Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with all theee parts pls. appreciated Re 4. Exercise 12-7 (Algo) Journalizing partnership transactions LO P2 2.5 points On March 1, Eckert and

please help with all theee parts pls. appreciated

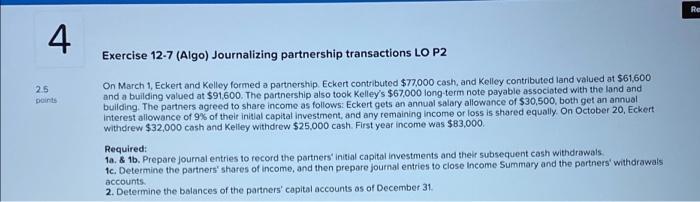

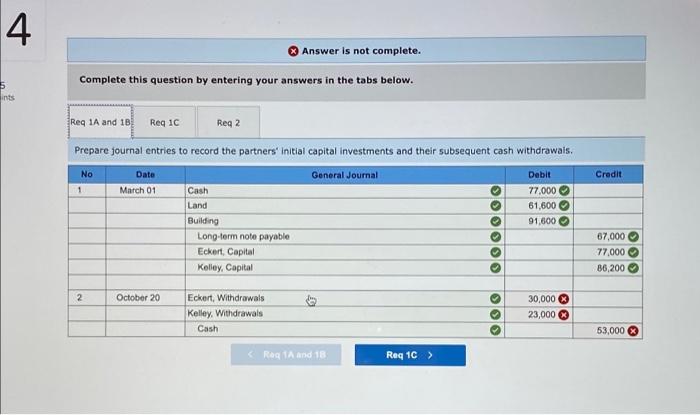

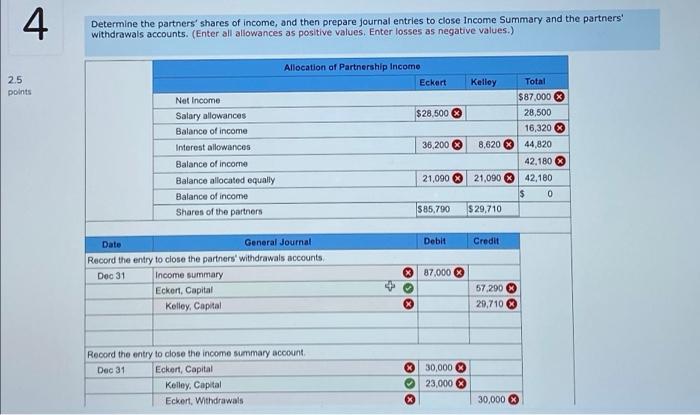

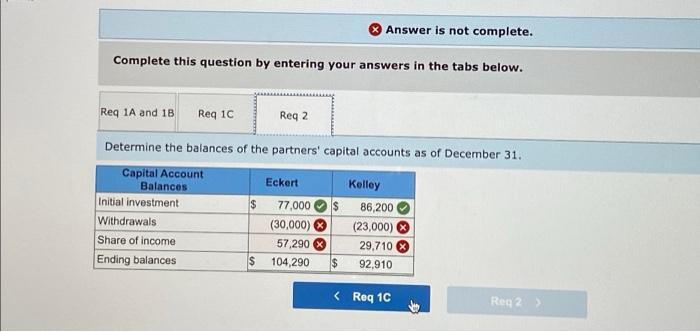

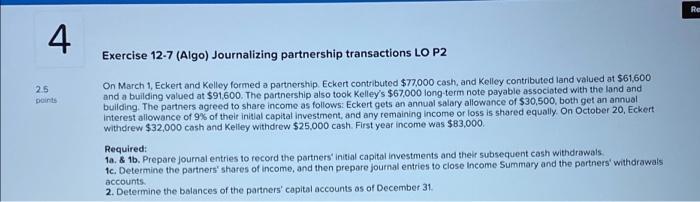

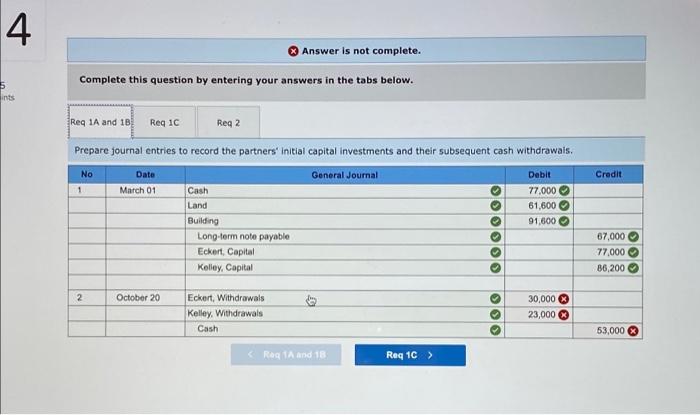

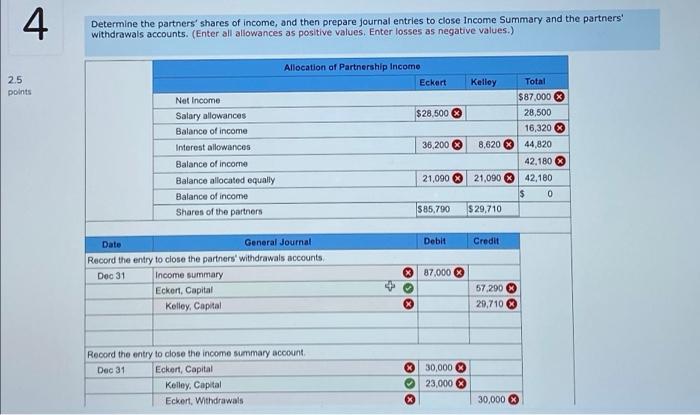

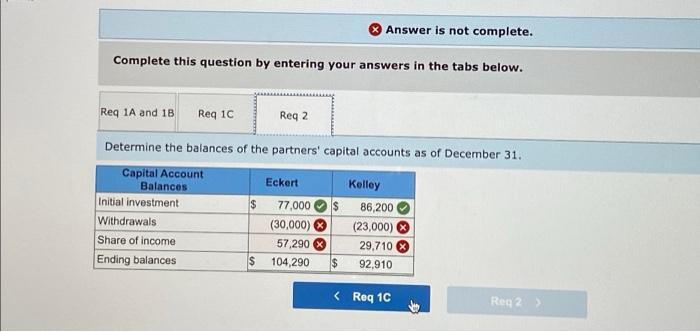

Re 4. Exercise 12-7 (Algo) Journalizing partnership transactions LO P2 2.5 points On March 1, Eckert and Kelley formed a partnership Eckert contributed $77,000 cash, and Kelley contributed land valued at $61,600 and a building valued at $91,600. The partnership also took Kelley's $67000 long-term note payable associated with the land and building. The partners agreed to share income as follows: Eckert gets an annual salary allowance of $30,500, both get an annual Interest allowance of 9% of their initial capital investment, and any remaining income or loss is shared equally. On October 20, Eckert withdrew $32,000 cash and Kelley withdrew $25,000 cash. First year income was $13,000 Required: 1a. & 1b. Prepare journal entries to record the partners initial capital investments and their subsequent cash withdrawals tc. Determine the partners' shares of income, and then prepare journal entries to close Income Summary and the partners' withdrawals accounts 2. Determine the balances of the partners' capital accounts as of December 31 4 Answer is not complete. Complete this question by entering your answers in the tabs below. 