Answered step by step

Verified Expert Solution

Question

1 Approved Answer

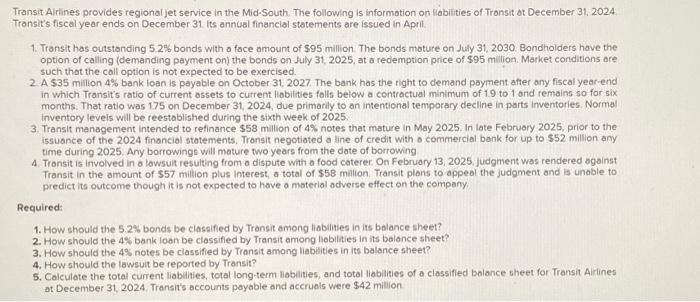

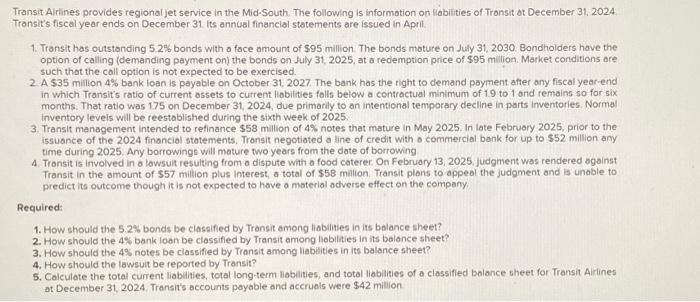

please help with all parts Transit Alrlines provides regional jet service in the Mid-South. The following is information on liabilities of Tronsit at December 31

please help with all parts

Transit Alrlines provides regional jet service in the Mid-South. The following is information on liabilities of Tronsit at December 31 , 2024 Tronsit's fiscal year ends on December 31 its annual financial statements are issued in April. 1. Transit has outstanding 52% bonds with o face amount of $95 million. The bonds moture on July 31,2030 . Bondholders have the option of calling (demanding payment on) the bonds on July. 31.2025, at a redemption price of $95million. Market conditions are such that the call option is not expected to be exercised. 2. A 535 milion 4% bank loan is payable on October 31,2027 . The bank has the right to demand payment after any fiscal year-end in which Transit's ratio of current assets to current liobilities falls below a controctual minimum of 1.9 to 1 and remains so for six months. That ratio was 1.75 on December 31,2024 , due primarily to an intentional temporary decline in parts inventories. Norma. inventory levels will be reestablished during the sixth week of 2025 . 3. Transit management intended to refinance $58 milion of 4% notes that mature in May 2025 . In late February 2025 , prior to the issuance of the 2024 financiol statements. Tronsit negotiated a line of credit with o commercial bank for up to $52 million any time during 2025. Any borrowings will mature two years from the date of borrowing 4. Transit is involved in o lowsult resulting from o dispute with a food caterer. On Februory 13, 2025. Judgment was rendered against Transit in the amount of $57 miltion plus interest, a total of $58 malion. Transit plans to appeal the judgment and is unable to predict its outcome though it is not expected to have a material odverse effect on the company, Required: 1. How should the 5.2% bonds be classified by Transit among liabilities in its balance sheet? 2. How should the 4% bank loan be classifled by Transit among labilities in its balance sheet? 3. How should the 4% notes be classified by Transit among liabilities in its balance sheet? 4. How should the lawsuit be reported by Transit? 5. Calculate the total current liabilities, total Iong-term liabilies, and total liabilities of a classified balance sheet for Transit Airlines at December 31,2024 . Transit's accounts payable and accruals were $42 million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started