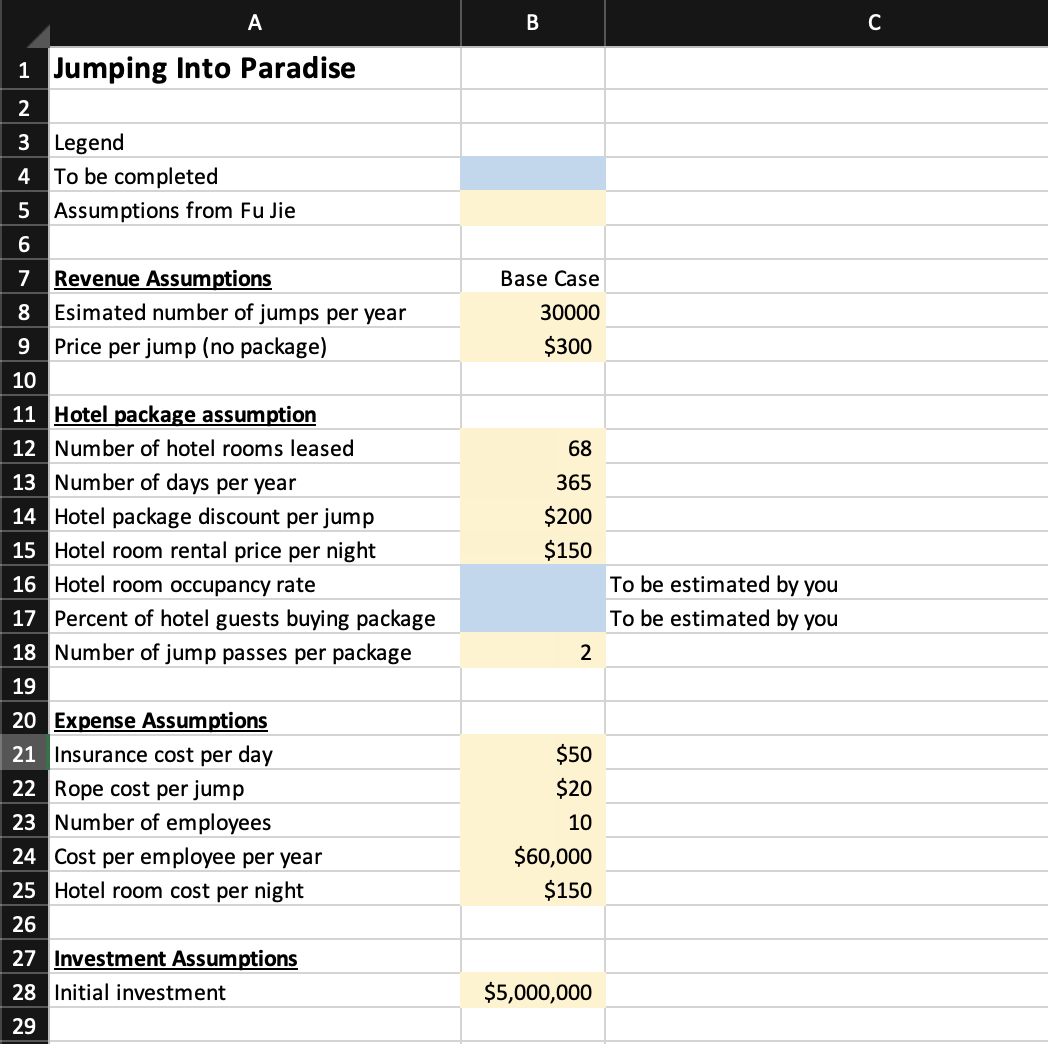

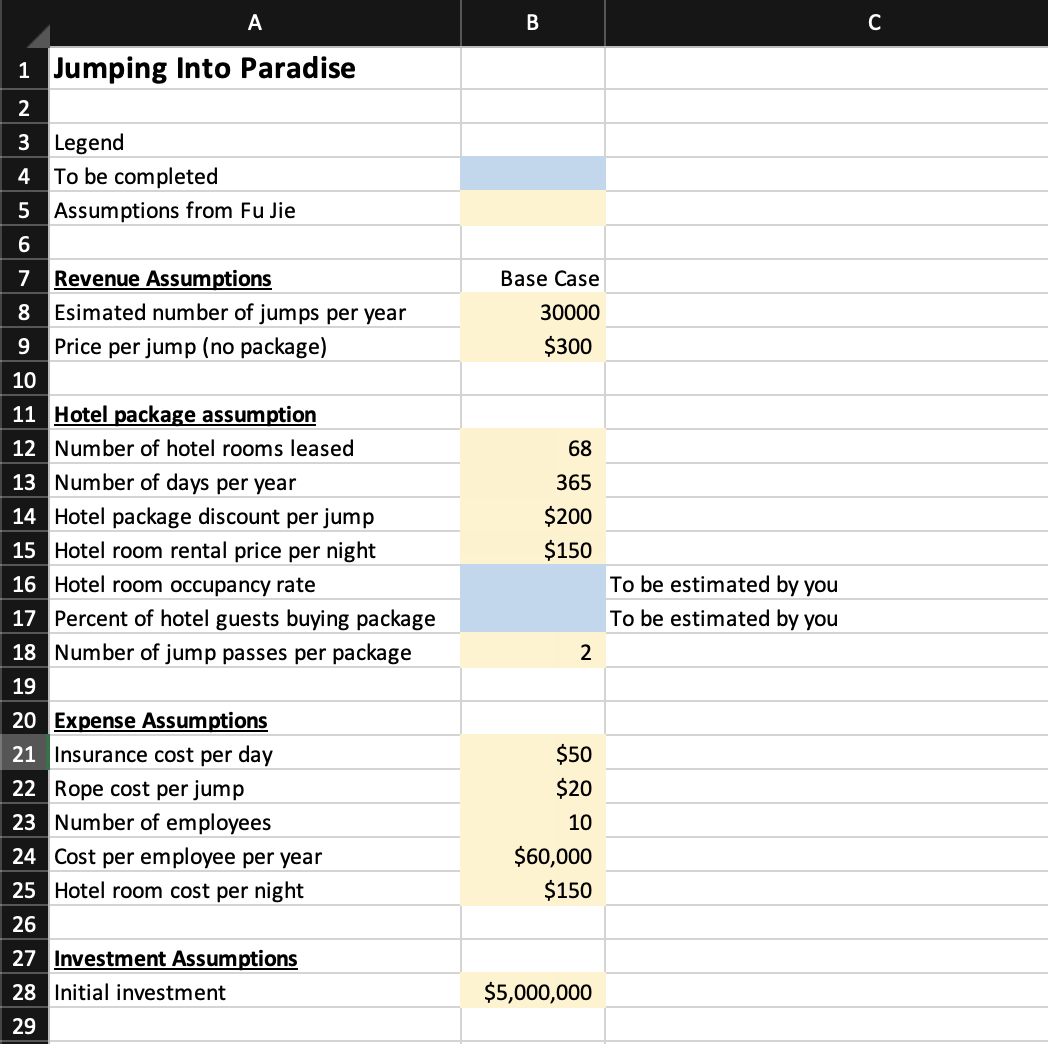

Please, help with all the blue fields. The data is in the second picture provided below. Thank you!

