Question

Please help with answers for Acconts Receivable A/C 114. I also need a little help with the answers to the journal portion (bottom of page)

Please help with answers for "Acconts Receivable A/C 114". I also need a little help with the answers to the journal portion (bottom of page) in addition verifying ithat I have the correct answers. Thank you!

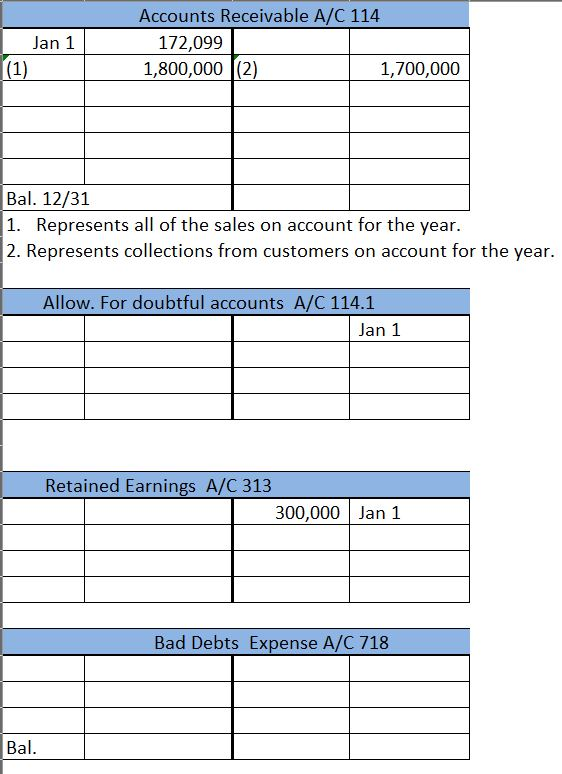

Open the following selected accounts recording the opening balances as of January 1 of the current year. In the (Project 3 Excel Spreadsheet Problem 2 Parts 2 - 6 tab).

Open the following selected accounts recording the opening balances as of January 1 of the current year. In the (Project 3 Excel Spreadsheet Problem 2 Parts 2 - 6 tab).

| 114.1 | Allowance for doubtful accounts | 12,200 Credit |

| 313 | Income summary |

|

|

|

|

|

| 718 | Bad debts expense |

|

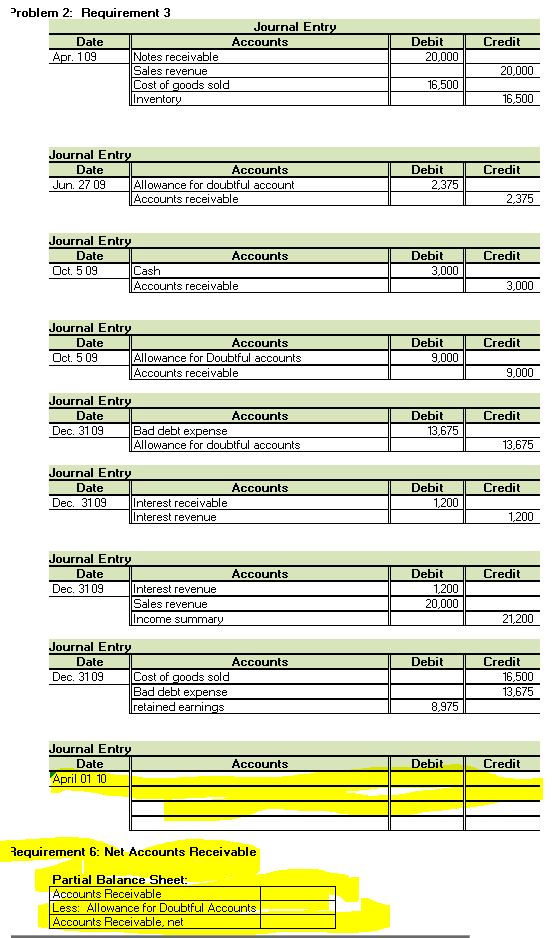

Record the following transactions in general journal form in the Project 3 Excel Spreadsheet Problem 2 Parts 2 - 6 tab.

Post these transactions to the three selected accounts above and to Accounts receivable in the Project 3 Excel Spreadsheet Problem 2 parts 2 - 6 tab.

Enter the ending balances in the three accounts above and enter the ending balance in the Accounts Receivable account. Enter those balances in the Project 3 Excel Spreadsheet Problem 2 parts 2 - 6 tab.

| Apr 1, 09 | Accepted a $20,000, one - year, 8% note dated April 1 from Bruce Hanson for the sale of inventory; Cost of Goods Sold was $16,500. |

| June 27 | Wrote off the $2,375 balance owed by Miller Corp., which has no assets. |

| Oct. 5 | Received 25% of the $12,000 balance owed by F.M. Knox Co., a bankrupt, and wrote off the remainder as uncollectible. |

| Dec. 31 | Based on an analysis of the $257,724 of accounts receivable, it was estimated that $14,500 will be uncollectible. Record the adjusting entry using the Aging method. |

| Dec. 31 | Record the adjusting entry for interest accrued on the Bruce Hanson note |

| Dec. 31 | Record the entries to close the appropriate accounts into Retained Earnings. |

| April 1, 10 | Collected the maturity value on the Hanson note. |

Determine the net accounts receivable (the amount Summer expects to collect as of December 31 and enter in the Project 3 Excel Spreadsheet Problem 2 Parts 2 - 6 tab).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started