Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP WITH AS MANY AS POSSIBLE NO EXPLANATION NEEDED WILL PAY 251 The manor how hastalarda 5 Theme of return is 123 percent, the

PLEASE HELP WITH AS MANY AS POSSIBLE NO EXPLANATION NEEDED WILL PAY

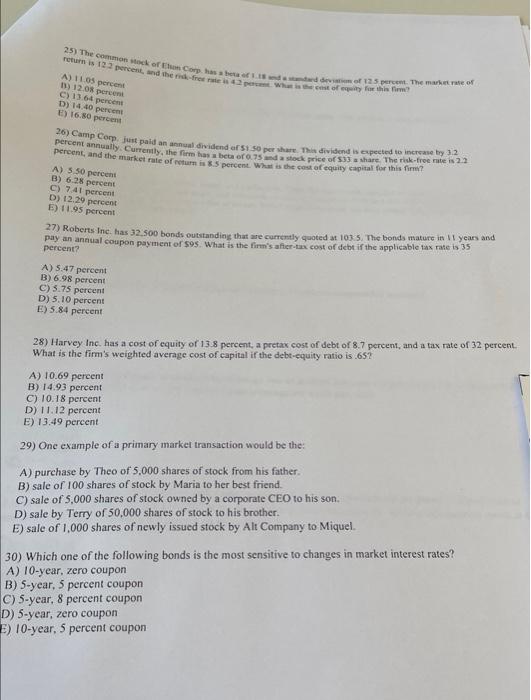

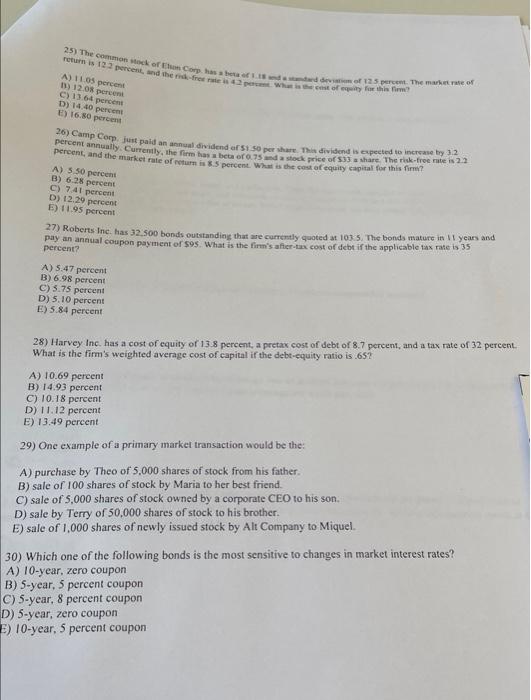

251 The manor how hastalarda 5 Theme of return is 123 percent, the free 42 What is toy for this A) ILOS percent D) 12.08 percent C) 13.6 percent D) 14.40 percent E) 16.80 percent 20) Camp Corp, just paid an annual dividend of 51 so per share. This dividend is expected to increase by 12 percent annually. Currently, the firm has becor.de stock price of 533 share. The risk-free nute 2.2 percent, and the market rate of return is 5 percent. What is the cost of equity capital for this form? A) 5.50 percent B) 6.28 percent C) 7.41 percent D) 12.29 percent E) 11.95 percent 27) Roberts Inc. has 32,500 bonds outstanding that are currently quoted at 1035. The bonds mature in 11 years and pay an annual coupon payment of $95. What is the firm's after-tax cost of debt if the applicable tax rate is 35 percent? A) 5.47 percent B) 6.98 percent C) 5.75 percent D) 5.10 percent E) 5.84 percent 28) Harvey Inc. has a cost of equity of 13.8 percent, a pretax cost of debt of 8.7 percent, and a tax rate of 32 percent. What is the firm's weighted average cost of capital if the debt-equity ratio is 65? A) 10.69 percent B) 14.93 percent C) 10.18 percent D) 11.12 percent E) 13.49 percent 29) One example of a primary market transaction would be the A) purchase by Theo of 5,000 shares of stock from his father B) sale of 100 shares of stock by Maria to her best friend. C) sale of 5,000 shares of stock owned by a corporate CEO to his son. D) sale by Terry of 50,000 shares of stock to his brother E) sale of 1,000 shares of newly issued stock by Alt Company to Miquel 30) Which one of the following bonds is the most sensitive to changes in market interest rates? A) 10-year, zero coupon B) 5-year, 5 percent coupon C) 5-year, 8 percent coupon D) 5-year, zero coupon E) 10-year, 5 percent coupon

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started