- Hotel room occupancy rate

- Percent of hotel guests buying package

- Number of hotel rooms sold

- Number of jumps qualifying for discount

- Bungee Jumping Revenue

- Less: Hotel package discount

- Total Bungee Jumping Revenue

- Hotel room rental revenue

- Total revenues

- Labor costs

- Rope costs

- Insurance cost

- Hotel lease cost

- Total cash expenses

- Pre-tax cash flows

- Year one ROI in US$

- Initial Investment in RMB

- Estimated future exchange rate

- Pre-tax cash flows in RMB

- Year one ROI in RMB

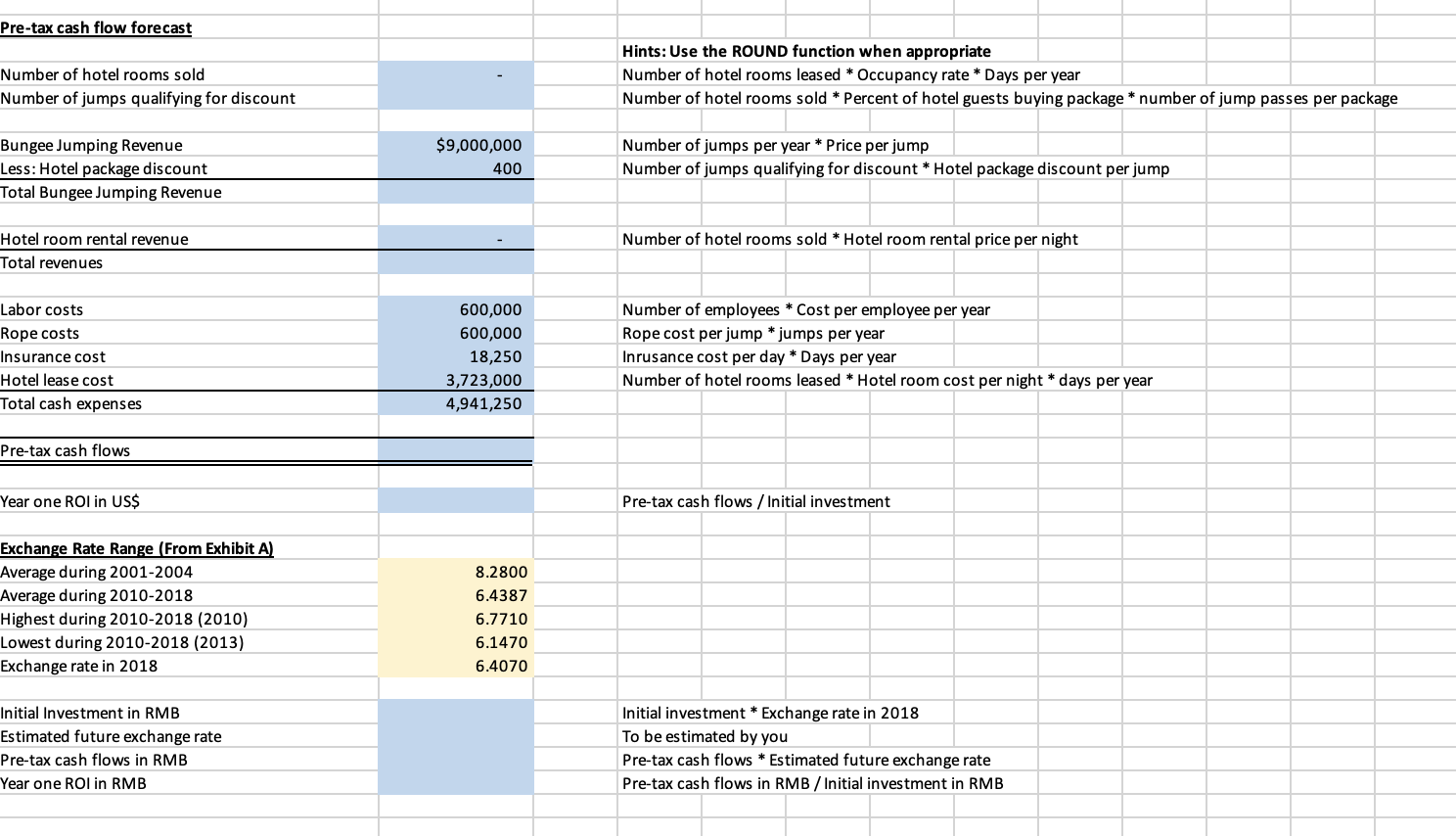

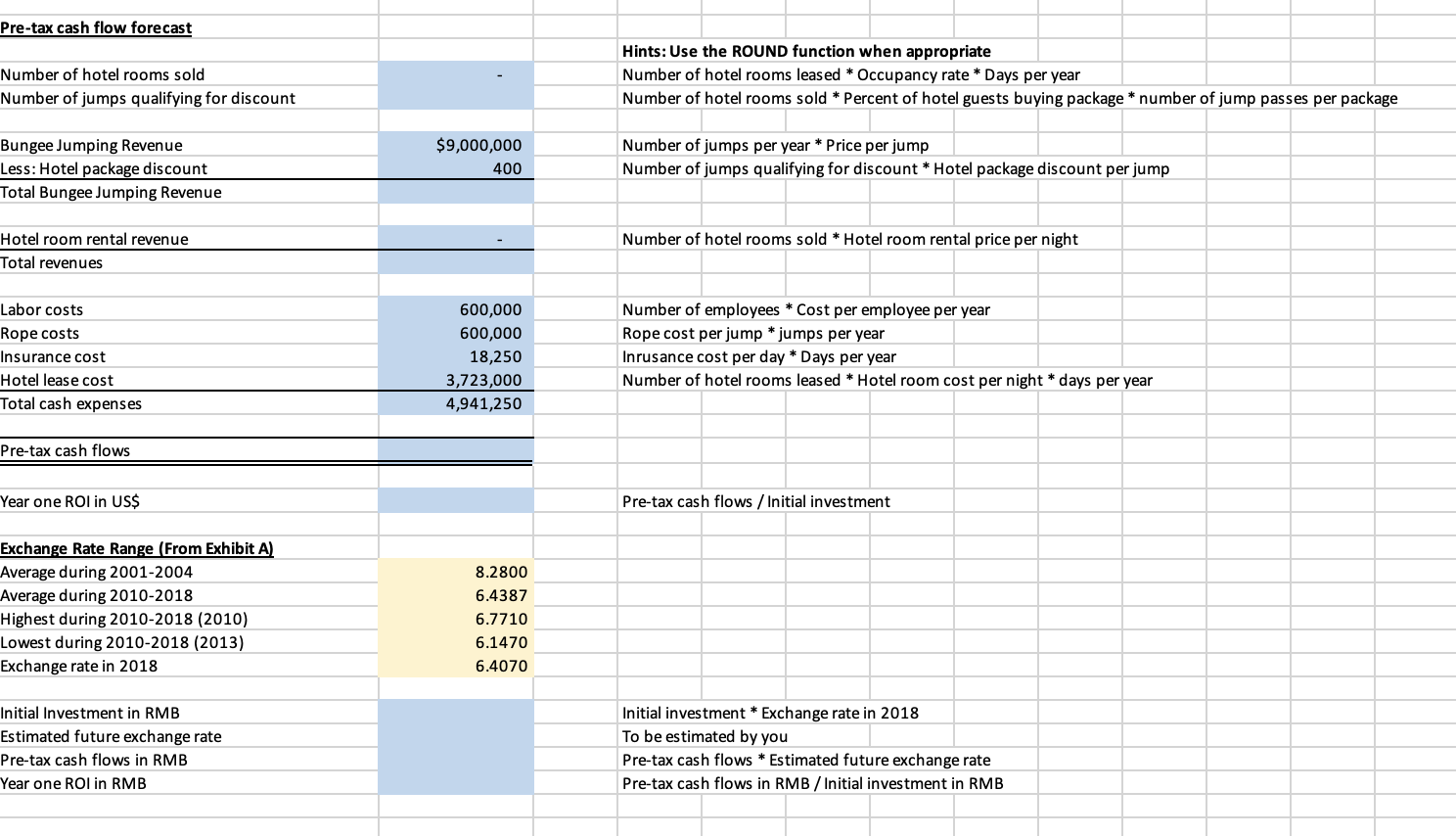

Pre-tax cash flow forecast Hints: Use the ROUND function when appropriate Number of hotel rooms sold Number of hotel rooms leased * Occupancy rate * Days per year Number of jumps qualifying for discount Number of hotel rooms sold * Percent of hotel guests buying package * number of jump passes per package Bungee Jumping Revenue Number of jumps per year * Price per jump Less: Hotel package discount Number of jumps qualifying for discount Hotel package discount per jump Total Bungee Jumping Revenue Hotel room rental revenue Number of hotel rooms sold * Hotel room rental price per night Total revenues \begin{tabular}{l} Labor costs \\ Rope costs \\ Insurance cost \\ Hotel lease cost \\ \hline Total cash expenses \\ \hline Pre-tax cash flows \\ \hline \hline Year one ROI in US\$ \end{tabular} Pre-tax cash flows / Initial investment Exchange Rate Range (From Exhibit A) \begin{tabular}{ll} \hline Average during 2001-2004 & 8.2800 \\ \hline Average during 2010-2018 & 6.4387 \\ \hline Highest during 2010-2018 (2010) & 6.7710 \\ \hline Lowest during 2010-2018 (2013) & 6.1470 \\ \hline Exchange