Answered step by step

Verified Expert Solution

Question

1 Approved Answer

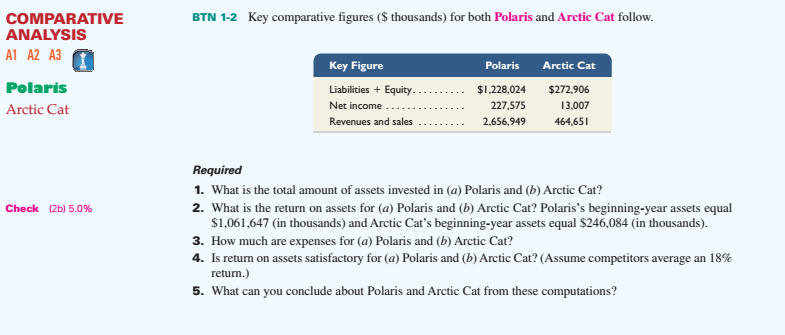

Please help with answering this problem BTN 1-2 Key comparative figures (S thousands) for both Polaris and Arctic Cat follow. COMPARATIVE ANALYSIS A1 A2 A3

Please help with answering this problem

BTN 1-2 Key comparative figures (S thousands) for both Polaris and Arctic Cat follow. COMPARATIVE ANALYSIS A1 A2 A3 Key Figure Polaris Arctic Cat Polaris Arctic Cat Liabilities + Equity. Net income Revenues and sales $1.228,024 $272.906 227,57513,007 2,656,949 464,65 Required 1. What is the total amount of assets invested in (a) Polaris and (b) Arctic Cat? 2. What is the return on assets for (a) Polaris and (b) Arctic Cat? Polaris's beginning-year assets equal Check (2b) 5.0% $1,061,647 (in thousands) and Arctic Cat's beginning-year assets equal $246,084 (in thousands). 3. How much are expenses for (a) Polaris and (b) Arctic Cat? 4. Is return on assets satisfactory for (a) Polaris and (b) Arctic Cat? (Assume competitors average an 18% return.) 5. What can you conclude about Polaris and Arctic Cat from these computationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started