Please help with all three questions. If you could also put show the work that would be amazing!

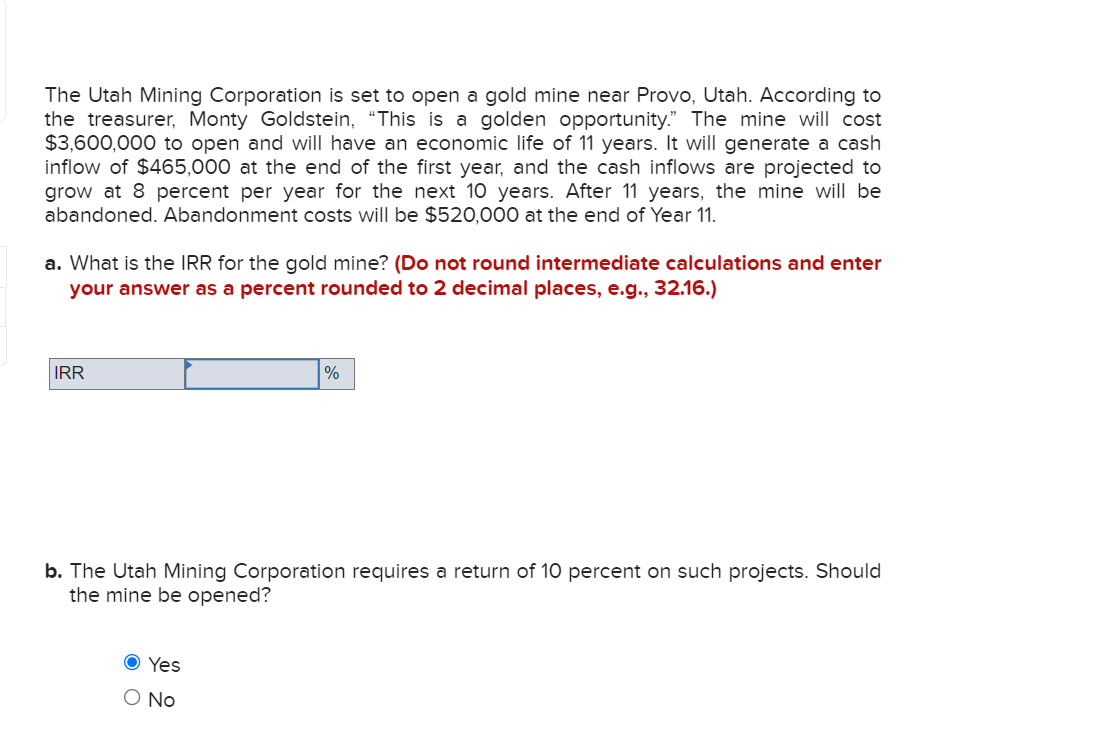

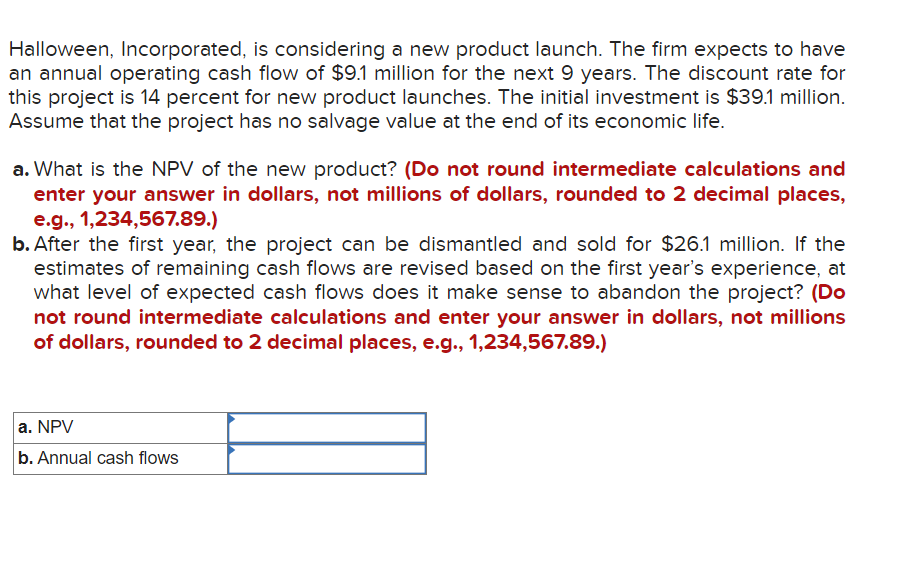

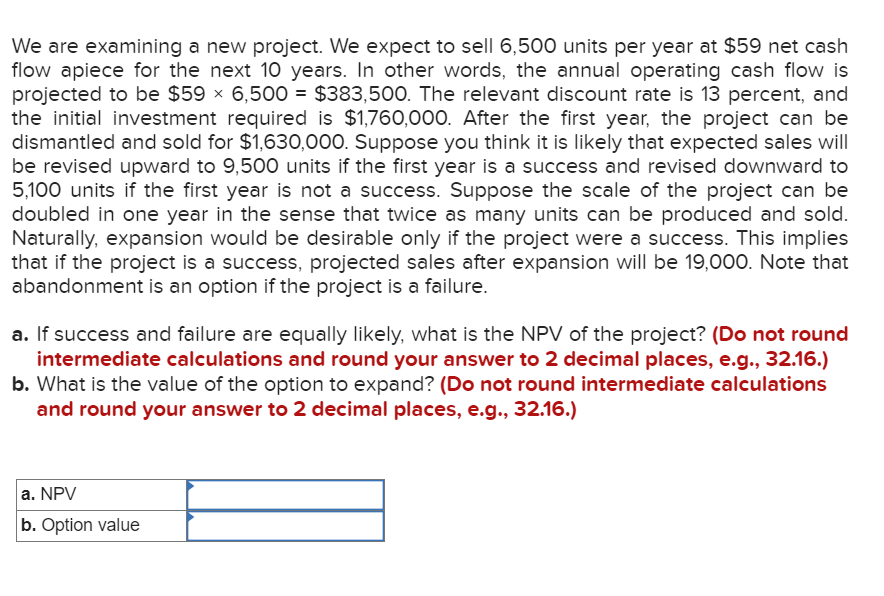

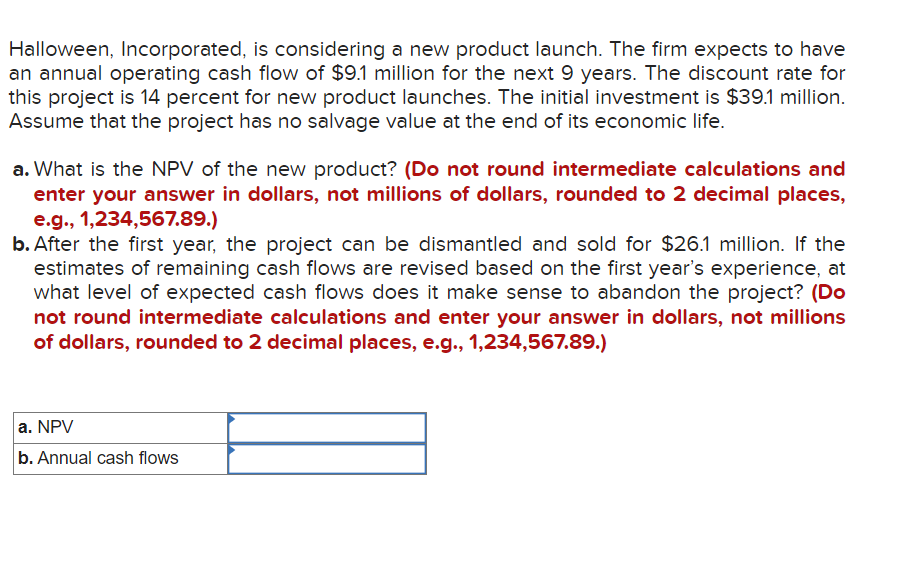

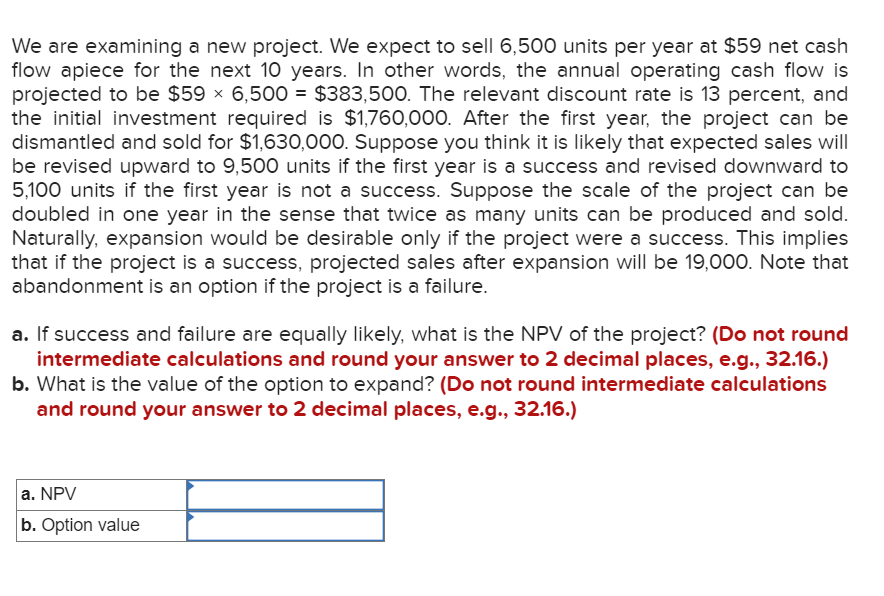

The Utah Mining Corporation is set to open a gold mine near Provo, Utah. According to the treasurer, Monty Goldstein, "This is a golden opportunity." The mine will cost $3,600,000 to open and will have an economic life of 11 years. It will generate a cash inflow of $465,000 at the end of the first year, and the cash inflows are projected to grow at 8 percent per year for the next 10 years. After 11 years, the mine will be abandoned. Abandonment costs will be $520,000 at the end of Year 11. a. What is the IRR for the gold mine? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. The Utah Mining Corporation requires a return of 10 percent on such projects. Should the mine be opened? Yes No Halloween, Incorporated, is considering a new product launch. The firm expects to have an annual operating cash flow of $9.1 million for the next 9 years. The discount rate for this project is 14 percent for new product launches. The initial investment is $39.1 million. Assume that the project has no salvage value at the end of its economic life. a. What is the NPV of the new product? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) b. After the first year, the project can be dismantled and sold for $26.1 million. If the estimates of remaining cash flows are revised based on the first year's experience, at what level of expected cash flows does it make sense to abandon the project? (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) We are examining a new project. We expect to sell 6,500 units per year at $59 net cash flow apiece for the next 10 years. In other words, the annual operating cash flow is projected to be $596,500=$383,500. The relevant discount rate is 13 percent, and the initial investment required is $1,760,000. After the first year, the project can be dismantled and sold for $1,630,000. Suppose you think it is likely that expected sales will be revised upward to 9,500 units if the first year is a success and revised downward to 5,100 units if the first year is not a success. Suppose the scale of the project can be doubled in one year in the sense that twice as many units can be produced and sold. Naturally, expansion would be desirable only if the project were a success. This implies that if the project is a success, projected sales after expansion will be 19,000 . Note that abandonment is an option if the project is a failure. a. If success and failure are equally likely, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the value of the option to expand? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)