rate in 2018 & 6.4070 \end{tabular} Initial Investment in RMB Initial investment * Exchange rate in 2018 Estimated future exchange rate To be estimated by you Pre-tax cash flows in RMB Pre-tax cash flows Estimated future exchange rate Year one ROl in RMB Pre-tax cash flows in RMB / Initial investment in RMB Pre-tax cash flow forecast Hints: Use the ROUND function when appropriate Number of hotel rooms sold Number of hotel rooms leased * Occupancy rate * Days per year Number of jumps qualifying for discount Number of hotel rooms sold * Percent of hotel guests buying package * number of jump passes per package Bungee Jumping Revenue Number of jumps per year * Price per jump Less: Hotel package discount Number of jumps qualifying for discount Hotel package discount per jump Total Bungee Jumping Revenue Hotel room rental revenue Number of hotel rooms sold * Hotel room rental price per night Total revenues \begin{tabular}{l} Labor costs \\ Rope costs \\ Insurance cost \\ Hotel lease cost \\ \hline Total cash expenses \\ \hline Pre-tax cash flows \\ \hline \hline Year one ROI in US\$ \end{tabular} Pre-tax cash flows / Initial investment Exchange Rate Range (From Exhibit A) \begin{tabular}{ll} \hline Average during 2001-2004 & 8.2800 \\ \hline Average during 2010-2018 & 6.4387 \\ \hline Highest during 2010-2018 (2010) & 6.7710 \\ \hline Lowest during 2010-2018 (2013) & 6.1470 \\ \hline Exchange rate in 2018 & 6.4070 \end{tabular} Initial Investment in RMB Initial investment * Exchange rate in 2018 Estimated future exchange rate To be estimated by you Pre-tax cash flows in RMB Pre-tax cash flows Estimated future exchange rate Year one ROl in RMB Pre-tax cash flows in RMB / Initial investment in RMB