5 ints Req 1A and 10 Req 1C Reg 2 Prepare journal entries to record the partners' Initial capital investments and their subsequent cash withdrawals. Date General Journal Credit No 1 March 01 Debit 77.000 61,600 91,600 Cash Land Building Long-term note payable Eckert, Capital Kelley, Capital BOO 67,000 77.000 B6,200 2 October 20 Eckert, Withdrawals Kelley, Withdrawals Cash 30,000 23,000 OO 53,000 R 1A and 18 Req 10 > 4 Determine the partners' shares of income, and then prepare journal entries to close Income Summary and the partners' withdrawals accounts. (Enter all allowances as positive values. Enter losses as negative values.) 2.5 points Net Income Salary allowances Balance of income Interest allowances Balance of income Balance allocated equally Balance of income Shares of the partners Allocation of Partnership Income Eckert Kelley Total $87,000 $ $28,500 28,500 16,320 36,200 8,620 44,820 42,1803 21,090 21,090 42,180 $ 0 $85,790 $ 29,710 Debit Credit Date General Journal Record the entry to close the partners' withdrawals accounts Dec 31 Income summary Ecken, Capital Kolloy, Capital 87.000 57,290 29,710 Record the entry to close the income summary account Dec 31 Eckert, Capital Kelley, Capital Eckert, Withdrawals 30,000 3 23.000 30,000 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1A and 18 Req 10 Reg 2 Determine the balances of the partners' capital accounts as of December 31. Capital Account Balances Eckert Kelley Initial investment $ 77,000 $ 86,200 Withdrawals (30,000) (23,000) Share of income 57,290 29.710 Ending balances 104,290 $ 92.910 IS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started