicolumn{2}{|c|}{Socialsecaritywegens23,000.00} & \multicolumn{2}{|c|}{4Socialsecantytaxwifhemid1,426.00} \\ \hline & & & \multicolumn{2}{|c|}{Meclourowagesandtipe23,000.00} & \multicolumn{2}{|c|}{6Modourotaxwhithoild333.50} \\ \hline & & & \multicolumn{2}{|c|}{7 Social seccurity tips } & \multicolumn{2}{|l|}{ a Alocaried tips } \\ \hline \multicolumn{3}{|c|}{ d Conferal number } & \multicolumn{2}{|l|}{9} & \multicolumn{2}{|c|}{10 Deperdent cars benefits } \\ \hline \multirow{4}{*}{\multicolumn{2}{|c|}{-EnoloysesfirstnameandintislLastnameCarlConch1234MallorySquare,Apt#64KeyWest,FL33040}} & \multirow[t]{4}{*}{ Sut. } & \multicolumn{2}{|c|}{11 Nonquesitiod plans } & \multicolumn{2}{|c|}{ fos Soo irsinuctions for bax 12} \\ \hline & & & & \multicolumn{2}{|l|}{1201} \\ \hline & & & \multirow{3}{*}{\multicolumn{2}{|c|}{14 Oover }} & \multicolumn{2}{|l|}{lim20} \\ \hline & & & & & \multicolumn{2}{|l|}{\begin{tabular}{|l|} 22d \\ 32d \\ \end{tabular}} \\ \hline \multicolumn{5}{|c|}{ I Employow's addroas and ZIP codo } & & \\ \hline \multirow[t]{2}{*}{15stsFL} & 16 State wages, tipa, otce. & \multicolumn{2}{|c|}{17 State invome tax } & 18 Locas wages, tips, obe. & 19 Local neomo tax & 20 Laaltynare \\ \hline & & & & & & \\ \hline \end{tabular} Required: Complete Carl and Mary's federal tax return for 2022 on Form 1040 and Schedule 1. CORRECTED (if checked) Form 1099-R wwe.h gowform 1099R 2B. Carl Conch and Mary Duval are married and file a joint return. Carl is retired US Army but likes to stay busy, and so he works as a part-time baker at the Key Lime Pie Company. Mary is unemployed since losing her job in 2021. Carl's birth date is June 14, 1957, and Mary's is October 2, 1967. Carl and Mary help support an old Army friend of Carl's named Buster Crabbe. Buster is 72 years old and lives in an over-55 community in Key West near Carl and Mary's apartment. Buster has a small Social Security benefit of $6,000 per year, and so Carl and Mary provide for more than half of his support. Buster's birth date is June 12, 1950, and his Social Security number is 454-11-1719. Carl's W-2, 1099-R (Army pension), and Social Security benefits statement are presented below: Sadly, in June 2022, Mary's father passed away and left her $75,000. Mary also received unemployment compensation as shown on the following Form 1099-G: Mary is divorced, and she pays her ex-husband (Tom Tortuga) child support. Pursuant to their January 12,2019 , divorce decree, Mary pays Tom $500 per month in child support. All payments were made on time in 2022. In early 2022, when Mary was struggling financially due to the loss of her job, she was able to renegotiate her auto loan and had the balance reduced by $4,000. The Form 1099-C is presented below: The Key Lime Pie Company provides all employees with a gym on the premises of the pie factory that Carl works at. Carl uses the gym at least three days a week. The value of a similar gym membership would be $1,200. Required: Complete Carl and Mary's federal tax return for 2022 on Form 1040 and Schedule 1. \begin{tabular}{|c|c|c|c|c|c|c|} \hline & & \\ \hline \multicolumn{3}{|c|}{bEmployeridentifoationnumber(Elive)617651234} & & \multicolumn{2}{|c|}{2Fodoralinoometaxwethiheid2,400.00} \\ \hline \multirow{3}{*}{\multicolumn{3}{|c|}{"Eneloyersname,sddess,andZiPcodeKeyLimePieCompany223KeyDeerBlvd.BigPineKey,FL33043}} & \multicolumn{2}{|c|}{Socialsecaritywegens23,000.00} & \multicolumn{2}{|c|}{4Socialsecantytaxwifhemid1,426.00} \\ \hline & & & \multicolumn{2}{|c|}{Meclourowagesandtipe23,000.00} & \multicolumn{2}{|c|}{6Modourotaxwhithoild333.50} \\ \hline & & & \multicolumn{2}{|c|}{7 Social seccurity tips } & \multicolumn{2}{|l|}{ a Alocaried tips } \\ \hline \multicolumn{3}{|c|}{ d Conferal number } & \multicolumn{2}{|l|}{9} & \multicolumn{2}{|c|}{10 Deperdent cars benefits } \\ \hline \multirow{4}{*}{\multicolumn{2}{|c|}{-EnoloysesfirstnameandintislLastnameCarlConch1234MallorySquare,Apt#64KeyWest,FL33040}} & \multirow[t]{4}{*}{ Sut. } & \multicolumn{2}{|c|}{11 Nonquesitiod plans } & \multicolumn{2}{|c|}{ fos Soo irsinuctions for bax 12} \\ \hline & & & & \multicolumn{2}{|l|}{1201} \\ \hline & & & \multirow{3}{*}{\multicolumn{2}{|c|}{14 Oover }} & \multicolumn{2}{|l|}{lim20} \\ \hline & & & & & \multicolumn{2}{|l|}{\begin{tabular}{|l|} 22d \\ 32d \\ \end{tabular}} \\ \hline \multicolumn{5}{|c|}{ I Employow's addroas and ZIP codo } & & \\ \hline \multirow[t]{2}{*}{15stsFL} & 16 State wages, tipa, otce. & \multicolumn{2}{|c|}{17 State invome tax } & 18 Locas wages, tips, obe. & 19 Local neomo tax & 20 Laaltynare \\ \hline & & & & & & \\ \hline \end{tabular} Required: Complete Carl and Mary's federal tax return for 2022 on Form 1040 and Schedule 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started