Please help with all questions

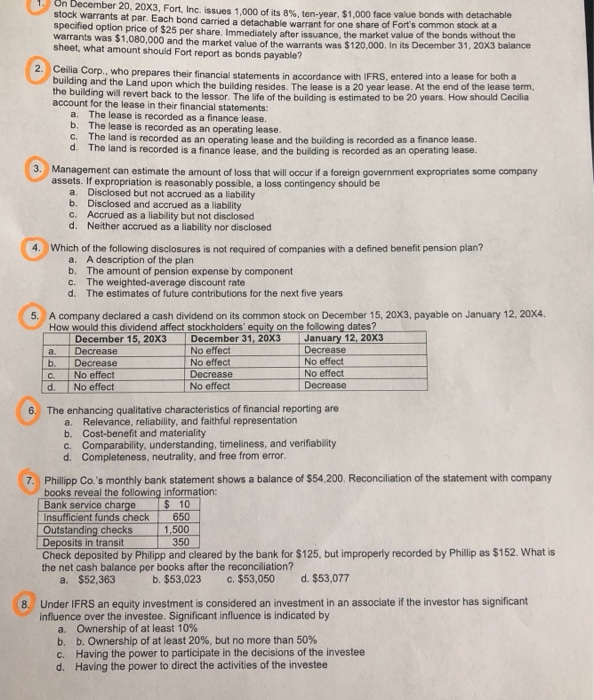

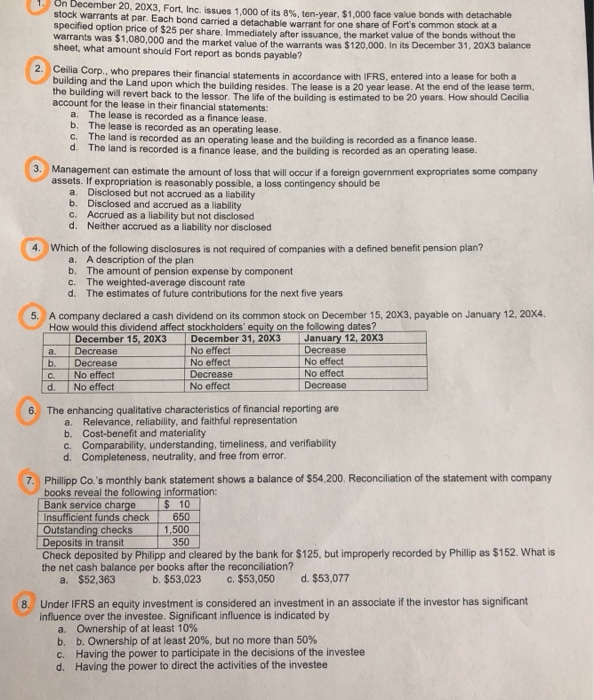

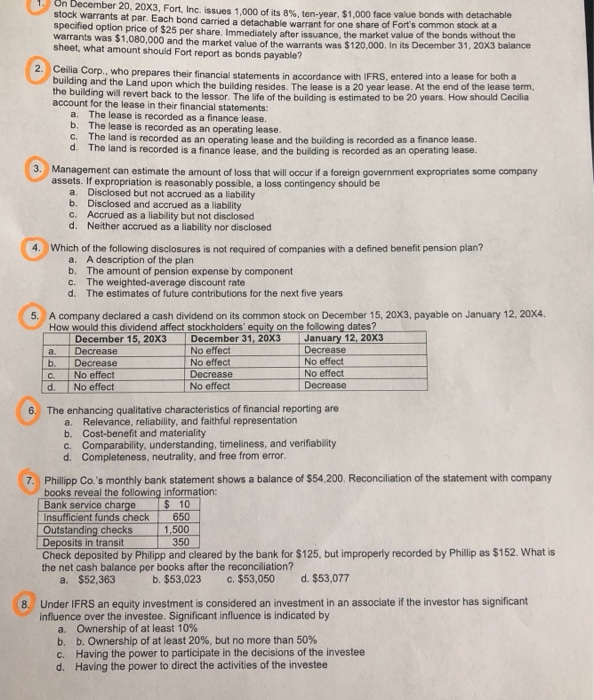

1./. December 20, 20X3. Fort. Inc. issues 1,000 of its 8%, ten-year, $1,000 face value bonds with On stock warrants at par. Each bond carried a detachable warrant for one share of Fort's common specified option price of $25 per share. Immediately after issuance, t warrants was $1,080,000 and the market value of the warrants was $120,000. In its sheet, what amount should Fort report as bonds payable? stock at a the market value of the bonds without the December 31, 20x3 balance 0 2. Ceilia Corp., who prepares their financial statements in accordance with IFRS, entered into a lease for both a building and the Land upon which the building will revert account for the lease in their financial statements: the building resides. The lease is a 20 year lease. At the end of the lease term, back to the lessor. The life of the building is estimated to be 20 years. How should Cecilia The lease is recorded as a finance lease. The lease is recorded as an operating lease. The land is recorded as an operating lease and the building is recorded as a finance lease. The land is recorded is a finance lease, and the building is recorded as an operating lease. a. b. c. d. 3. Management can estimate the amount of loss that will occur if a foreign government expropriates some company assets. If expropriation is reasonably possible, a loss contingency should be a. Disclosed but not accrued as a liability b. Disclosed and accrued as a liability c. Accrued as a liability but not disclosed d. Neither accrued as a liability nor disclosed 4. Which of the following disclosures is not required of companies with a defined benefit pension plan? a. b. c. d. A description of the plan The amount of pension expense by component The weighted-average discount rate The estimates of future contributions for the next five years 5. A company declared a cash dividend on its common stock on December 15, 20X3, payable on January 12, 20X4. How would this dividend affect stockholders' equity on the following dates? December 15, 20X3 December 31, 20x3 January 12, 20x3 No effect No effect Decrease No effect b. Decrease C. | No effect d. No effect No effect No effect 0 6. The enhancing qualitative characteristics of financial reporting are a. Relevance, reliability, and faithful representation b. Cost-benefit and materiality c. Comparability, understanding, timeliness, and verifiability d. Completeness, neutrality, and free from error 0 7, Philip Co.'s monthly bank statement shows a balance of $54,200. Reconciliation of the statement with company books reveal the following information: Bank service charge Insufficient funds check650 Outstanding checks 10 its in transit 350 Check deposited by Philipp and cleared by the bank for $125, but improperly recorded by Phillip as $152. What is the net cash balance per books after the reconciliation? a. $52,363 b, $53,023 C. $53,050 d.$53,077 Under IFRS an equity investment is considered an investment in an associate if the investor has significant influence over the investee. Significant influence is indicated by a. Ownership of at least 10% b. b. Ownership of at least 20%, but no more than 50% c. Having the power to participate in the decisions of the investee d. Having the power to direct the activities of the investee